As a seasoned financial analyst with extensive experience in the cryptocurrency market, I find the recent WazirX security breach and the subsequent impact on Shiba Inu (SHIB) holders deeply concerning. Having closely monitored and analyzed various market trends over the years, I am acutely aware of the potential repercussions such incidents can have on investors’ confidence and asset prices.

WazirX, a major cryptocurrency exchange in India, experienced a significant security breach on Thursday, leading to the loss of approximately $230 million, which is almost half of its total reserves. The incident was labeled as a “force majeure event” by WazirX. This unfortunate occurrence has implications beyond just WazirX, instilling doubt amongst Shiba Inu (SHIB) investors.

Panic Sell-Off Fears Rise

Elliptic, a leading blockchain analysis firm, delved into the details of the breach, disclosing that approximately $235 million in crypto assets were stolen. The stolen funds encompassed Shiba Inu to the tune of $96.7 million, Ethereum amounting to $52.6 million, Polygon (MATIC) with $11 million, Pepe $7.6 million, Tether’s USDT $5.7 million, and Floki Inu $4.7 million.

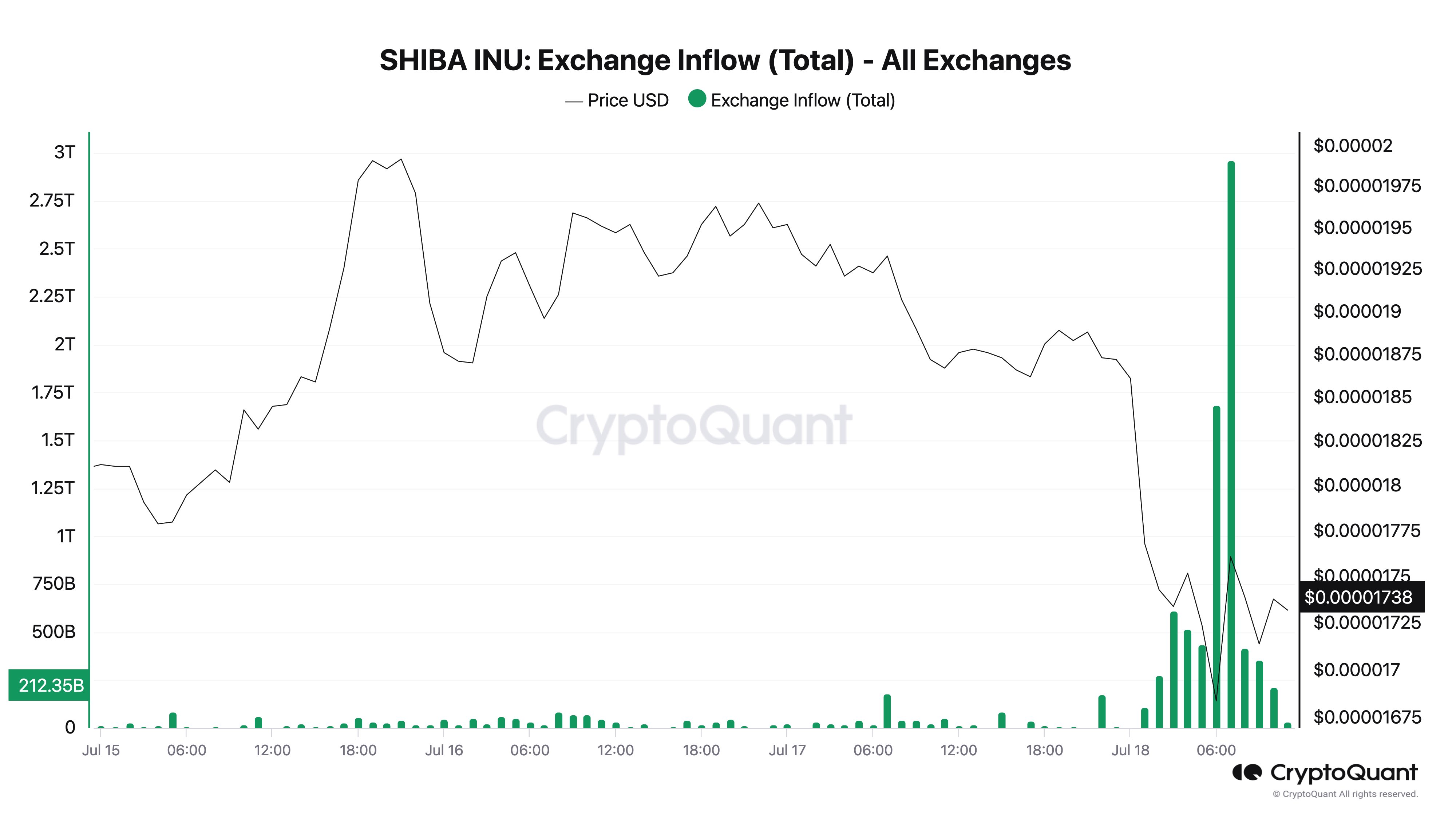

When word of the security incident circulated, Julio Moreno, the research chief at CryptoQuant, noted a significant increase in individuals hurrying to trading platforms to dispose of their holdings. Strikingly, more than 5 trillion SHIB tokens were offloaded onto exchanges within just a few hours, heightening worry about a possible massive wave of selling.

The exploit took a toll on Shiba Inu’s price, resulting in a significant drop of around 10%. Consequently, the token is now trading at $0.000017.

As a seasoned cybersecurity analyst with years of experience under my belt, I can tell you that the recent revelation about the WazirX hacker selling off $102.1 million worth of SHIB tokens is a stark reminder of the far-reaching consequences of cybercrimes. The on-chain data from Arkham paints a clear picture of how such actions can significantly impact market trends, and as someone who has witnessed the ripple effects of similar incidents in the past, I find it both intriguing and alarming.

Market makers like Wintermute have been observed stepping in to buy SHIB from decentralized platforms and then selling it on more traditional exchanges. This action has helped prevent a more significant decline in the token’s price.

Shiba Inu Price Analysis

Looking ahead, the potential magnitude and consequences of widespread selling are cause for worry. As fear escalates, investors may choose to offload their assets, potentially intensifying the existing market decline.

Analyzing the SHIB/USD chart, I’ve identified three potential areas where the price may find support and potentially halt any further decline. The first, less notable one, is around the $0.000014 area. Historically, this level had acted as a resistance during early July but later served as a support when the price bounced back towards $0.000020.

If the selling pressure overpowers this particular level, focus shifts towards the pivotal support at $0.000012 over a six-month timeframe. Shiba Inu investors need to defend this price point in order to prevent potential further losses if strong buying momentum does not surface.

In summary, the price point of $0.0000092 is significant for optimistic investors in Shiba Inu as it marks their final buying threshold. If this level is surpassed, there’s a strong possibility that these investors may reconsider their positions and reassess the coin at its historical minimum values.

If Shiba Inu (SHIB) bounces back, its 200-day exponential moving average (EMA), represented by the yellow line on the SHIB/USD chart, may serve as a hurdle for further gains. This resistance level will surface if the bullish trend dominates Shiba Inu’s price movements.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

2024-07-19 10:17