Due to an increase in liquidations within the cryptocurrency market, all coins are experiencing a steep decline at present. Notably, Solana has seen a significant drop of approximately 10% in the last 24 hours.

At present, Solana’s trading price is approximately $176. This figure represents a significant bearish intraday move, given the appearance of an engulfing candle. With crypto market liquidations reaching $528 million and Bitcoin dropping below the $92K mark, there’s speculation that Solana may experience a potential drop to around $150.

Symmetrical Triangle Breakdown Points to $155 Target

On the daily graph, the Solana price movement appears to have broken down a long-awaited support trendline, suggesting a bearish outlook. This breakdown concludes a rising wedge pattern, as indicated by an intraday bearish engulfing candle that resulted in a 6.35% decline.

At the moment, it’s holding steady near a significant resistance level at $175. A bearish engulfing candle has dropped below the 200 Exponential Moving Average (EMA), indicating a potential bearish trend. Additionally, the recent correction has led to a crossover between the 20-day and 50-day EMA lines.

Therefore, the moving averages suggest a selling opportunity for Solana. Yet, the daily Relative Strength Index shows a bullish divergence during the latest test of the $175 support level.

If Solana’s price manages to maintain a daily close above its support area and the 200 EMA, there’s a possibility that the bulls might regain control of the market trend. This could lead to a test of the resistance at the $200 level if the breakout is maintained. Conversely, a bearish daily close may result in another test of the $155 support.

Solana Derivatives Signal Extended Correction

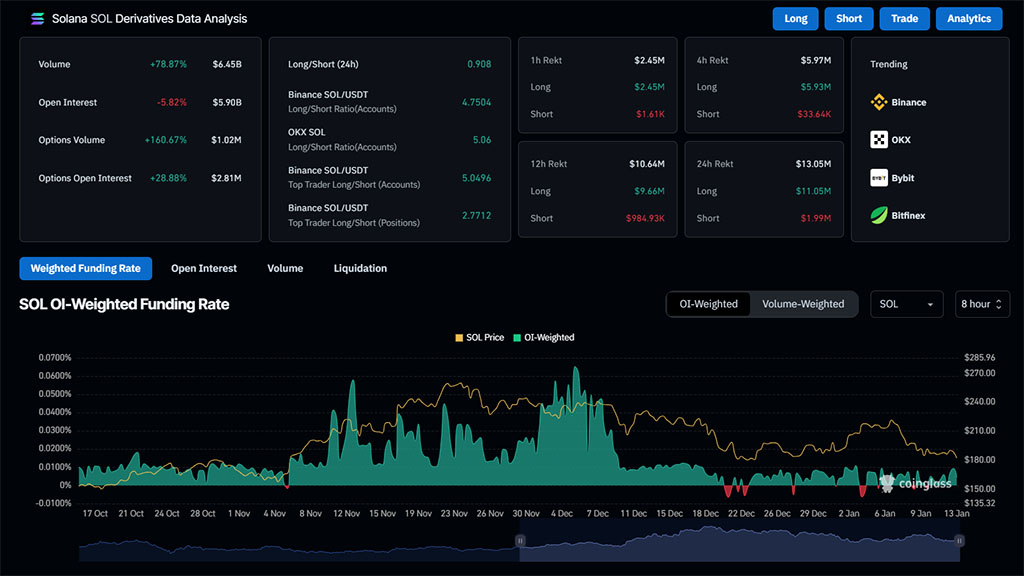

With a growing bearish trend in the cryptocurrency market, the derivatives linked to Solana suggest a prolonged period of correction. Notably, the open interest is now below the $6 billion threshold.

At present, there’s a 6.07% decrease, which brings the value down to approximately $5.90 billion. Furthermore, the long-to-short ratio has fallen to 0.8854, indicating a strong bearish sentiment prevailing within the cryptocurrency market.

Over the last day, liquidations related to Solana specifically have climbed up to approximately $16.69 million. Yet, the long position holders have experienced a substantial loss of around $14.89 million, whereas the short liquidations amount to about $1.8 million.

Currently, the funding rate stands at 0.044%, suggesting a strong likelihood that it may dip into negative figures, given its recent decline from its highest point of 0.0093%.

Analyst Targets Downfall to $155

According to crypto analyst Ali Martinez’s latest analysis, the drop in Solana’s price below $180 indicates a bearish breakout from a symmetrical triangle formation observed on the 4-hour chart, suggesting a potential downward trend for Solana.

In simpler terms, if the price of Solana breaks through the $214 resistance barrier (signifying a bullish trend), it could lead to an increase in momentum by up to 40%. Conversely, if Solana experiences a bearish breakdown below the $183 support level, there might be a significant drop, potentially reaching $155.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2025-01-13 17:57