As a seasoned researcher with over a decade of experience in the cryptocurrency market, I have seen my fair share of volatility and price swings. The recent performance of Shiba Inu (SHIB) has caught my attention, particularly its resilience against the broader market sell-off.

In the wider cryptocurrency market downturn this week, Shiba Inu’s price experienced a significant drop of approximately 11%, falling below $0.000025. However, the bullish sentiment returned today, causing a surge of around 12% from yesterday’s low, resulting in a 7.65% increase over the last 24 hours. This suggests that bulls are attempting to regain the 11% price loss observed on the weekly chart for SHIB.

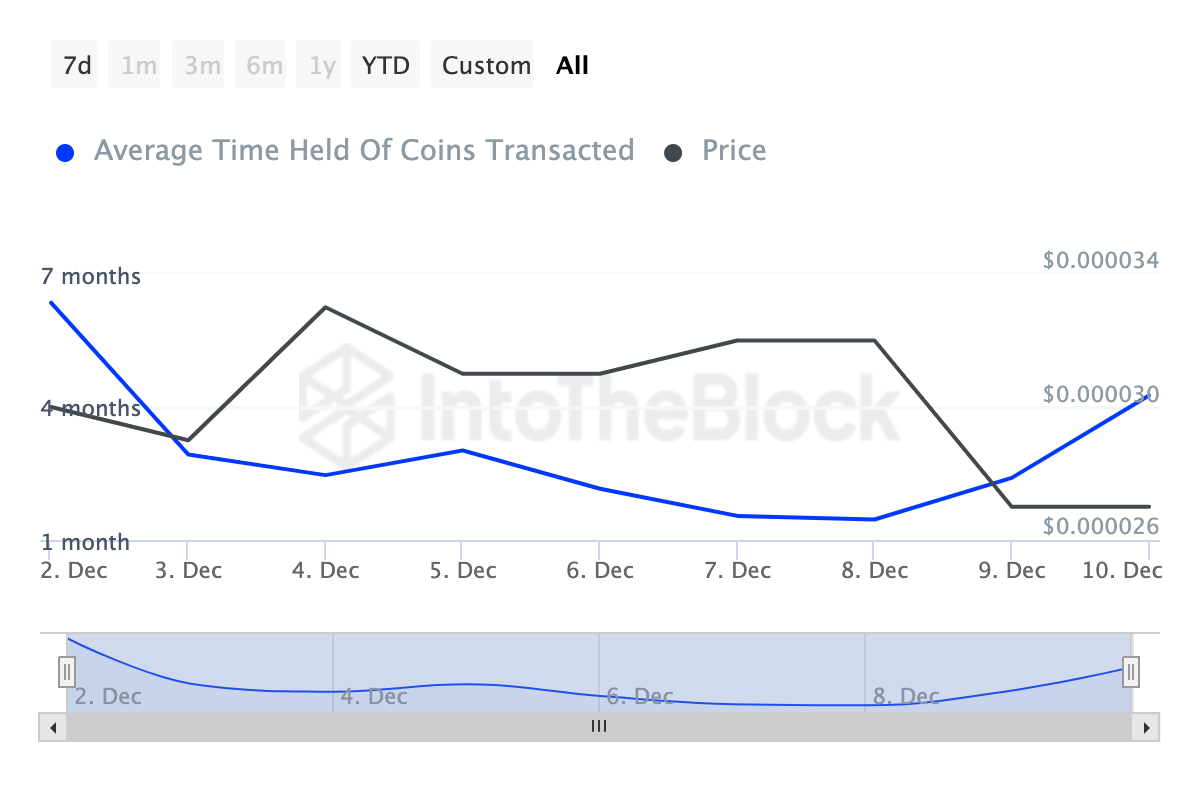

Moreover, even with the significant market fluctuations, long-term Shiba Inu (SHIB) investors have maintained their grip on their coins. As reported by IntoTheBlock, the duration of SHIB coin ownership has been increasing steadily since December 8.

Courtesy: IntoTheBlock

The length of time a cryptocurrency stays in a wallet without being traded or transferred is known as “coin retention period”. An upward trend in this period means that holders prefer to keep their digital assets instead of trading or transferring them, which is viewed as a positive sign. Conversely, a decrease in the retention period might indicate a lack of confidence in the short-term prospects.

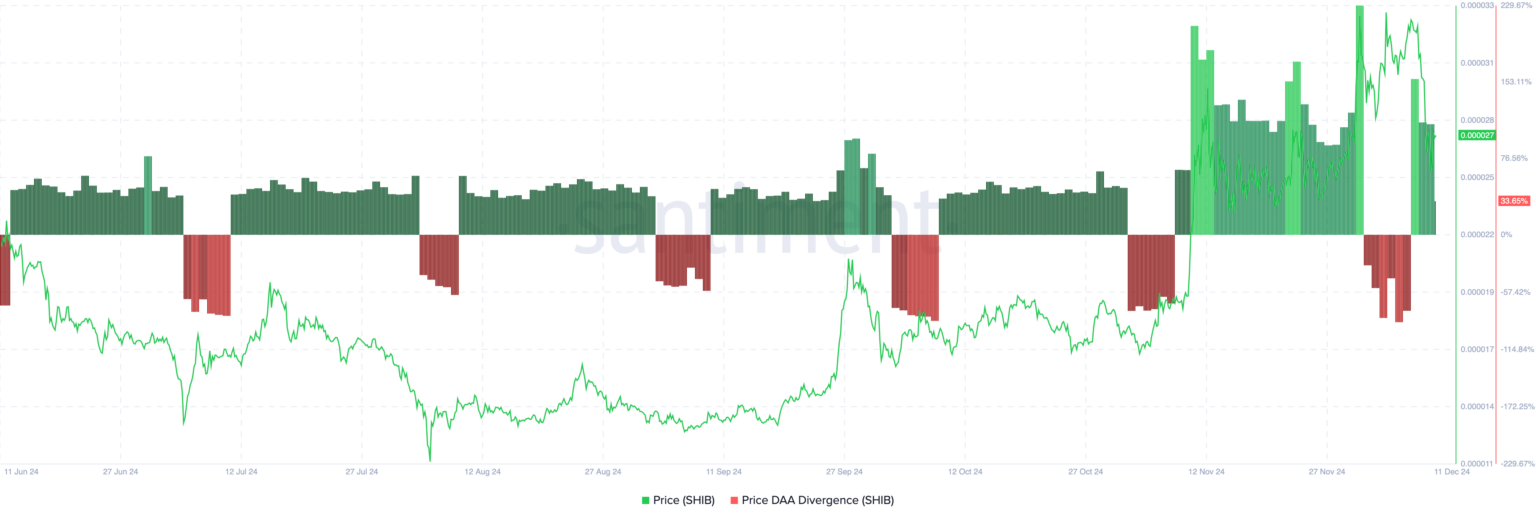

Furthermore, the difference between Daily Active Addresses (DAA) in relation to Shiba Inu’s price suggests a robust indication of an upcoming recovery for SHIB. Essentially, this metric examines the level of user engagement on the blockchain and its connection to price fluctuations, providing useful insights.

A growing discrepancy between the price and the Daily Accumulation/Distribution (DAA) indicator, where the price increases while the DAA shows an uptrend (positive divergence), usually signals heightened network activity and may lead to price advancements. Conversely, a declining discrepancy in which the price drops while the DAA continues its downtrend (negative divergence) suggests decreased engagement, often signaling bearish market momentum.

Courtesy: Santiment

According to the graph given by Santiment, the price-DAA disparity for Shiba Inu (SHIB) is currently at 33.65%. If this pattern persists, it’s possible that SHIB could experience robust upward price movements soon.

Shiba Inu Price Prediction Ahead

According to reports, Shiba Inu has rebounded from its weekly low of less than 0.000025 dollars, with buyers driving up the SHIB price by more than 7.65% at the current moment. Furthermore, the open interest in SHIB trading has jumped by 5.3%, exceeding $102 million, suggesting that traders are optimistic about future price movements for Shiba Inu.

On a daily scale, the Accumulation/Distribution (A/D) line has climbed up, suggesting an increase in purchasing interest for Shib. This A/D line, which evaluates whether a cryptocurrency like Shib is being accumulated or offloaded by considering both volume and price, indicates that Shib is experiencing more buying actions.

Courtesy: TradingView

As a researcher, I’m observing that the A/D (Accumulation/Distribution) indicator is consistently increasing, indicating a potential bullish trend for SHIB. For this positive momentum to persist, it’s crucial that the bulls manage to uphold the support level at $0.000024. If they succeed in doing so, we might see SHIB’s price surging towards $0.000034. Conversely, if the bears were to breach this support level, there’s a possibility that SHIB could experience a downtrend, potentially dropping down to $0.000019.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- Delta Force Redeem Codes (January 2025)

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Stellar Blade New Update 1.012 on PS5 and PC Adds a Free Gift to All Gamers; Makes Hard Mode Easier to Access

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- How to Update PUBG Mobile on Android, iOS and PC

- CNY RUB PREDICTION

- Best Heavy Tanks in World of Tanks Blitz (2025)

2024-12-11 17:54