“Saylor’s Bitcoin Bet: A Gamble of Epic Proportions”

As the sun sets on another tumultuous day in the world of cryptocurrency, one man’s unyielding devotion to the almighty Bitcoin stands as a beacon of hope for the faithful, and a cautionary tale for the skeptical. Michael Saylor, the enigmatic CEO of Strategy (MSTR), has long been a vocal proponent of the digital currency, and his firm’s latest move is a testament to his unwavering conviction.

With the goal of raising a staggering $21 billion through a preferred stock offering, MSTR aims to acquire even more of the coveted BTC (currently trading at a mere $77,843, with a 24-hour volatility of 5.6%). The firm’s 8% series A perpetual strike preferred stock will be sold at a paltry $0.001 per share, a move that has left many scratching their heads in wonder.

But Saylor remains undeterred, his confidence in the long-term prospects of Bitcoin unshakeable. As he tweeted in a now-infamous post (

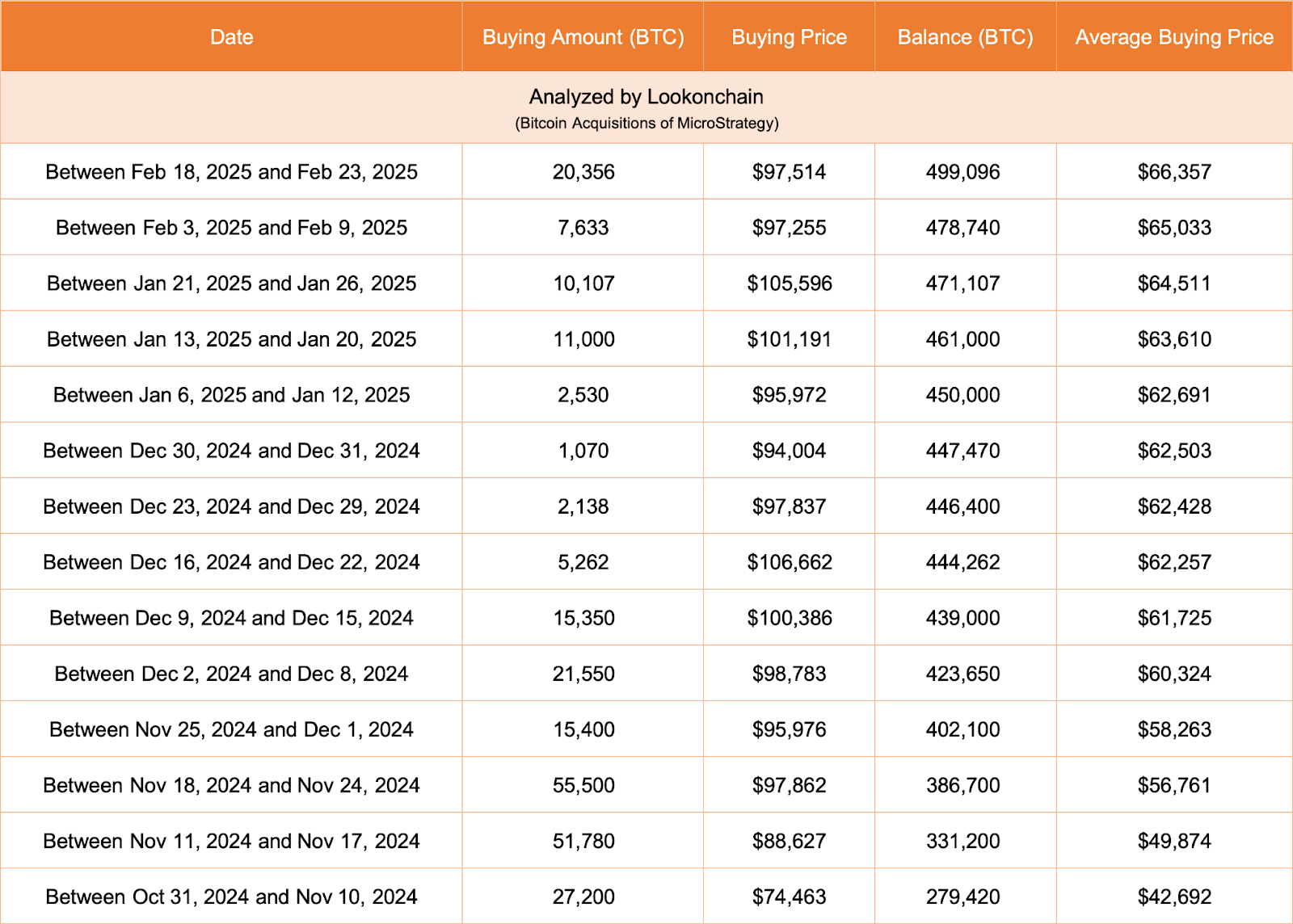

), the firm has been consistently purchasing Bitcoin almost every week in 2025, with a total of 499,096 BTC now under their belt, valued at a cool $41.41 billion.

However, this aggressive accumulation strategy has not been without its costs. As of now, MSTR sits at a 25% appreciation on its BTC stockpile, but all Bitcoin acquired since November 2024 are currently under loss, with a net investment value of $23.2 billion now worth a mere $20.2 billion. This translates to an unrealized loss of $3 billion, a staggering blow to the firm’s bottom line.

But Saylor remains resolute, his vision for a Bitcoin-dominated future unwavering. As he continues to advocate for the U.S. government to acquire 25% of the Bitcoin supply over the next decade, the world watches with bated breath, wondering what the future holds for this enigmatic CEO and his beloved cryptocurrency.

And so, as the markets continue to fluctuate and the price of Bitcoin teeters on the brink of collapse, one thing is certain: Michael Saylor’s gamble is one for the ages, a testament to the unbridled optimism and unwavering conviction of a true believer.

But will it pay off? Only time will tell. 🤔

Market Analysts Predict Further Decline

As the Bitcoin price plummets to $80,000, market analysts are predicting a further fall to $75,000, which can lead to a similar selling pressure on the MSTR stock moving ahead. Some even believe that if BTC falls under Strategy’s average buying price of $66,000, it can trigger a massive Bitcoin sell-off by the firm to protect the MSTR stock from a free-fall, which can trigger a chain reaction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2025-03-10 22:13