As a seasoned analyst with over two decades of experience navigating market turbulence, I have learned to appreciate the resilience that Solana has shown during these testing times. The recent sell-off, while causing temporary discomfort for many investors, is merely a speed bump on Solana’s road to success.

Yesterday, Solana experienced increased market turbulence, decreasing by 7% after the Federal Reserve declared a 0.25% reduction in interest rates and fewer anticipated reductions in 2024. Despite this downturn, Solana’s price movements have shown strength by maintaining above an important support threshold, which bolsters faith in its capacity to adapt to broader economic fluctuations.

As the market responds to the Federal Reserve’s cautious stance, the story told by Solana’s on-chain metrics is markedly brighter. The number of daily transactions on the Solana network has skyrocketed, approaching 67 million, indicating increasing use and consistent activity within the network. This high transaction volume underscores Solana’s standing as a prominent blockchain platform, with developers and users relying on its scalability and efficiency continuing to thrive.

Experts believe that if Solana (SOL) manages to hold above its crucial support point, it might lead to a robust recovery. This assumption becomes stronger when market-wide conditions start showing signs of stability. Moreover, the surge in on-chain activity supports this optimistic view, implying that the long-term foundations of Solana remain robust.

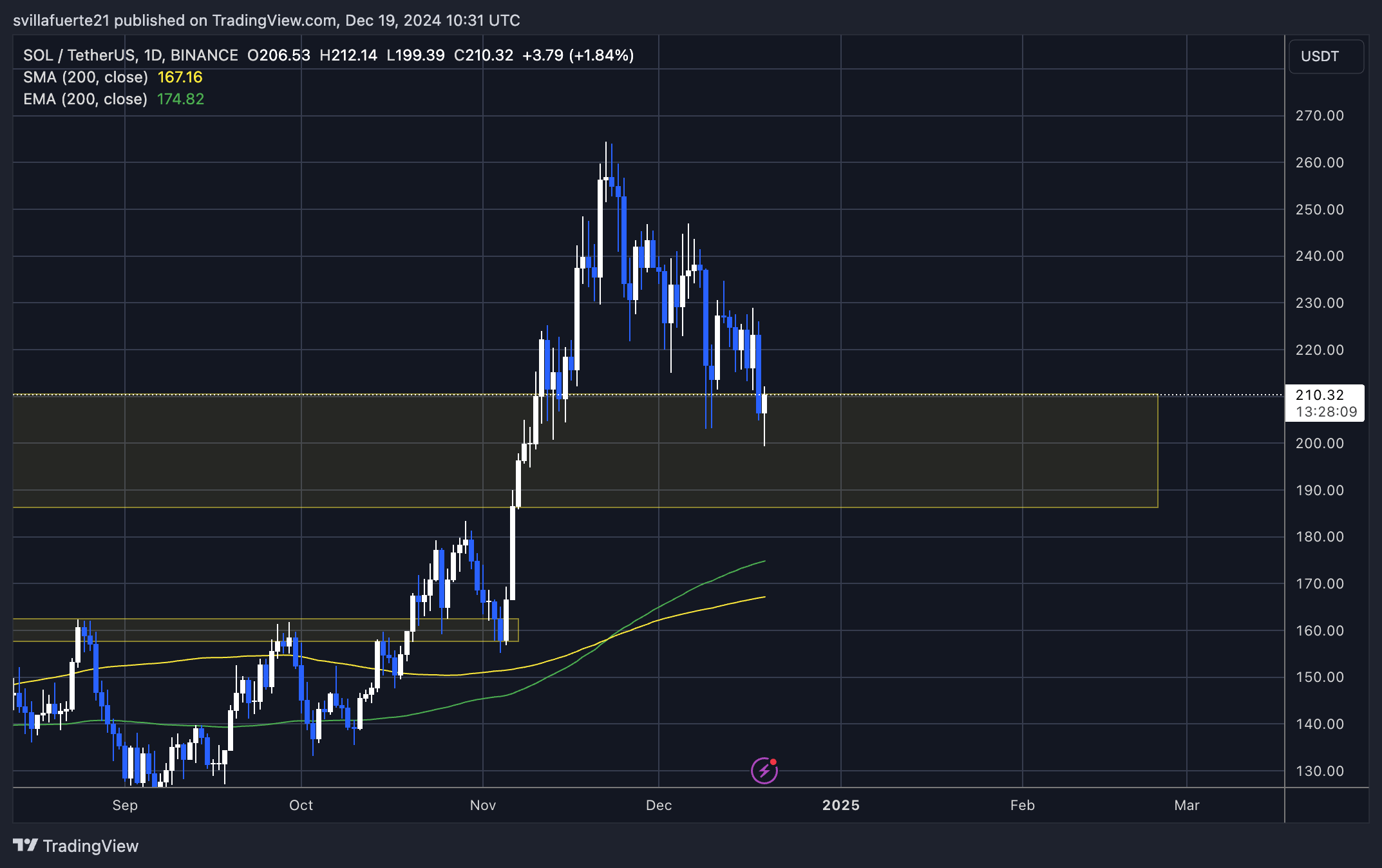

Solana Holding Key Demand

Despite the recent market turbulence caused by the Federal Reserve’s policy updates, Solana maintains its strength, staying above crucial demand levels around $210 after yesterday’s sell-off. This robust support level strengthens optimistic feelings among investors, as numerous analysts anticipate a potential breakout in the near future.

Top analyst Jelle recently offered an insightful breakdown on the technical performance of X, pointing out that Solana has managed to surpass previous lows, consistently held its ground above key monthly and weekly support thresholds, and has been moving within a contracting triangle pattern known as a falling wedge. Based on this analysis, Jelle predicts that a breakout could occur soon, potentially propelling Solana towards fresh record highs.

From my perspective as an analyst, the on-chain indicators present a hopeful scenario for Solana’s network dynamics. Data recently shared by Ali Martinez reveals that the Solana network is approaching 67 million daily transactions, which suggests robust adoption and active user participation. The increased network activity serves to emphasize Solana’s usefulness and solidifies the groundwork for continued price expansion.

If Solana maintains its position above $210 in the near future, it might ignite a substantial upward trend due to growing bullish sentiments. The market participants are keeping a close eye on Solana’s price fluctuations, seeking evidence of a clear breakout. A mix of robust technical and blockchain analytics suggests that the asset could experience a powerful rise to fresh record highs.

Price Action: Liquidity Resting Above

Currently, Solana is being traded at approximately $210, a significant level it has maintained over several days even amidst broader market fluctuations. This steady pricing indicates strong demand, but simply holding this level isn’t enough to trigger the next surge in value. For Solana to rekindle its bullish momentum, a firm break above $240 is crucial. Such a move would indicate restored strength and open the path for even higher price predictions.

Reaching the $225 point again is a significant milestone. If Solana manages to regain this level confidently, it might indicate a bullish trend and pave the way for more price increases. This could draw in more buyers as they view this movement as a sign of Solana’s strength.

If Solana doesn’t manage to surpass these resistance levels, it may find itself confined within a range and unable to fully leverage the backing it has received recently. As market circumstances develop, whether Solana can overcome these critical barriers will decide if it shifts towards a more robust uptrend or remains in a phase of consolidation.

Read More

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Brody Jenner Denies Getting Money From Kardashian Family

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Death Stranding 2: On the Beach controls

- Capcom Spotlight livestream announced for next week

- All Elemental Progenitors in Warframe

2024-12-20 10:52