As a seasoned investor with a knack for spotting unique opportunities, I find Semler Scientific Inc.’s bitcoin strategy quite intriguing. I’ve been around the block a few times, and I can tell you that such bold moves are not common among healthcare-focused tech firms.

In a recent move, healthcare technology firm Semler Scientific Inc., listed on NASDAQ as SMLR, has been garnering attention due to its proactive Bitcoin investment approach. From December 5th to December 15th, 2024, Semler purchased approximately 211 Bitcoins, with each Bitcoin costing an average of around $101,890. This strategic investment amounts to a total of roughly $21.5 million. The daily volatility of Bitcoin during this period was approximately 3.0%, while the market cap stood at a staggering $2.11 trillion, with a 24-hour trading volume of $123.16 billion.

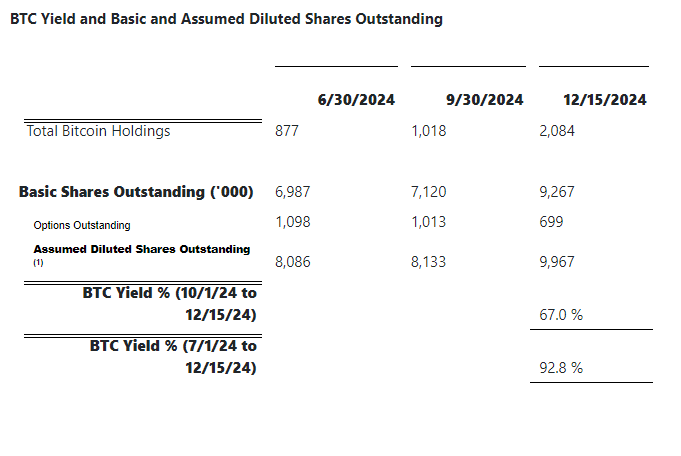

Semler Scientific purchased approximately 211 Bitcoins for roughly $21.5 million each costing around $101,890 per Bitcoin. This move has yielded a return of 67.0% in the last quarter and an impressive 92.8% since the adoption of their Bitcoin treasury strategy in May. As of December 15, 2024, they hold approximately 2,084 Bitcoins, acquired for around $168.6 million with each Bitcoin costing approximately $80,916. $SMLR represents Semler Scientific.

— Eric Semler (@SemlerEric) December 16, 2024

The company revealed they now own 2,084 Bitcoins, which collectively cost approximately $168.6 million. On average, each Bitcoin was bought for around $80,916 after accounting for related charges and expenditures. Semler financed these purchases using funds from its ongoing stock offering at market value (ATM) and internal cash flows.

Semler’s ATM service has demonstrated significant effectiveness as a means of raising funds. As of December 13, 2024, the company has garnered a total of $100 million in gross earnings from share sales. More recently, they increased their potential offering to an impressive $150 million, indicating faith in their capacity to utilize equity markets to finance their bitcoin-related plans.

BTC Yield Hits 92.8% Since Treasury Strategy Launch

One way to rephrase the given text for a more natural and easy-to-understand style is:

Source: Semlerscientific

BTC Yield functions as a means to evaluate the success of Semler’s method for obtaining Bitcoin, which they believe positively impacts shareholders. Although this Key Performance Indicator (KPI) isn’t a standard measure of financial results, Semler stresses that it enhances investors’ comprehension of their strategy to finance Bitcoin purchases through stock sales.

The business has openly acknowledged that the BTC Yield measure does not encompass every financing method employed when buying Bitcoin. Nevertheless, it highlights Semler’s proficiency in converting investment funds into significant Bitcoin holdings.

Semler Expands Shares Amid Bitcoin Push

Semler’s bold approach toward Bitcoin fits with its overall financial aspirations. By December 2024, it substantially boosted its share count. The basic number of outstanding shares jumped from 6.99 million in June 2024 to 9.27 million by mid-December. When considering stock options, the estimated diluted shares climbed to approximately 9.97 million.

Although Bitcoin is a significant aspect, Semler doesn’t believe that the value of their cryptocurrency affects their stock value directly. They emphasized that numerous elements, not solely the market value of their Bitcoin holdings, impact their stock price.

Although the Bitcoin Yield figure is significant, Semler has explained its specific role in a subtle manner. It doesn’t signal profits for shareholders or demonstrate the efficiency of operations. Rather, it underscores the management’s strategic emphasis on employing equity capital in manners they deem will foster long-term value for shareholders.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

2024-12-16 23:14