As a seasoned crypto investor with a knack for spotting promising projects, I’ve been closely watching Solana’s progression. Having witnessed the meteoric rise and fall of Bitcoin and Ethereum, I must admit that Solana has caught my attention due to its impressive scalability and robust network.

Similar to Bitcoin, Ethereum, and other popular alternative coins, Solana is experiencing significant downward pressure from sellers. However, the buyers are finding it challenging to build up speed, with $160 becoming a potential hurdle for traders as they look on for signs of resistance.

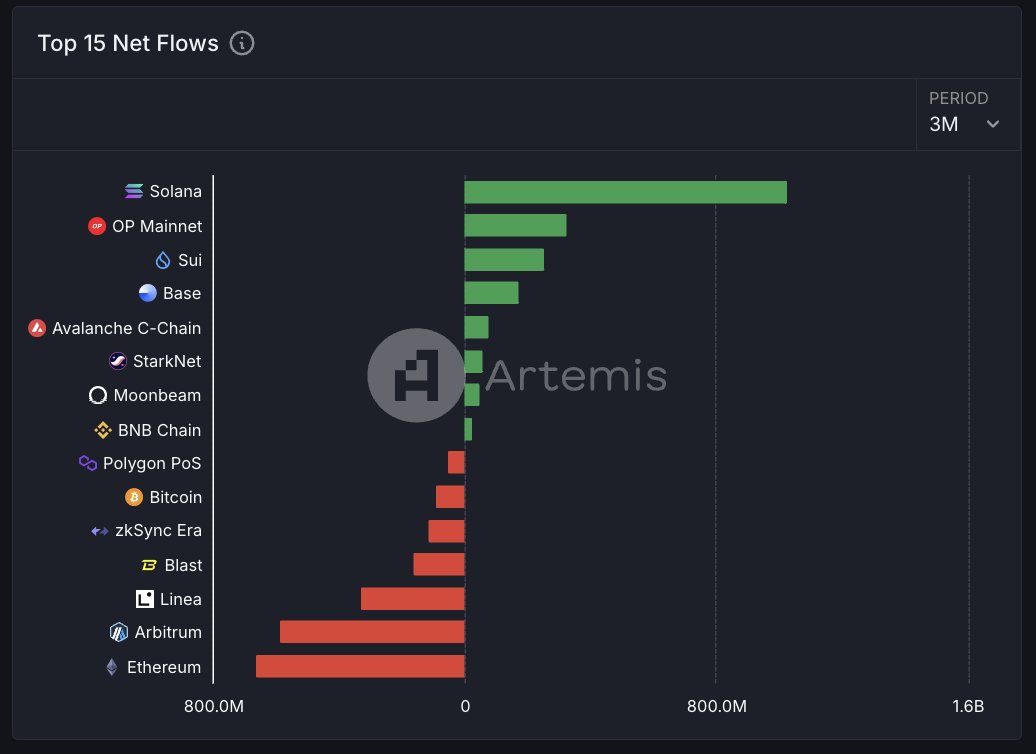

Although Solana saw a positive trend in September, it failed to push the price above a certain level. Currently, there’s a local double top formation, but one analyst from X observes that Solana has performed better than other platforms, showing a significant increase in net inflow.

Solana Received Over $800 Million In Net Flows Over Three Months

Instead of Ethereum, Solana is a contemporary blockchain with impressive scalability. It’s capable of handling thousands of transactions per second, which means lower fees and a smoother user experience for projects launched on its network. In fact, the recent influx of capital into Solana over the past three months has solidified its reputation as a preferred choice for many projects.

Solana attracted over $800 million in new investments, which is significantly larger than the funds raised by OP Mainnet on Ethereum’s layer-2, and far beyond what Sui, another scalable blockchain, managed in the last quarter. This amount also surpasses the capital raised by two other popular Ethereum layer-2 projects, Base and Starknet, and is greater than the funds received by Avalanche and the BNB Chain.

It’s worth noting that during this timeframe, Arbitrum, the leading Ethereum layer-2 solution, along with Linea, Blast, and Bitcoin, experienced withdrawals. Surprisingly, even though Ethereum is the biggest platform for smart contracts, it recorded significant outflows totaling approximately $800 million.

It’s yet unclear what factors might have caused the Ethereum outflows and attracted capital to Solana. While differences in on-chain transaction fees could play a role, the ongoing selling of ETH in Q3 2024 might have sparked the exodus. Currently, ETH is 35% below its Q3 2024 peak prices, while Solana is only 25% off from its July highs where it reached approximately $192 before experiencing a decline.

Will SOL Break $160?

Despite drawing investment, Solana’s coin is experiencing significant selling pressure. For the bullish trend observed in the latter part of 2023 to persist, it’s crucial to surmount the immediate resistance at around $160 convincingly. If this level is breached, Solana could potentially rise to approximately $190 and even break free from its current price range.

Despite some potential positives, there may still be challenges ahead for Bitcoin and its impact on other cryptocurrencies like Solana. If Bitcoin doesn’t bounce back, it might pull down the altcoin market, including Solana, as well. Additionally, there’s apprehension that the upcoming FTX token distribution could negatively influence SOL prices.

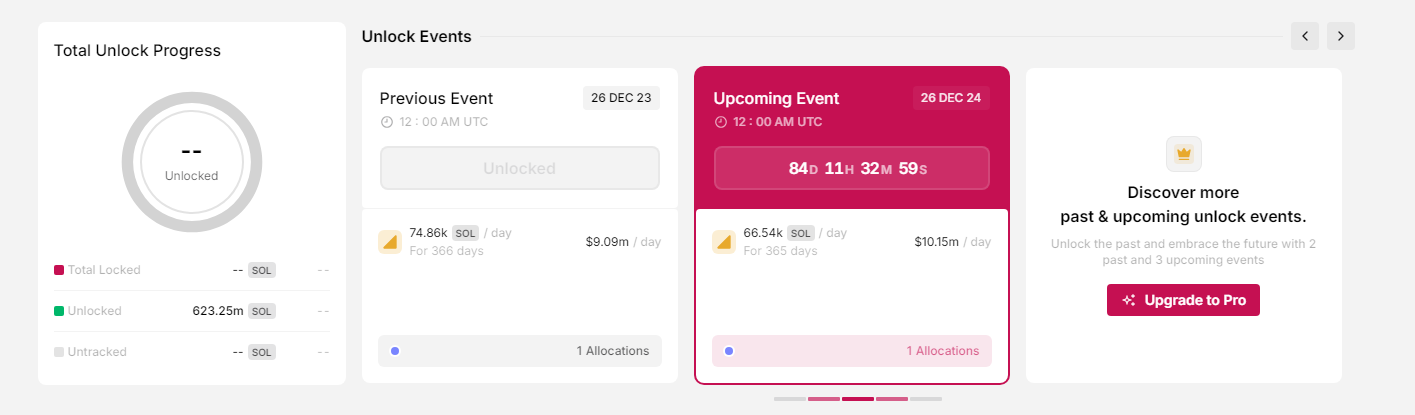

As a researcher, I’m excited to share that Token Unlocks has revealed their intention to distribute tokens on December 26, 2024. Every day for an entire year, a sum of approximately 66,000 SOL will be distributed.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

2024-10-03 04:16