As a seasoned researcher with over two decades of experience in the ever-evolving world of blockchain and cryptocurrencies, I’ve witnessed firsthand the rise and fall of numerous digital assets. The recent surge in Solana (SOL) DeFi activity has caught my attention, particularly its DEXes surpassing Ethereum (ETH) in monthly trading volume.

The activity in Solana’s decentralized finance sector has seen a notable boost, as its decentralized exchanges (DEX) have outpaced Ethereum‘s DEX in monthly trading volume. In November alone, trades on Solana-based DEXes have exceeded $100 billion, signaling a major achievement for the ecosystem.

Solana DeFi Ecosystem Gains Momentum, Outshines Ethereum DeFi

Mentioning Solana, the fourth-largest cryptocurrency boasting a market capitalization of about $118.34 billion, has been following an unprecedented price trend. Lately, this digital currency set a new personal best (peak) at $263, having dipped down to $8 during the FTX crisis’s height.

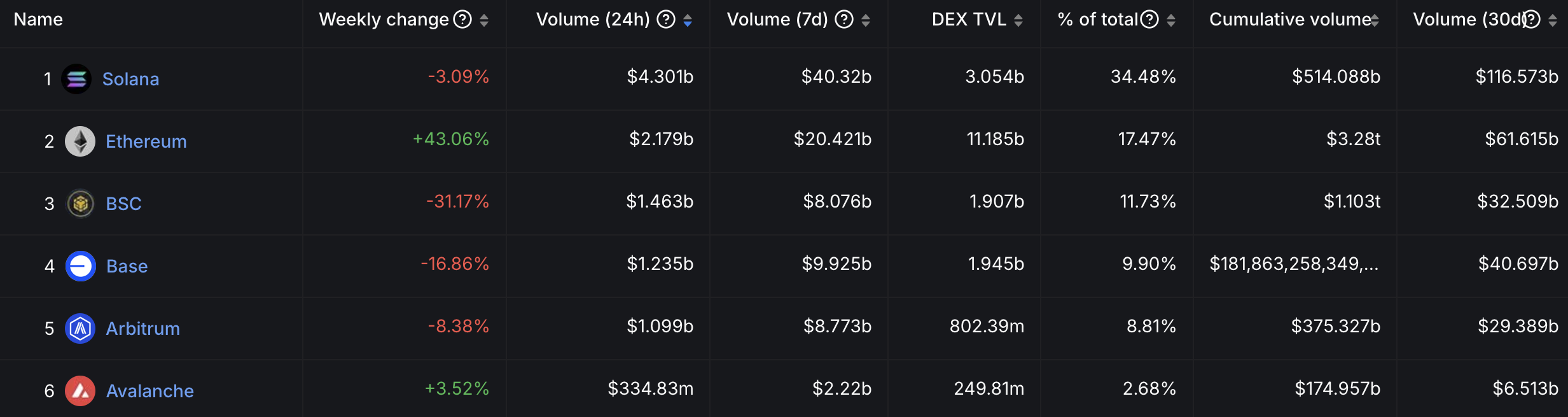

Currently, the blockchain operating on layer-1 has reached a significant achievement as decentralized exchanges built on Solana exceeded $100 billion in monthly trade volume for the first time. As per DefiLlama’s data, the 30-day aggregated trading volume of Solana DEXes currently stands at approximately $116.51 billion.

During the same timeframe, decentralized exchanges (DEXes) built on the Ethereum mainnet reported a total trading volume of $61.61 billion. As a researcher, I found that the trading volume on DEXs powered by Solana significantly outpaced this figure, nearly doubling it.

Compared to last month, Solana’s DEX trading volume significantly jumped by more than 100%, reaching approximately $52.5 billion in October. Simultaneously, the total value locked within Solana’s DeFi environment has escalated, now standing at around $9.30 billion – a rise from $6.23 billion just a month prior.

The significant increase in trading volumes on Decentralized Exchanges (DEX) that use Solana as their base could be largely due to a few key reasons. These factors encompass the continuing hype surrounding meme coins, the affordability of transactions thanks to the blockchain’s low fees, and an interface designed for easy user navigation.

It’s important to note that Solana’s Total Value Locked (TVL) has not reached its all-time high (ATH) of $10.02 billion, a figure achieved in November 2021. In January 2023, the TVL for this blockchain dropped significantly to $210 million due to the broader crypto market downturn, worsened by the collapse of the FTX exchange.

Currently, approximately $3.58 billion in value locked (TVL) on the Solana network is associated with the liquid staking protocol Jito, while Jupiter DEX manages around $2.4 billion. Additionally, Raydium, another well-known decentralized exchange (DEX) on Solana, controls about $2.37 billion of TVL.

Where Is SOL Headed?

The increasing number of users adopting Solana significantly contributed to the surge in its native token, SOL. Since starting at $101 in January, the price of SOL has climbed up to $263 by November 23, representing a year-to-date growth of more than 157%.

Even with these impressive earnings, cryptocurrency specialists continue to show optimism towards Solana (SOL), anticipating more growth for this digital currency. As per the latest study by Titan of Crypto, there’s a possibility that SOL could reach $400 due to its breakout from a long-term cup-and-handle structure.

Other positive indicators, like Bitcoin‘s decreasing dominance and the growing possibility of a Solana-based Exchange Traded Fund (ETF), might boost SOL to unprecedented peaks. Currently, SOL is trading at $248.31, showing a 0.5% increase over the past 24 hours.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-11-26 07:17