As a seasoned researcher who has weathered numerous market cycles, I can confidently say that Solana is currently at a crucial crossroads. The recent dip below $140, a key structural level, has left me, like many other analysts and investors, on tenterhooks, awaiting the next price movement with bated breath.

Currently, Solana’s value exceeds an important resistance point at $137. This follows a drop of nearly 17% from previous peak prices around $160. The recent descent has caused uneasiness among analysts and investors, as they wait for clarity on the future price trend.

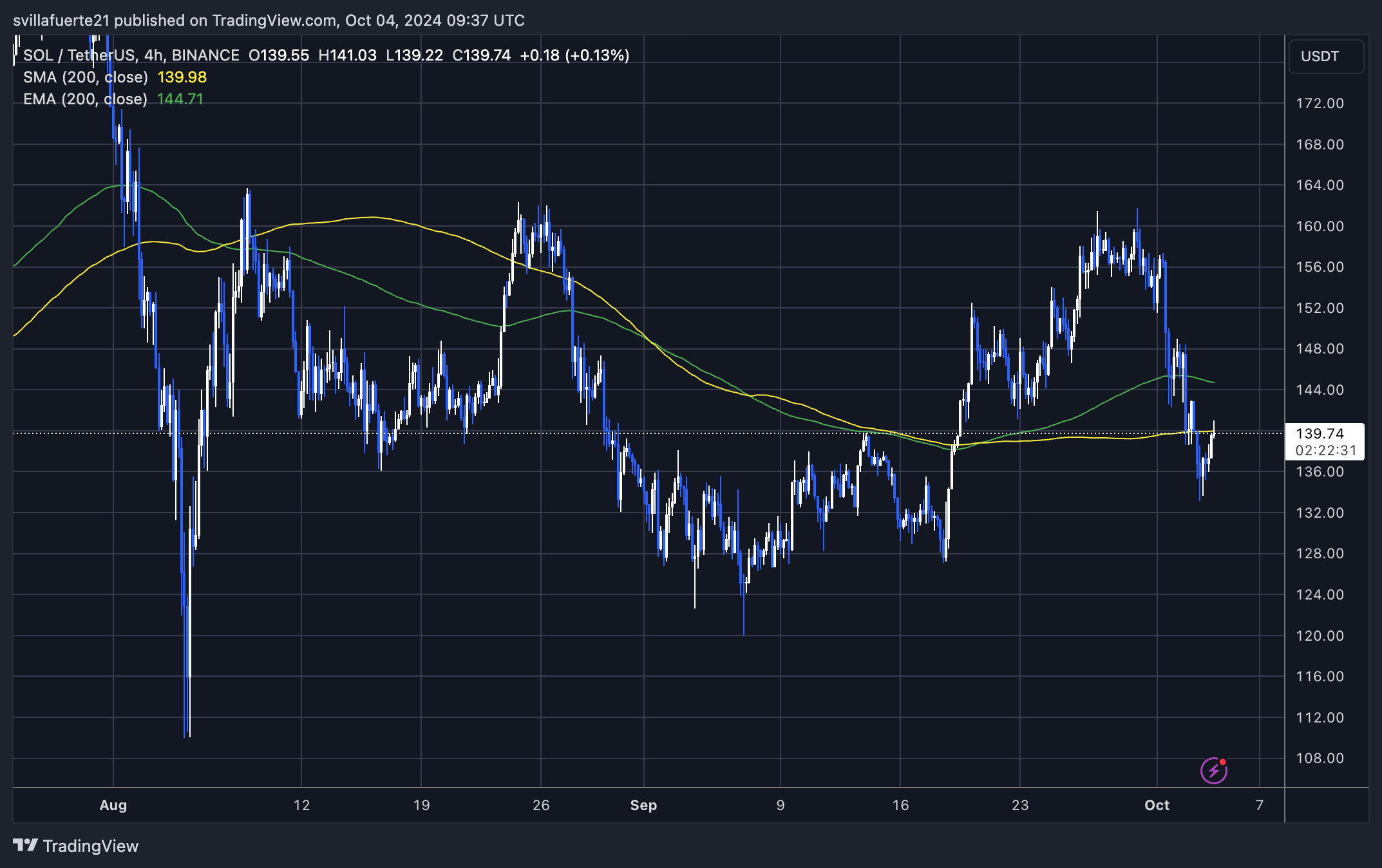

Recently, there’s been a significant shift in market sentiment from optimism to apprehension and doubt. Notably, analyst Carl Runefelt has presented a graph indicating potential risks for Solana as it approaches a crucial support level. If this level is breached, the coin could experience further declines.

In simpler terms, the unpredictable fluctuations in the cryptocurrency market are causing worry among investors because they’re unsure if the market will drop even more. Despite Solana performing well recently, the current market instability has made people feel uneasy and hopeful for a sign that could restore trust.

Over the next few days, we’ll get a clearer picture of whether Solana can resume its upward trend or if we should expect more downward movement, as it currently hovers around a crucial support point.

Solana Testing Crucial Demand Levels

Currently, Solana finds itself at a significant point in its trajectory. The market trend has swiftly changed from bullish to bearish within a short timeframe. Caution is being exercised by the bulls, particularly below the $140 threshold, which signifies an important structural level.

The $137 support level is crucial, as it could be Solana’s last defense against a further drop. Top crypto analyst Carl Runefelt recently shared a technical analysis on X, highlighting the precarious situation Solana finds itself in. According to Runefelt, Solana could see a sharp drop to $128 if this support level breaks, extending the current consolidation phase.

Besides the possibility of a halt, Runefelt additionally highlighted significant resistance points that bulls should aim for if Solana intends to restore its positive trend. Notably, the $150 and $160 price ranges are the key areas to keep an eye on.

To verify a shift towards a bullish trend, we need to see a jump surpassing these key zones. However, until that happens, the market behavior is unclear, and investors are keeping a close eye on these vital levels of support and resistance for further guidance.

Traders are showing caution due to the unpredictable fluctuations in the market and the possibility of additional drops. Whether Solana maintains its current position or breaks past its resistance levels will influence its future direction.

SOL Technical Analysis: Prices To Watch

Currently, Solana (SOL) is being traded at around $139 following a dip from peak prices that haven’t been surpassed since July. The price is encountering substantial resistance as it endeavors to rebound above the 4-hour 200 moving average (MA), which stands at approximately $139.9. This MA serves as a crucial indicator of strength.

To keep the bullish trend going, it’s crucial that the price remains above its current level. Furthermore, breaking back above the 4-hour 200 Exponential Moving Average (EMA) at $144.3 would provide evidence of a bullish reversal and hint at an upcoming recovery.

If Solana doesn’t break through these vital technical thresholds, it might face additional selling pressure, potentially causing its price to drop to around $120 – a significant support level. This could prolong the present period of sideways movement and put even more pressure on Solana’s price, pushing it downward further.

Observers are keeping a close eye on Solana (SOL) as it moves through a crucial phase. Both optimistic investors (bulls) and pessimistic ones (bears) are on the lookout for a clear signal indicating whether SOL will rise or fall further.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-10-04 18:40