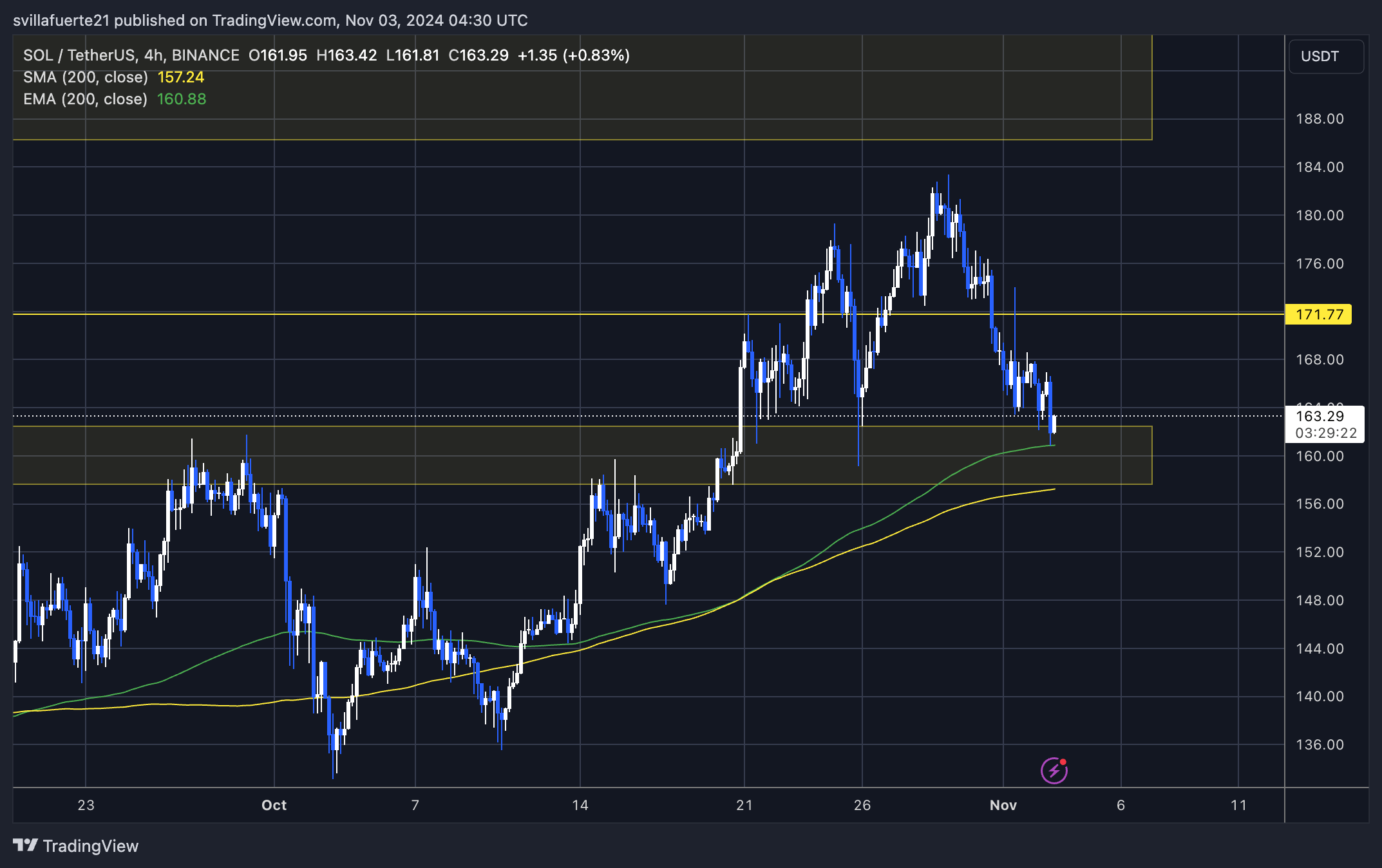

As an analyst with years of experience navigating the volatile cryptocurrency market, I’ve seen my fair share of rollercoaster rides and market manipulations. However, Solana (SOL) has managed to impress me with its resilience at the critical support level around $160. This demand zone could be the foundation for the next upward move, as suggested by top analyst Daan.

At the moment, Solana (SOL) is being traded at a pivotal point close to $163, having pulled back from recent peaks around $183. This price point is a significant area of potential demand that could influence the future price trend of SOL. If this level is breached, it might indicate a more substantial correction, which would amplify selling pressure and possibly cause SOL to revisit lower support zones.

According to expert analyst Daan, if Solana (SOL) can maintain its position within the $160 “safe zone,” it might trigger a recovery. Daan points out that in the best-case scenario, SOL could sustain this support and initiate a slow but steady upward trend, eventually aiming to challenge the resistance line that has been limiting its growth. This configuration would preserve SOL’s bullish pattern, potentially offering an attractive opportunity for investors anticipating a rebound.

Over the coming days, as the overall cryptocurrency market fluctuates significantly and Solana approaches a critical point, it’s all eyes on whether this potential demand area can hold strong enough to spark a turnaround. If successful, this could guide Solana back towards its recent peak levels.

Solana Holding Strong Despite Uncertainty

Despite the current market turbulence and unpredictability, Solana (SOL) has successfully maintained its position above the significant support zone of approximately $160. This level is pivotal for SOL’s price dynamics, serving as a robust demand area that could potentially serve as a base for the upcoming price increase.

crypto expert Daan has recently expressed his viewpoint on topic X, stating that Solana’s (SOL) “most optimistic scenario” involves maintaining a price range near $160, enabling it to steadily climb back towards the downward-sloping trendline which has restricted recent advancements.

According to Daan, it’s possible that the next attempt at this trendline could lead to a breakout, potentially pushing Solana’s price over $200. He advises that investors who prefer a more conservative approach might want to wait for confirmation of this breakout, as there is still significant potential for further growth even after a confirmed reversal. Daan’s analysis indicates a positive perspective on Solana’s possible recovery, viewing the current accumulation zone as an attractive opportunity for buying.

Nevertheless, it’s worth noting that Daan concedes the possibility of continued negative risks. If Solana (SOL) struggles to maintain its value above the $160 mark, a more significant correction might ensue, possibly pushing Solana down towards additional support zones.

At present, traders are focusing intently on this key support level in SOL’s market, as it serves as a vital sign of its short-term direction. If SOL manages to maintain above this level, it would suggest strength and possibly initiate a rally. Conversely, a drop below could instigate a prolonged period of bearishness. Given the fluctuating nature of the broader market’s outlook, Solana’s upcoming actions will be decisive for both traders and investors alike.

SOL Price Action

As a crypto investor, I’m observing Solana currently trading at $163, which has just touched the 4-hour 200 Exponential Moving Average (EMA). This EMA is a significant marker of short-term strength in the market. The fact that Solana is holding above this EMA indicates a positive outlook for SOL, implying that buyers are actively stepping in to keep the price afloat at this level.

Nevertheless, the $160 region serves as a vital support point. If this support weakens, it could lead to substantial selling pressure, possibly pushing SOL towards the $150 range. Here, fresh demand might surface, making it an area of interest for investors seeking accumulation chances. Such a dip could offer attractive entry points for long-term investors.

Instead of it, an intense surge beyond the current demand level would suggest a resurgence of bullish energy, potentially allowing SOL to aim and potentially exceed its recent peaks. As SOL finds itself near this significant technical area, traders will be on the lookout for any clear indication of the future direction, whether that’s a continued upward trend or a return to lower demand areas.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Simone Ashley Walks F1 Red Carpet Despite Role Being Cut

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Connections Help, Hints & Clues for Today, June 17

2024-11-04 12:54