As a seasoned researcher with a background in cryptocurrency and finance, I find myself intrigued by Solana’s current trajectory. The way it has transformed a previous resistance level into a solid demand zone is quite remarkable and could be a sign of things to come. If Solana manages to maintain its position above the critical $171 mark, it might just be the catalyst for an extended uptrend in the coming weeks.

As a researcher, I’m observing an impressive surge in Solana as it surpasses the crucial $171 mark. Previously, this price point functioned as a supply area, but now it’s transforming into a robust demand zone. This level holds significance for bullish investors, as maintaining its position above could potentially trigger a bullish trend in the upcoming weeks.

According to crypto expert Carl Runefelt, Solana’s ongoing price trend continues to show optimistic signs if it can maintain its value above the specified level as support.

As a crypto investor, I’ve noticed that Solana’s previous resistance levels are now serving as a strong support base. This shift suggests growing demand, which could potentially fuel more positive momentum. The market is keenly watching these developments, and the coming days are shaping up to be pivotal for Solana. If things continue in this direction, it could be an exciting time for Solana investors!

Should Solana’s value continue to hover above $171, it might foster optimism for a prolonged upward movement. Investors will undoubtedly monitor Solana’s price movements closely, as a drop below this point could potentially influence the near-term perspective of one of cryptocurrency’s most promising assets.

Solana Testing Liquidity

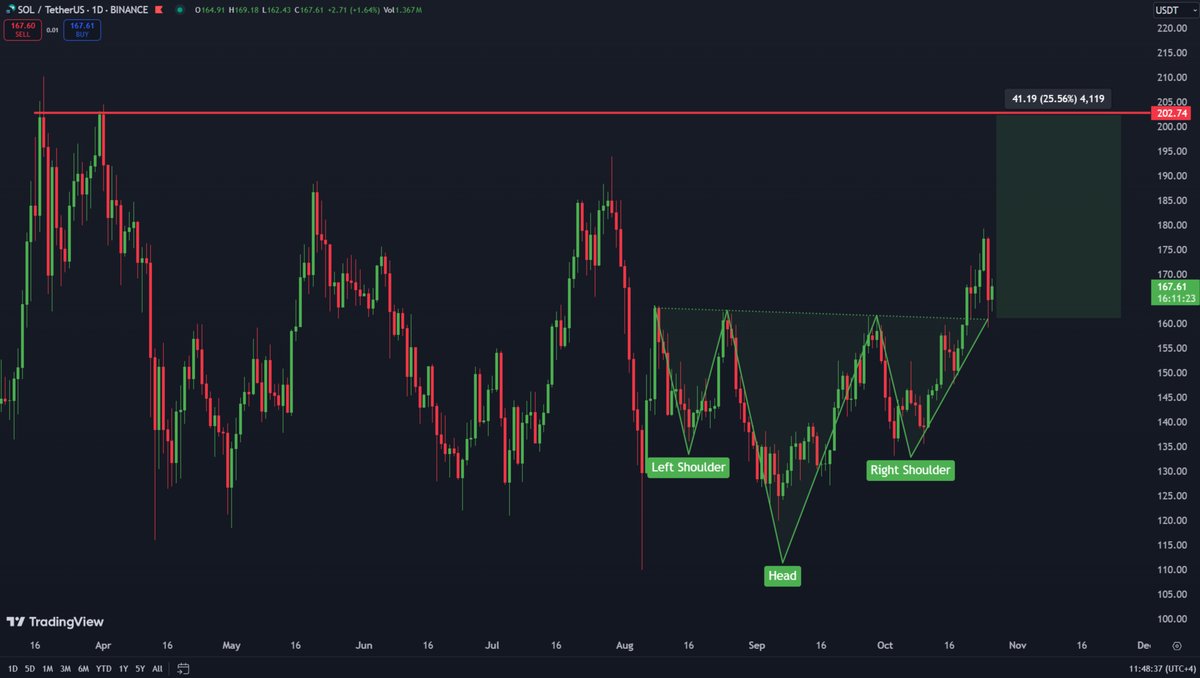

Top investor Carl Runefelt recently shared his insights on X, highlighting the significance of Solana’s head and shoulders pattern. In his analysis, Runefelt noted that a successful neckline retest would confirm the bullish trend’s strength.

According to Runefelt’s analysis, if Solana (SOL) stays above its neckline, it suggests continued bullish movement, and he predicts a short-term price of around $202.

The proposed upward trajectory has piqued the interest of both investors and traders, who view the $202 mark as a realistic goal if the ongoing bullish trend persists. Runefelt’s analysis emphasizes that the neckline serves as a vital support level; maintaining this could trigger substantial buying activity. However, should there be a break below this neckline, it might alter the momentum, possibly leading to a more cautious stance.

In the coming days, the significance of Solana’s price movement, as it forms a pattern with its head and shoulders, cannot be overstated. If Solana manages to successfully revisit the neckline again, this could ignite further expansion, potentially taking SOL prices to unprecedented heights.

SOL Price Action

As a researcher observing the market dynamics, I find myself noting that Solana (SOL) is currently trading at $172 and showing a steady climb towards a higher supply zone. For the bullish momentum to be sustained, it’s crucial that SOL bulls manage to push the price beyond the vital resistance at $180. This particular level serves as a significant barrier, and overcoming it could instigate a surge of FOMO buying, further propelling the price upward. This psychological threshold might pique the interest of traders who perceive a clear breakout as an indication of potential further profits.

Maintaining an upward trajectory for SOL is crucial. If it fails to hold above $171, a reversal towards areas with less buying interest may occur. This shift might cause SOL to retest support levels near past lows, potentially dampening the ongoing momentum.

Keeping a close eye on the market, the upcoming actions near the $171 and $180 mark are significant indicators for traders and investors. If Solana’s price surges beyond $180, it might indicate persistent strength in its price movement. On the other hand, falling below $171 could hint at weakness, suggesting a brief halt or correction in the ongoing bullish trend.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-27 11:28