As a crypto investor with several years of experience in the market, I’ve witnessed numerous trends come and go. The recent surge of Solana-based meme coins is an intriguing development that has caught my attention.

As a crypto investor, I’ve noticed an intriguing trend in the first quarter of this year. Solana-based meme coins have taken the lead, leaving Ethereum‘s meme coin ecosystem and AI tokens behind, based on the latest report by CoinMarketCap.

The increasing preference for meme coins indicates a significant transformation in the crypto market’s power structure. Meme coins are now making waves and disrupting established trends like smart contracts, DeFi, and NFTs.

Solana Ecosystem Dominates Growth Chart

The report from CoinMarketCap indicates that the Solana network has been leading the way in growth for the previous eight months. In just the second quarter, more than twenty fresh tokens were added to its ecosystem.

As a crypto investor, I’ve noticed an intriguing development in the market recently. Ethereum’s ecosystem has seen a boom with the launch of 14 new tokens. Meanwhile, the growth in Derivatives and Stablecoins has been more modest, with only 5 and 4 new tokens debuting respectively. This surge in Solana-based token offerings is an indication of the increasing excitement and potential that investors see in this network.

Since October 2023, there’s been a noticeable surge in both price value and public interest surrounding Solana’s meme coin ecosystem. While Ethereum continues to hold its leading position in the cryptocurrency sector, Solana’s increasing relevance is an intriguing development worth keeping an eye on.

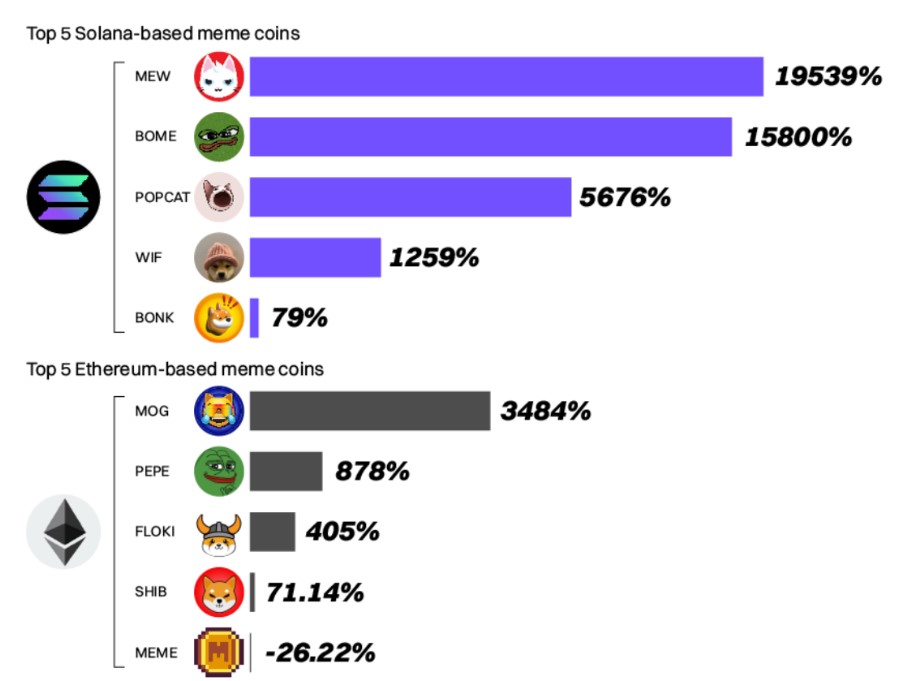

As a researcher studying meme performance in the crypto market, I’ve discovered an intriguing finding: SOL memes have yielded remarkably higher returns than ETH memes. Specifically, the average return for SOL memes stands at a staggering 8,469%, while ETH memes have delivered only 962% in comparison. Check out the accompanying chart for a clearer perspective.

With the influx of speculative investment from other cryptocurrency markets drawn to Solana by the meteoric growth of tokens like Dogewhiz and Bonk Inu, more meme coins witnessed impressive price increases, thereby garnering increased interest and financing.

As a successful crypto investor in the meme coin sector, I’ve noticed some remarkable performers that have surpassed even the likes of WagmiCats (WIF), BonkInu (BONK), Ethereum’s Pepe the Frog (PEPE), and Shiba Inu (SHIB). Among these standouts are MEW, POPCAT, and Book of Meme (MEME).

Significantly, political memes became a significant trend, with the most popular MAGA (TRUMP) meme coin seeing a remarkable increase of over 5100% year-to-date. This surge was largely driven by former President Donald Trump’s advocacy for cryptocurrencies and the acceptance of crypto as campaign donations.

Ethereum Tops Fee Income Rankings

Although Solana has made notable advancements, Ethereum remains the leader in the Layer 1 (L1) smart contracts sector, accounting for a substantial 62.11% of the major L1 platforms. The report highlights that Ethereum’s latest achievement was boosted by the Securities and Exchange Commission (SEC) granting approval to Ethereum Spot Exchange-Traded Funds (ETFs).

Nevertheless, Binance Smart Chain (BNB) and Solana have made significant strides, increasing their market shares in the L1 network category by $42 billion for BNB and $18 billion for Solana. Presently, Solana holds the top spot with approximately 1.6 million daily active addresses, while Binance Smart Chain follows closely behind with around 1 million active addresses.

As an analyst, I’ve observed that Ethereum encountered historically low gas fees in Q2, a phenomenon last witnessed in 2020. This trend can be attributed to two primary factors: the expanding implementation of Layer 2 solutions and the escalating market buzz surrounding Solana-hosted meme coins.

Among the leading L1 (Layer 1) platforms, Ethereum, which makes up 62% of the total market capitalization, was responsible for generating around 70% of the daily earnings, amounting to roughly $2.7 million. Solana came in second place with approximately $900,000 in daily revenue.

As a crypto investor, I’ve closely monitored the fee income rankings for the past year based on data from Lookonchain. To my observation, Ethereum reigned supreme with an impressive earnings of approximately $2.728 billion. In contrast, Bitcoin took the second spot with fee income amounting to around $1.302 billion.

As a market analyst, I’d like to highlight that there are other significant networks besides Ethereum in the crypto space. These include Tron with a market capitalization of approximately $459.39 million, Solana at around $241.29 million, Binance Smart Chain valued at about $176.56 million, Avalanche with a market cap of around $68.83 million, zkSync Era worth roughly $59.77 million, Optimism at around $40.4 million, and Polygon with a market value of approximately $23.91 million.

Although Solana’s platform and Ethereum’s have thrived in financial indicators and expansion graphs, Solana’s native token, SOL, has markedly surpassed Ethereum’s ETH token in terms of growth.

At present, the market value of SOL is $143.25 based on its trading price, representing an impressive year-to-date increase of 650%. In contrast, ETH has experienced a more moderate surge, with a year-to-date growth of 68%, and is currently priced at $3,310.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-07-04 18:41