As a seasoned researcher with over two decades of experience in the crypto market, I can confidently say that the recent accumulation trend among Smart Money investors in Chainlink (LINK) has piqued my interest. Having witnessed numerous bull and bear cycles, I’ve learned to read between the lines of market trends and investor behavior.

Despite Bitcoin spearheading the market’s upward trend, savvy investors are keeping a keen interest in Chainlink and other DeFi tokens, as they appear to be quietly amassing their holdings in this altcoin.

It seems that over the last seven days, Chainlink (LINK) has been the third-most acquired token by savvy investors. This hints at potential substantial price increases for LINK in the upcoming months.

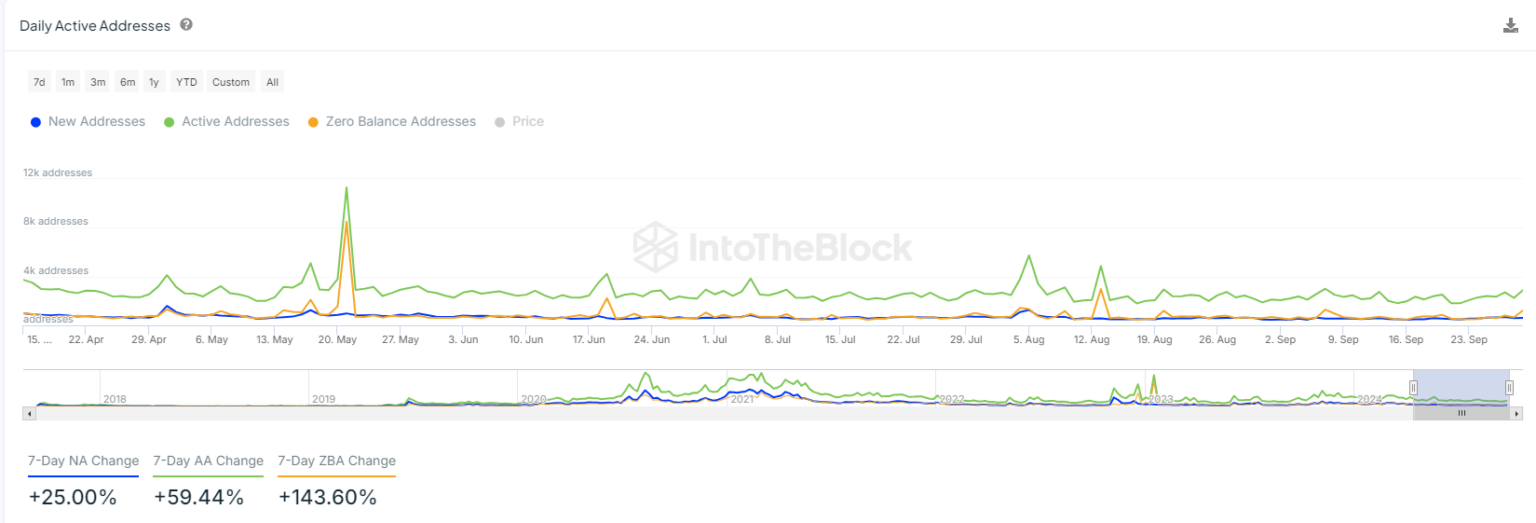

Moreover, the increased activity on Chainlink’s network lends credence to its bullish trend. For instance, there has been a 25% rise in new Chainlink addresses, a 59% increase in active addresses, and an astounding 143% surge in zero-balance addresses.

Courtesy: IntotheBlock

These figures indicate that traders are preparing to engage in the LINK market, similar to the actions of Smart Money. The rise in trading activity, coupled with increasing investor interest, could propel LINK toward the $20 price target.

Furthermore, it’s observed that the distribution of LINK token holders undergoes significant changes. For instance, investors who own between 1-10 million LINK tokens have seen a 2% rise in their holdings. Conversely, those with 10 million LINK coins have decreased their ownership by 5%.

The diverse pattern of liquidations, accompanied by a rise in trading transactions, points towards a positive perspective regarding the future fluctuations in the LINK‘s market value.

Chainlink Technical Chart and Expectations

With an increasing buzz from both individual and corporate investors, the behavior of Chainlink’s price has exhibited some encouraging trends on its technical analysis. For instance, the LINK/USDT pair has surpassed the neckline of a double-bottom pattern, indicating a high likelihood of a forthcoming trend reversal.

After the market dip on August 5th, this particular pattern began to materialize. Chainlink hovered close to its supportive price point before experiencing an uptrend. Upon revisiting this support level, a double bottom was established, which was later confirmed. This led Chainlink to surpass its short-term resistance, indicating a significant change in structure.

Currently, we’re experiencing a period where prices are adjusting or pulling back, which could lead to a dip towards the established trendline. Following this possible decline, there may be another significant rise.

Courtesy: TradingView

Additionally, certain important factors such as MACD are now displaying a bullish trend. This is indicated by the rise in the number of buying volumes, which are represented by the histogram bars. This suggests that the value of LINK might increase significantly and reach around $20 in the immediate future.

Additionally, the Chainlink Money Flows (CMF) index is also showing a positive sign, implying a significant flow of funds into the altcoin. This bullish trend aligns with Smart Money’s buying pattern, suggesting that a potential 70% return on investment may be achieved if LINK reaches its $20 target by the end of the year.

Recently, Chainlink Labs has been establishing significant collaborations. For instance, they recently teamed up with Fireblocks to create a system for the release and administration of stablecoins.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-01 15:18