As a seasoned researcher who has closely followed the cryptocurrency market for years, I must say that Solana’s consistent growth and performance are nothing short of impressive. After observing its meteoric rise over the past few months, it is clear that Solana is not just another flash-in-the-pan crypto; it’s a legitimate contender in the blockchain space.

During this cycle, Solana consistently demonstrates its status as a leading blockchain. Following a surge that increased its value by 35% within the last two months, the widely recognized Layer 1 blockchain has once again garnered attention due to an uptick in on-chain activities.

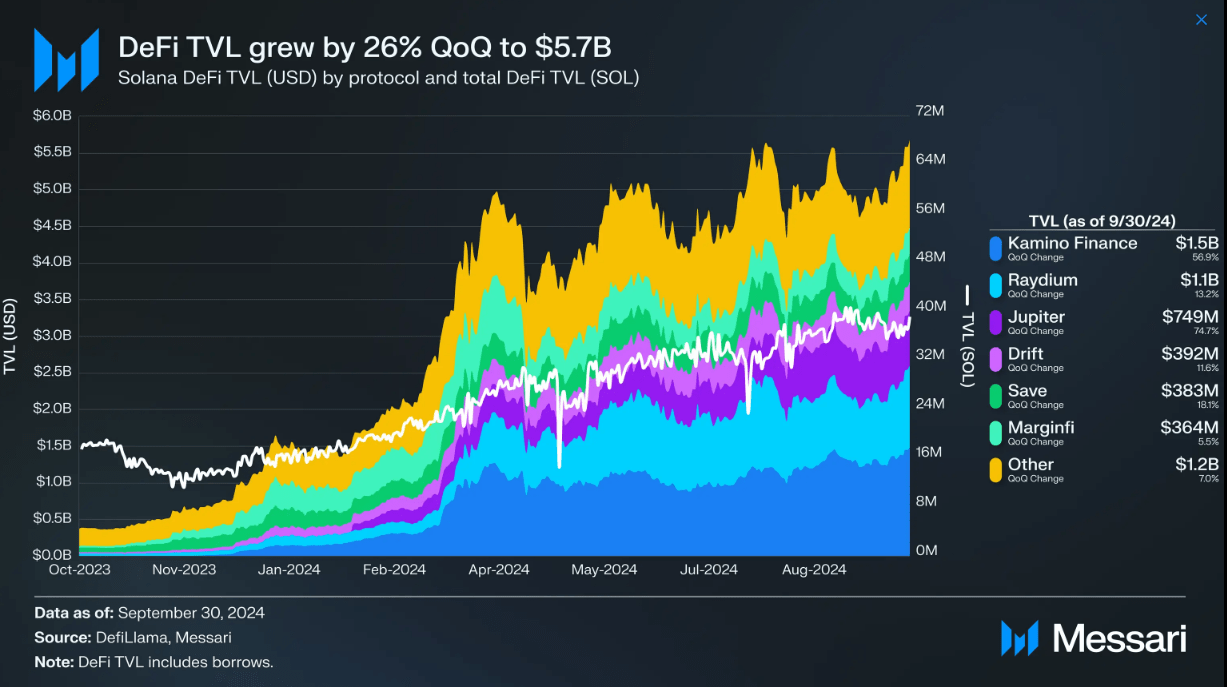

Based on current figures, it appears that Solana’s DeFi Total Value Locked (TVL) climbed up to approximately $5.7 billion during the third quarter. This represents a notable 26% growth compared to the second quarter.

crypto lending platform Kamino currently tops the charts with a staggering TVL (Total Value Locked) of $1.5 billion and a remarkable 7% growth each quarter. This impressive expansion is attributed to the addition of jupSOL and PYUSD. Moreover, recent data indicates that Solana’s market capitalization has grown to $3.8 billion, marking a significant increase of 23%. This uptick can be linked to the integration of PayPal’s PYUSD.

DeFI Continues To Drive Growth For Solana

On Solana’s blockchain, DeFi (Decentralized Finance) activities lead the way with a combined value of approximately $5.7 billion. This new data on SOL demonstrates an impressive 26% increase quarter over quarter, propelling the chain to take third place in this category, surpassing Tron.

As a crypto investor, I’ve noticed an exciting growth in Solana’s Total Value Locked (TVL) recently, primarily due to heightened activity surrounding Kamino. This particular project contributed approximately $1.5 billion to the overall contracts locked. Interestingly, Kamino’s latest quarterly figures show a staggering 57% surge. This significant rise can be attributed to the recent integration of jupSOL and PYUSD into the platform.

On the Solana blockchain, aside from Kamino Finance, Raydium has locked assets worth approximately $1.1 billion, while Jupiter holds around $749 million. The remarkable growth of Kamino Finance can be attributed to the launch of its Kamino Lend V2, which provides a vault and market layer that operates without requiring permission.

Experts predict that Kamino Finance will maintain its leadership position by introducing innovative initiatives such as Spot Leverage and Lending Orderbook.

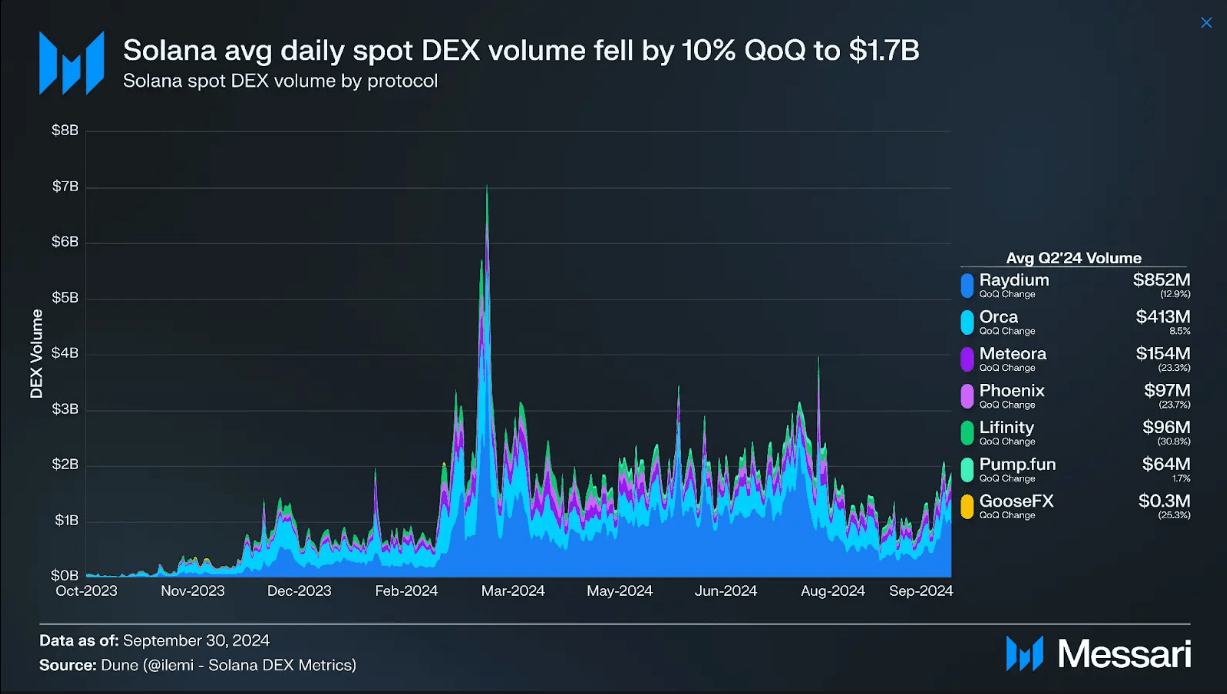

Solana DEX Shows Signs Of Slowing Down

Solana’s Decentralized Exchange (DEX) saw a decrease of around 10% compared to the previous quarter, but it showed some recovery by October. The typical daily trading volume on its blockchain reached approximately $1.7 billion, mainly due to a decline in meme coin transactions.

Raydium continues to lead Solana’s decentralized exchange (DEX) sector, holding approximately 51% of the market share. However, its daily transaction volume decreased by around 13%, reaching about $852 million. Interestingly, with the launch of Moonshot – a crypto mobile trading application – there was an increase in volume to the tune of $350 million.

Jupiter maintained its leading position, accounting for about 43% of the overall trading volume on all spot exchanges. Notable advancements such as the launch of Jupiter Mobile and the incorporation of Google Pay and Apple Pay have been beneficial to the platform.

SOL’s Stablecoins Get Help From PYUSD

According to the same Messari report, it’s PayPal’s PYUSD that has boosted the market for Solana’s stablecoin. The launch of PYUSD in May on Solana has significantly contributed to its current market cap of $3.8 billion. The appeal of features such as programmable transfers and transfer hooks have made PayPal’s PYUSD quickly gain popularity.

Beyond just PYUSD, USDC is another significant player in Solana’s stablecoin sector. Circle’s incorporation of Web 3.0 services for SOL offers businesses advanced functionalities such as fee reimbursement and customizable wallets, enabling developers to seamlessly integrate cross-chain solutions in a timely manner.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-11-04 12:50