As a seasoned analyst with over two decades of trading under my belt, I’ve seen bull markets rise and bear markets fall, and have learned that patience is often the key to success. The current situation with Solana (SOL) has me intrigued, given its position at the lower end of a monthly range that began in March – a level that could potentially dictate its price action in the coming months.

Currently, Solana (SOL) can be found towards the lower part of its monthly price range which started in March. This significant location could influence the token’s price movement over the next few months.

In the face of widespread unpredictability within the cryptocurrency sector, experts and investors are keenly observing if this price range indicates a period of buying and holding, potentially setting the stage for a substantial market surge.

Recently, renowned analyst and investor, Mr. Crypto, offered a technical comparison between Solana’s current price pattern and its 2021 performance. This comparison, he notes, indicates similarities that could signal an impending bullish surge. His assessment, given amidst market unease, reflects a generally optimistic outlook on Solana, with several investors anticipating another significant upward trend for the cryptocurrency.

As cautious optimism prevails, investors eagerly wait for clear evidence that Solana’s current period of sideways movement is setting the stage for a prolonged upward trend. The events of the coming weeks could greatly influence Solana’s path for the remainder of 2021.

Solana Price Action: Accumulation Or Bull Trap?

Since mid-March, the price of Solana (SOL) has been moving between approximately $210 and $110. Some investors have begun to suspect that this might be a bear trap instead of an accumulation period, while others maintain a guarded optimism.

There’s a rising feeling that Solana might continue moving sideways instead of experiencing the predicted surge, and it could potentially result in even more drops. However, despite this apprehension, well-known analyst Mister Crypto offers a more optimistic viewpoint.

In his recent assessment, Mr. Crypto draws a parallel between the current mood towards Solana and how it was prior to its meteoric rise in 2021, just before it hit unprecedented record highs. He emphasizes the likenesses in market apprehension and doubt that preceded Solana’s previous monumental surge.

As he explains, this type of consolidation driven by fear could be indicative of bullish tendencies emerging, suggesting that when the market rebounds, there’s a strong possibility of significant returns.

Mr. Crypto doesn’t give an exact price prediction but indicates that Solana might exceed its previous record high of $260. Despite the prevailing cautious sentiment, his analysis offers optimism about a potential upcoming substantial increase in Solana’s value. This optimism is based on historical trends, which suggest that Solana has exhibited similar price patterns before experiencing major surges.

Over the approaching period, Solana’s future could be shaped significantly. Market participants are on edge, eagerly watching whether Solana will exceed its current limits or persist under bearish pressure.

SOL Key Levels To Watch

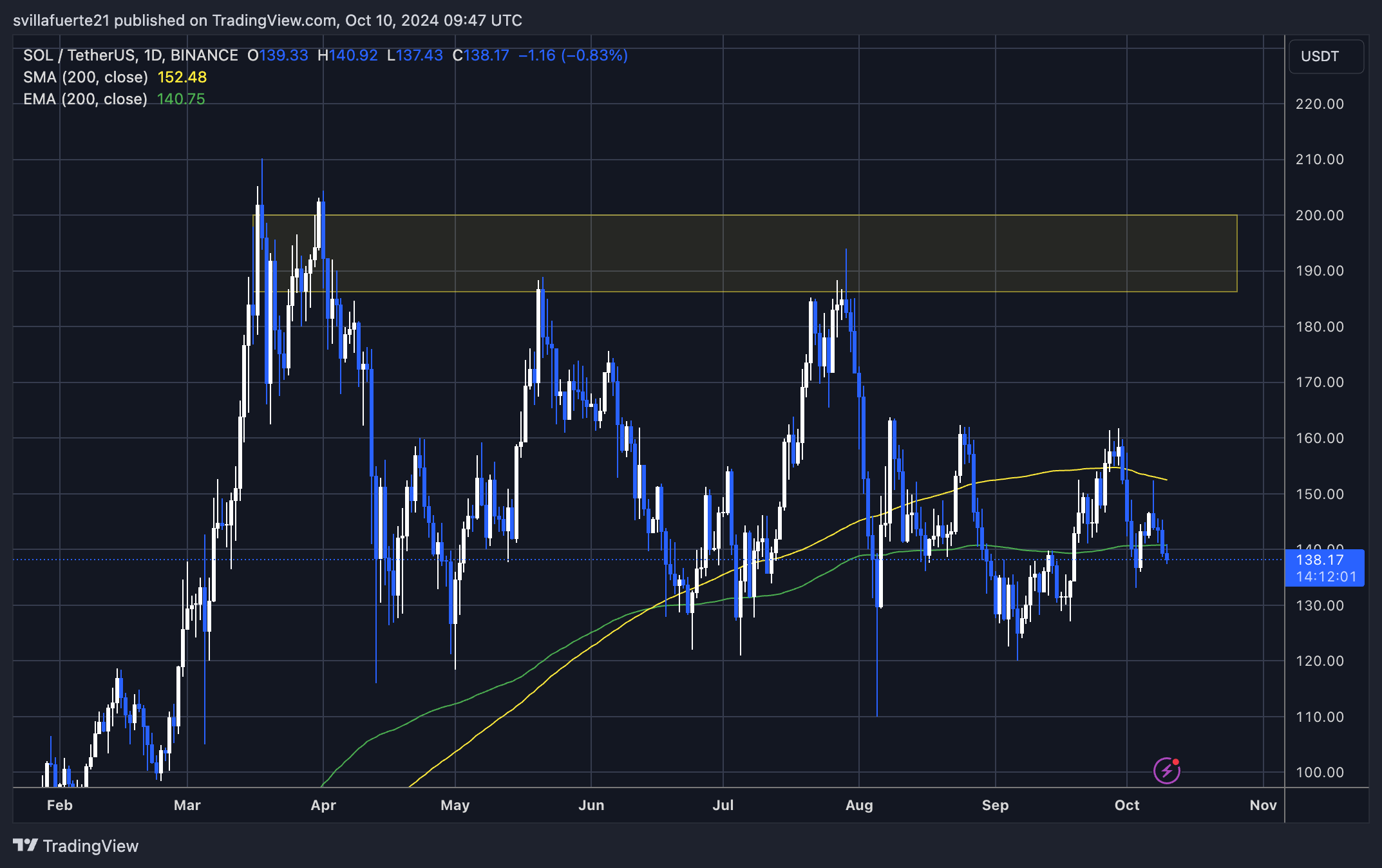

At the moment, Solana (SOL) is being traded at around $138. This represents a 9% decrease from its daily 200 moving average (MA) of $152. This decline signals a notable slowdown in momentum, as the price has also dipped below the daily 200 exponential moving average (EMA) of $140 – an important support threshold. Dropping below this 200 EMA raises questions about potential further drops in the upcoming weeks.

As an analyst, I find myself closely monitoring Solana’s price action. To regain control and potentially fuel a bull run, Solana needs to reclaim its 200-day moving average (MA) and exponential moving average (EMA), and break above the crucial resistance level at $160. A strong surge beyond this point would suggest a resurgence of bullish sentiment, possibly leading to further price increases for Solana. However, if Solana fails to recover these critical technical indicators, it may signal a deeper correction in its trajectory.

If the price of SOL keeps falling, it might move towards regions with lower demand, potentially around $110. This level has previously served as a robust support for Solana. Market observers are attentive to determine whether Solana can maintain its current position or if it could face additional downward pressure in the coming days. The upcoming period will likely shape SOL’s price trend and overall market direction significantly.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-10-10 21:04