As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous bull and bear cycles, but none quite like the crypto space. The current market conditions present a unique challenge, and my gut feeling is that Solana, despite its recent downturn, could potentially witness a final bullish surge before the year ends.

Currently, Bitcoin‘s price is dipping below $98,000, causing a downturn in the overall crypto market cap that excludes Bitcoin and Ethereum, which now stands at around $950 billion. This bearish trend seems to be affecting top altcoins like Solana, as their prices are also experiencing intraday declines. The 24-hour volatility for Bitcoin is 2.9%, while for Ethereum it’s 3.7%. The trading volume within the last 24 hours for both Bitcoin and Ethereum is substantial, with $40.68 billion and $20.05 billion respectively.

The SOL price, currently at $189.0, hasn’t managed to surpass the $200 mark, indicating it’s stuck in a limited upward trend. Could we expect a powerful bullish push from Solana to propel it past the $200 barrier and embark on a breakout?

Solana Price Analysis

Looking at the day-to-day price movements, it appears that the Solana price has shifted sideways following an unsuccessful attempt to surpass the $200 psychological resistance, resulting in a consolidation phase where prices are moving between the support levels of $100 and $75. This suggests a period of market uncertainty or hesitation.

In simpler terms, the current trend indicates a potential downward continuation since the high rejection has occurred, which means prices are expected to drop further. This downtrend is supported by the fact that the fall is going below both the 50-Moving Average Line and the 20-Moving Average Line on the 4-hour chart. At the moment, Solana (SOL) is being traded at $193.46, and it has formed its third consecutive bearish candle in the same 4-hour chart.

With increasing bearish pressure, it seems likely that the price will revisit the significant support point, potentially increasing the chances of a price drop. This downward trend is backed by the fact that the RSI line on the 4-hour chart now sits below the EMA line, indicating an increase in selling activity.

2024: A Bullish Year for Solana

Contrary to the temporary negative outlook, Solana’s performance in the year 2024 has predominantly been positive, boasting a growth of 90.77% so far. Solana has witnessed substantial increases across various sectors.

⚡ LATEST: Bitcoin and Solana hit all-time highs in monthly trading volume last month.

Meanwhile, Ethereum remains around 50% below its 2021 peak.

— Cointelegraph (@Cointelegraph) December 25, 2024

Additionally, Bitcoin (BTC) and Solana (SOL) reached new peak volumes in their monthly trading during the past month, strengthening their dominance within the market even more.

Solana Outpaces Ethereum in Social Mentions

It’s worth noting that Solana has surpassed Ethereum in terms of social media mentions across various platforms over the past six months. Specifically, Solana (SOL) has been mentioned about 12.6 million times, exceeding the 11.42 million mentions for Ethereum.

2024 marked a significant shift as Solana surpassed Ethereum in terms of frequency on social media discussions, with Solana’s token ($SOL) garnering 12.6 million mentions over the past six months compared to Ethereum’s ($ETH) 11.42 million.

…

— LunarCrush Social Intelligence (@LunarCrush) December 26, 2024

This signifies a substantial rise, indicating an expanding level of community involvement and curiosity towards the system.

Surging DEX Activity on Solana

It’s worth noting that the usage of Decentralized Exchanges (DEX) on the Solana network has significantly increased. In fact, the volume of transactions on DEX over Solana was approximately 83.7% greater than on Ethereum in November. To be more specific, Solana handled a whopping $129.7 billion, while Ethereum managed only $70.6 billion during the same period.

Additionally, it signifies that this is the second straight month where we’ve seen trading volumes exceed $100 billion on decentralized exchanges. This underscores the increasing influence of Solana within the Decentralized Finance (DeFi) industry.

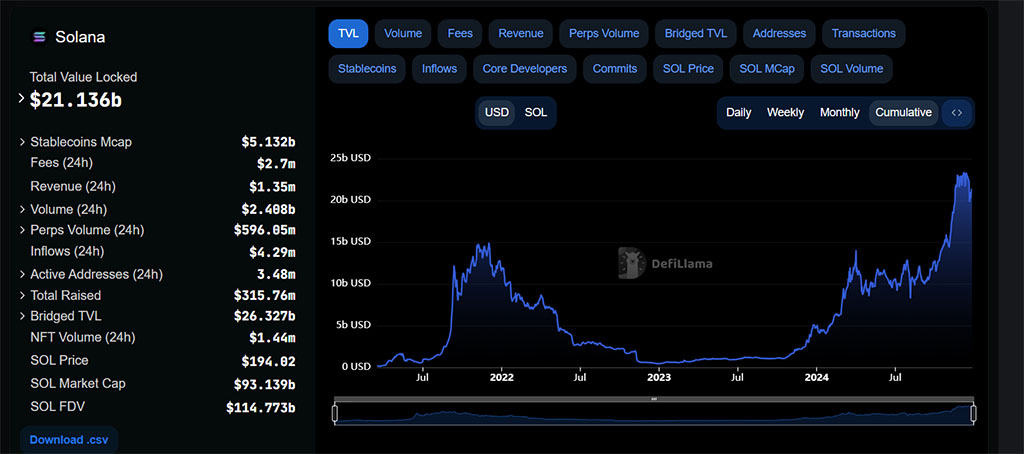

Record-Breaking Total Value Locked (TVL)

In the midst of the 2024 recovery, the total value locked on the Solana network has soared to an unprecedented record, surpassing $23.08 billion.

As a crypto investor, I’m excited to see that Solana’s Total Value Locked (TVL) currently stands at a staggering $21.136 billion, demonstrating its robustness and incredible growth. Over the past 24 hours, the network has generated an impressive revenue of approximately $1.35 million, further solidifying its position in the crypto space.

Solana Price Target

According to the present trend, it appears that the Solana price might return to the $175 as a potential support point. Yet, should there be a ‘Santa Rally’ in the cryptocurrency market, Solana could experience one final bull run in 2024.

If the price of SOL surges past the $200 mark, it might be targeting the potential price levels of around $220 and $250.

Conclusion

Despite temporary bearish trends in SOL’s short-term price movement, its impressive growth throughout 2024, growing social buzz, escalating decentralized exchange activity, and unprecedented Total Value Locked suggest a sturdy base for future success. These elements point towards an optimistic forecast for 2025. As the overall market bounces back, Solana is expected to further cement its influence within the cryptocurrency sector.

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- Brody Jenner Denies Getting Money From Kardashian Family

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- Steven Spielberg UFO Movie Gets Exciting Update as Filming Wraps

- Nobuo Uematsu says Fantasian Neo Dimension is his last gaming project as a music composer

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

2024-12-26 13:10