a meme coin craze.

Many investors suffered significant financial losses when they invested in quirky dog and cat-themed, or simply bizarre, tokens that failed to deliver on promises of impressive returns, leaving them feeling disappointed and financially bruised.

Solana Stampede: A Frenzy Of Frivolous Finance

Spurred on by social media excitement and the anxiety of not being part of something profitable (FOMO), a rush of investors injected funds into meme coin presales. A new project titled “I Like This Coin” (LIKE) emerged swiftly, enticing investors with promises of extraordinary gains.

The “I Like This Coin” tale proved to be a cautionary example of “let the buyer beware.” With an impressive market capitalization of $577 million at the outset, the token’s worth dropped an alarming 90% just eight hours after its launch.

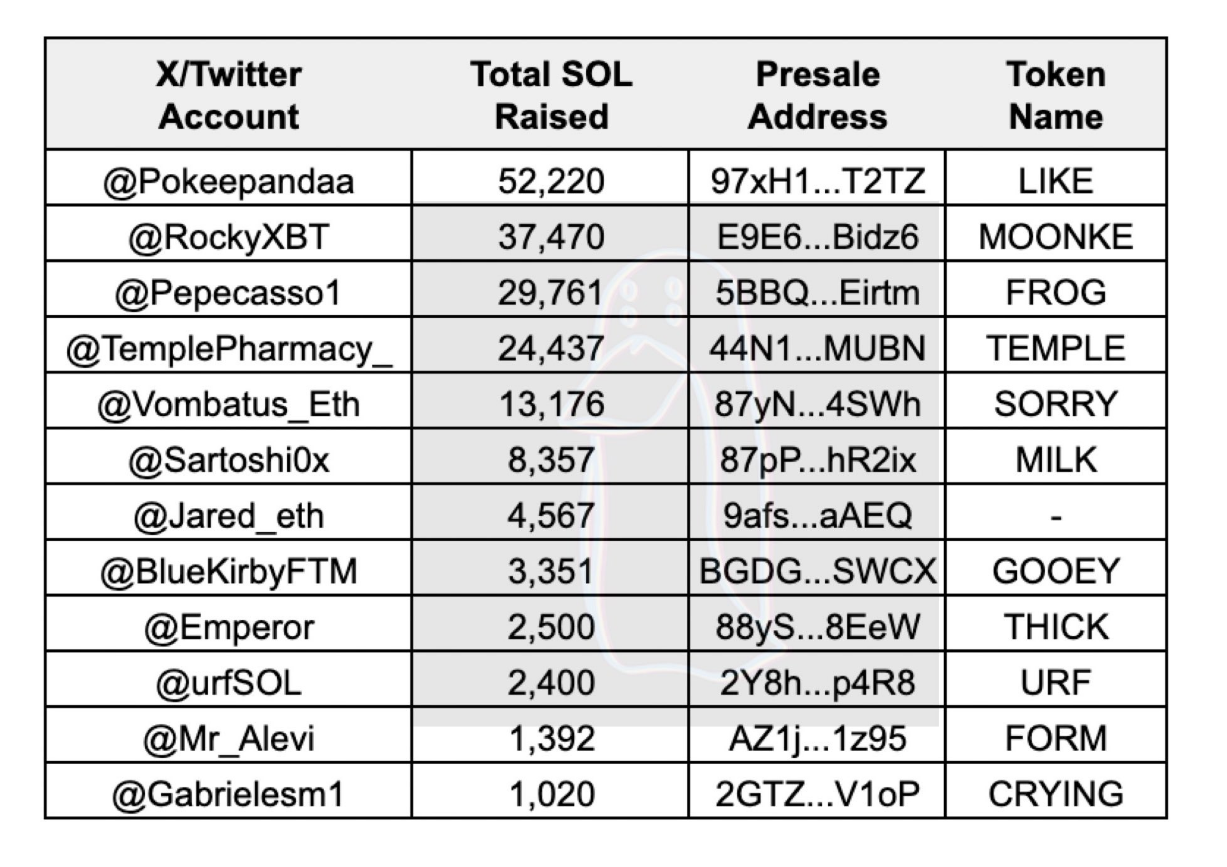

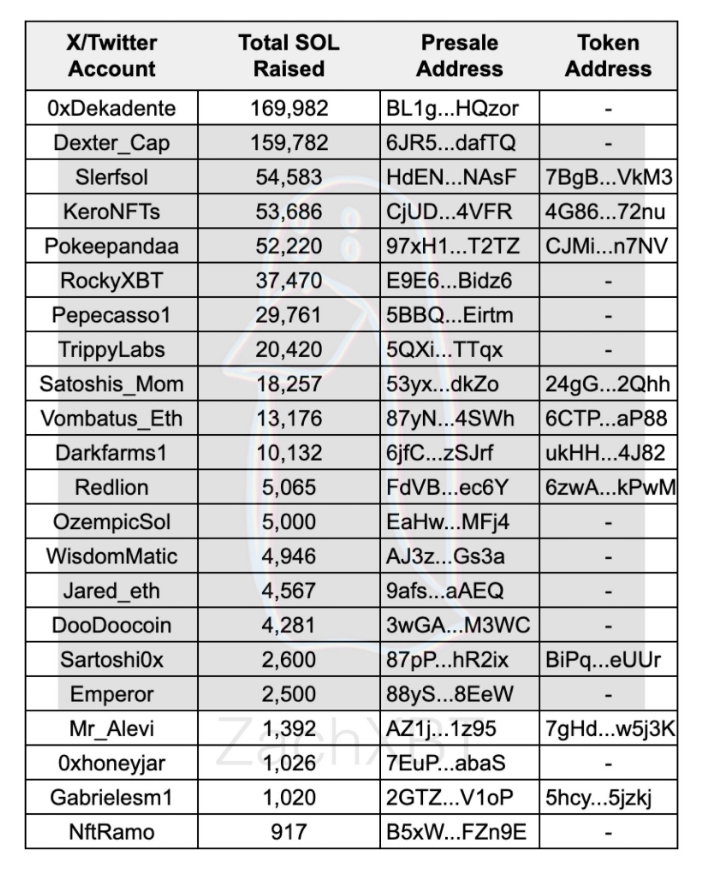

The party didn’t stop there. Blockchain investigator ZachXBT uncovered a particularly galling trend: a dozen meme coin projects vanished into thin air after their presales, taking a combined $26.7 million from investors with them.

In just a month, more than a dozen meme tokens sold during Solana’s presale have already been abandoned, with a total raised amounting to over $26.7 million or 180,650 SOL.

Would avoid any future projects launched by these founders.

— ZachXBT (@zachxbt) April 21, 2024

Solana Slowdown: When Meme Mania Clogs The Network

Meme coin mania didn’t come without its drawbacks. The overwhelming surge in transactions caused Solana’s network to become congested, resulting in transaction failures and irritating delays. This incident shed light on a significant problem with meme coins: they frequently lack practical uses in the real world and fail to contribute meaningfully to the advancement of their respective blockchains.

Anatoly Yakovenko, the founder of Solana, openly voiced his doubts about meme coin presales. He believed that such fundraising methods were more fitting for projects with robust technological backgrounds rather than those relying solely on hype and social media buzz, which some perceived as a speculative bubble.

Meme Coin Meltdown: A Cautionary Tale For Crypto Curious Investors

Investing in Solana’s meme coins, which have seen both success and failure, serves as a cautionary tale. The promise of instant wealth may be enticing, but the dangers of putting money into unregulated, speculative assets are real. The possibility of fraudulent activities, such as scams or developers abandoning projects after raising funds (known as rug pulls), is ever present.

The aftereffects of the meme coin craze may bring about significant consequences. Governments and regulatory authorities could increase their scrutiny over this sector of cryptocurrencies, possibly resulting in more stringent rules to safeguard investors.

If you’re intrigued by the allure of cryptocurrencies, take this as a guideline: meticulously investigate any project, focus on those with practical applications, and keep in mind the wisdom that if something seems overly enticing, it might be too good to be true.

Read More

- CNY RUB PREDICTION

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-04-23 10:34