As a seasoned researcher with over a decade of experience in the ever-evolving world of cryptocurrencies, I find it intriguing to observe how different digital assets respond differently during market corrections. The recent data on Open Interest suggests that while Bitcoin plummeted, Solana and Ethereum have only seen a mild retrace.

The data indicates that the Bitcoin Open Interest dropped significantly during the recent market pullback, however, Solana and Ethereum have demonstrated remarkable resilience.

Solana & Ethereum Open Interest Has Only Seen A Mild Retrace

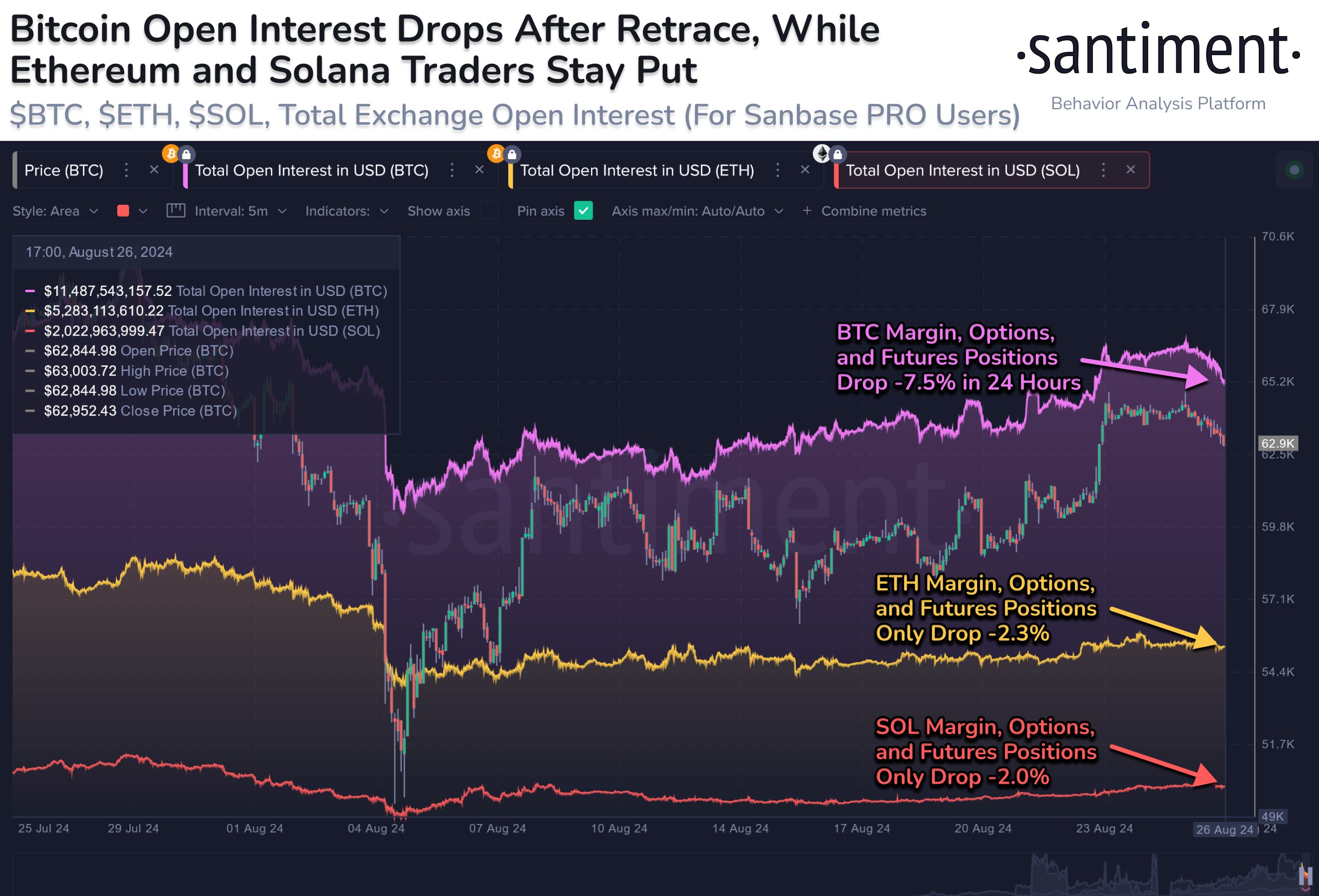

Based on figures from analytics company Santiment, Bitcoin’s Open Interest has dropped significantly following the decrease in its price. In this context, “Open Interest” represents a measurement that monitors the overall number of open derivative contracts linked to a specific asset (expressed in USD) across all trading platforms.

When the level of this indicator increases, it’s likely that investors are currently entering new derivative contracts. Since new contracts often indicate an increase in overall market exposure, the rising Open Interest could potentially cause greater fluctuations in the cryptocurrency’s value.

From another perspective, when the indicator shows a drop, it suggests that some investors are choosing to sell off their investments voluntarily or are being forced to do so by their platforms. Once this downward trend has passed, the asset typically exhibits increased stability.

Currently, I’d like to present a graph illustrating the change in Open Interest for the leading cryptocurrencies within their sector – Bitcoin, Ethereum, and Solana – over the last 30 days.

Over the course of the last day, I’ve noticed a significant drop of approximately 7.5% in Bitcoin Open Interest as per the graph. This decrease could be attributed to the cryptocurrency pulling back towards levels below $63,000.

It’s worth noting that despite Ethereum and Solana experiencing comparable price decreases within this timeframe, their Open Interest has only dropped by roughly 2% for each.

It could be that among these assets, Bitcoin had the highest level of leverage, which means a minor price decrease could trigger substantial sell-offs or liquidations. Nevertheless, there might be alternative explanations as well.

Currently, it seems that investors are leaning towards altcoins over Bitcoin, preferring to liquidate their BTC-associated investments and instead expand their holdings in coins such as Solana and Ethereum.

It’s challenging to determine if the growing interest in Solana and Ethereum compared to Bitcoin is beneficial for the overall market. However, this trend certainly positions those coins for potential activity in the near future.

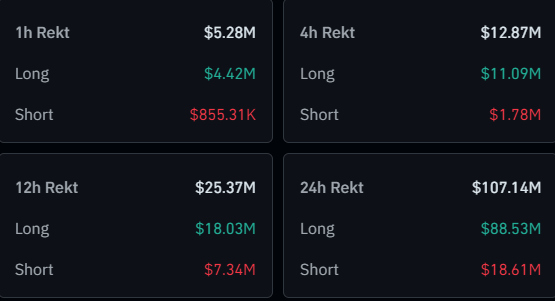

Regarding the subject of liquidations, recent data from CoinGlass shows the precise amounts of Open Interest that have been cleared across the cryptocurrency market over the past day.

Yesterday, we saw approximately $107 million worth of cryptocurrency derivative contracts being liquidated, and more than $88 million of that amount was from individuals holding long contracts specifically.

SOL Price

At the time of writing, Solana is trading around $156, up almost 7% over the past week.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-08-27 23:46