As a seasoned crypto investor with a keen interest in Solana (SOL), I’ve seen my fair share of ups and downs in the market. The recent selling pressure on SOL, with its price dropping nearly 8% within the last 24 hours, and slipping under $125, is a cause for concern.

As a crypto investor, I’ve noticed that Solana (SOL), the world’s fifth-largest cryptocurrency by market capitalization, has experienced significant selling pressure in the past 24 hours. The price of SOL has dropped nearly 8%, and it now hovers around $125. This downward trend comes as the revenue generated on the Solana blockchain has plummeted to its lowest point over the past week, reaching only $626,900.

As a crypto investor, I’ve noticed that the revenue from my Solana holdings has taken a hit following the recent network upgrade. A few days ago, the Solana team requested validators to upgrade their nodes to a new version. Their objective was to tackle the long-standing congestion issues that have been affecting the Solana network.

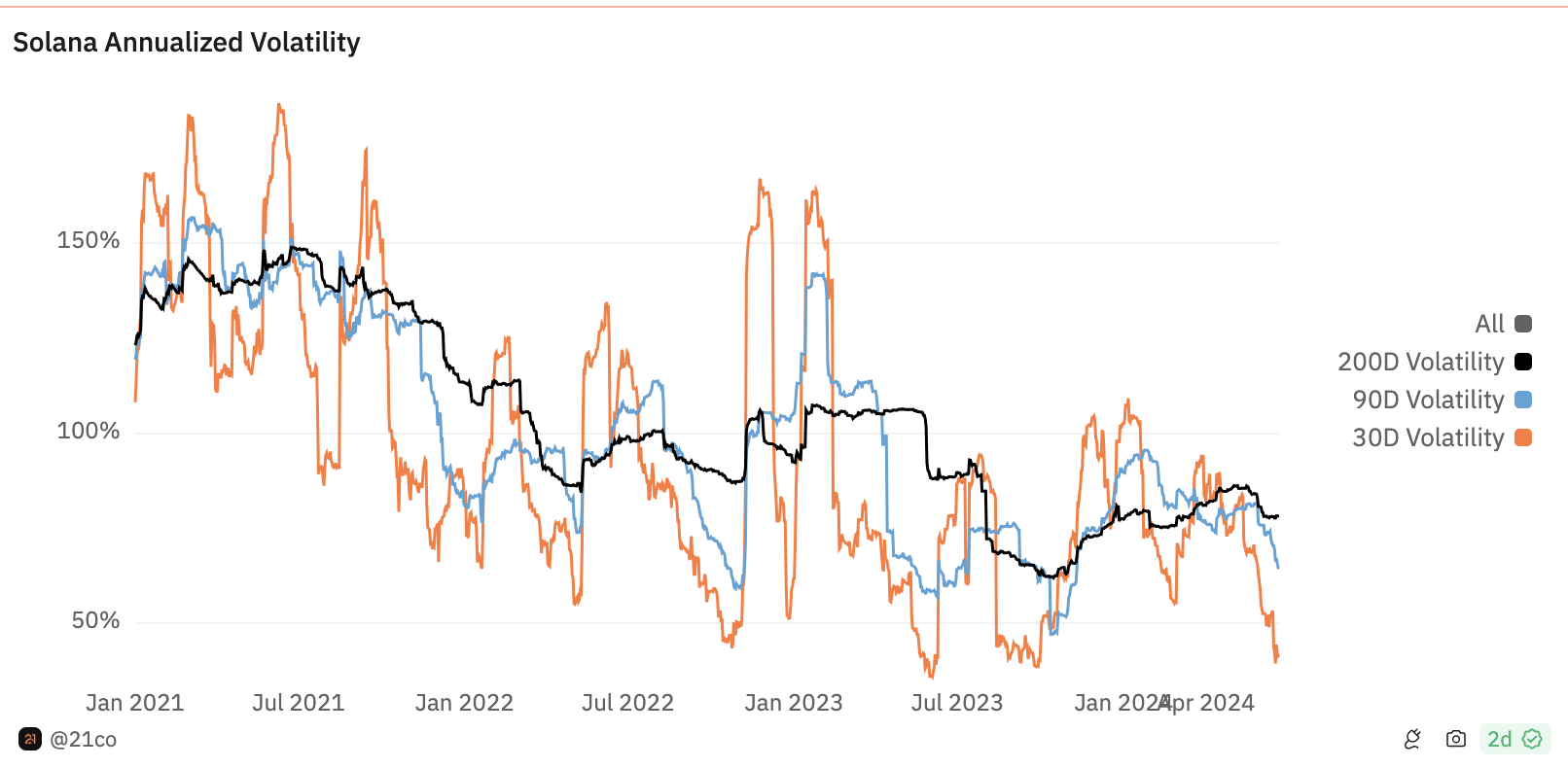

As a Solana investor, I’ve noticed that following the network upgrade, transaction fees have become more stable and no longer spike excessively, while maintaining a consistent throughput of 2,000 to 3,000 Transactions Per Second (TPS). However, my observation of the Solana volatility chart reveals that the SOL price may exhibit sideways movement. Volatility refers to the speed at which the SOL price moves. A high volatility reading implies that the SOL price can experience significant price swings in a short timeframe, potentially reaching remarkable heights. Conversely, lower volatility indicates more stable price action.

As a crypto investor, I’ve noticed some intriguing volatility trends with Solana (SOL) recently. Over the past year, its annualized volatility stood at a high 77.80%. But over the last quarter, specifically the previous 90 days, that figure had dropped to a more manageable 66.30%.

Solana Active Addresses Surge

Expert: SolanaFloor from the renowned Solana X Account recently announced that the Solana blockchain has achieved a notable achievement as the number of monthly active addresses exceeded 30 million for the first time, reaching an all-time high. However, this impressive milestone in monthly active addresses was not reflected in the daily transaction numbers, which have seen a noticeable decrease over the past month. Additionally, the captured value on the Solana blockchain experienced a decline, resulting in reduced revenue and fees.

The decline in Solana’s DeFi space performance was reflected in its TVL (Total Value Locked) graph, signaling a drop in the blockchain’s effectiveness.

Additionally, the technical chart indicates that buyers’ strength is waning significantly, potentially leading to a drop of around 8-10% in Solana’s price within the upcoming days. Given we’re approaching the midpoint of 2024, market instability could escalate further this week.

The downtrend in trading activity over the last 40 days implies a takeover by bearish traders. As depicted in the following chart, the price of Solana (SOL) is approaching its liquidity zone following the formation of a double-top pattern.

Photo: TradingView

The price has met resistance and bounced back multiple times as it entered these regions, forming a pivotal and influential area. This area currently aligns with the neckline of an “M-shaped” pattern, implying a potential major reversal or pullback in the near future. As we approach the monthly closing, there is a strong anticipation for the bearish trend to continue, potentially causing the price to fall below the significant support level of $100.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-06-24 14:27