As an experienced financial analyst, I believe that Michael Nadeau’s analysis on the potential impact of Ethereum (ETH) spot Exchange-Traded Funds (ETFs) on its price trajectory is insightful and well-supported by data. The SEC’s approval of these ETFs for leading financial entities marks a significant milestone in the cryptocurrency space, potentially paving the way for increased institutional interest and investment in Ethereum.

Michael Nadeau, the founder of The DeFi Report, has released an in-depth examination of how the green light from the US Securities and Exchange Commission (SEC) for spot Ethereum (ETH) Exchange-Traded Funds (ETFs) could impact Ethereum’s price trend. This analysis comes after the SEC granted approval to the 19b-4 applications of eight major financial institutions: Grayscale, Bitwise, BlackRock, VanEck, Ark 21Shares, Invesco, Fidelity, and Franklin.

On May 23rd, these approvals were issued collectively under an omnibus order, paving the way for the last necessary actions: securing the approval of S-1 registrations. Once obtained, these spot ETFs will be ready to begin trading.

Why Ethereum Could Skyrocket To $15,000

According to the report, the predictions made by Bloomberg’s Ethereum ETF specialists, including James Seyffart and Eric Balchunas, indicate that Ethereum ETF investments could account for 10-20% of the inflows seen in Bitcoin ETFs. The reasoning behind these estimates is based on several factors: firstly, institutional investment in Ethereum currently lags behind Bitcoin; secondly, Ethereum is more intricate than Bitcoin; thirdly, the trading volume for Ethereum futures ETFs is significantly lower than that of Bitcoin’s, ranging from 10-20%; and lastly, Ethereum spot trading volumes are approximately half of Bitcoin’s.

The speaker mentioned that Ethereum (ETH) presents more complexity than Bitcoin (BTC), as indicated by the following statistics. ETH futures exchange-traded fund (ETF) trading volumes trail behind those of BTC, with approximately 10-20% volume. Regarding spot trading, ETH’s volumes are roughly half that of BTC, amounting to around 50%. Lastly, Ethereum represents about one-third of Bitcoin’s market capitalization.

As a researcher, I’ve noticed an intriguing distinction between Ethereum and Bitcoin’s market dynamics. Ethereum validators don’t bear the significant operational costs that Bitcoin miners endure. Nadeau points out this difference, emphasizing its importance in examining Ethereum’s supply-side characteristics contrasted to Bitcoin’s.

As a researcher, I’d like to share some insights from Nadeau’s analysis regarding Ethereum’s current on-chain dynamics. Approximately 38% of Ethereum is currently ‘immobilized’ through various mechanisms such as staking contracts and Decentralized Finance (DeFi) applications. This situation, as Nadeau explains, leads to a significant reduction in the available circulating supply. Consequently, the amount of ETH held on exchanges has dropped to around 11% of the total circulating supply – a level last seen in 2016.

In Nadeau’s report, the idea of reflexivity in Ethereum’s market dynamics is given considerable importance. According to him, Ethereum (ETH) exhibits more reflexivity than Bitcoin (BTC). This reflexivity can be illustrated through price movements triggering on-chain activity, resulting in more ETH being burned. In turn, this can fuel narratives, generate additional price action, and boost on-chain activity, leading to even more ETH being burned. Essentially, this forms a cyclical pattern that could substantially enhance Ethereum’s market influence and value.

As a researcher delving into possible market situations, I ponder over the likelihood of Bitcoin ETF investors rebalancing their portfolios towards Ethereum. I contemplate the appeal of maintaining a 50/50 split between Bitcoin and Ethereum, as well as the potential surge of institutional interest in Ethereum. I ask myself, “If Ethereum gains momentum, will the ‘reflexivity flywheel’ be triggered? How many institutions are currently on the sidelines, having overlooked Bitcoin’s rise? Will they jump into Ethereum instead?”

Nadeau wraps up his assessment by proposing a valuation model predicting the global cryptocurrency market to hit a staggering $10 trillion in value. He asserts that Ethereum is more likely than 10-20% of Bitcoin’s inflows, leading him to estimate “a market cap for ETH at its peak cycle of $1.8 trillion, which translates to an ETH price of around $14,984 (3.9x) if the supply remains constant.” For comparison, should Bitcoin reach a $4 trillion market capitalization, it would equate to a price tag of roughly $202,000 (2.8x) at its peak cycle.

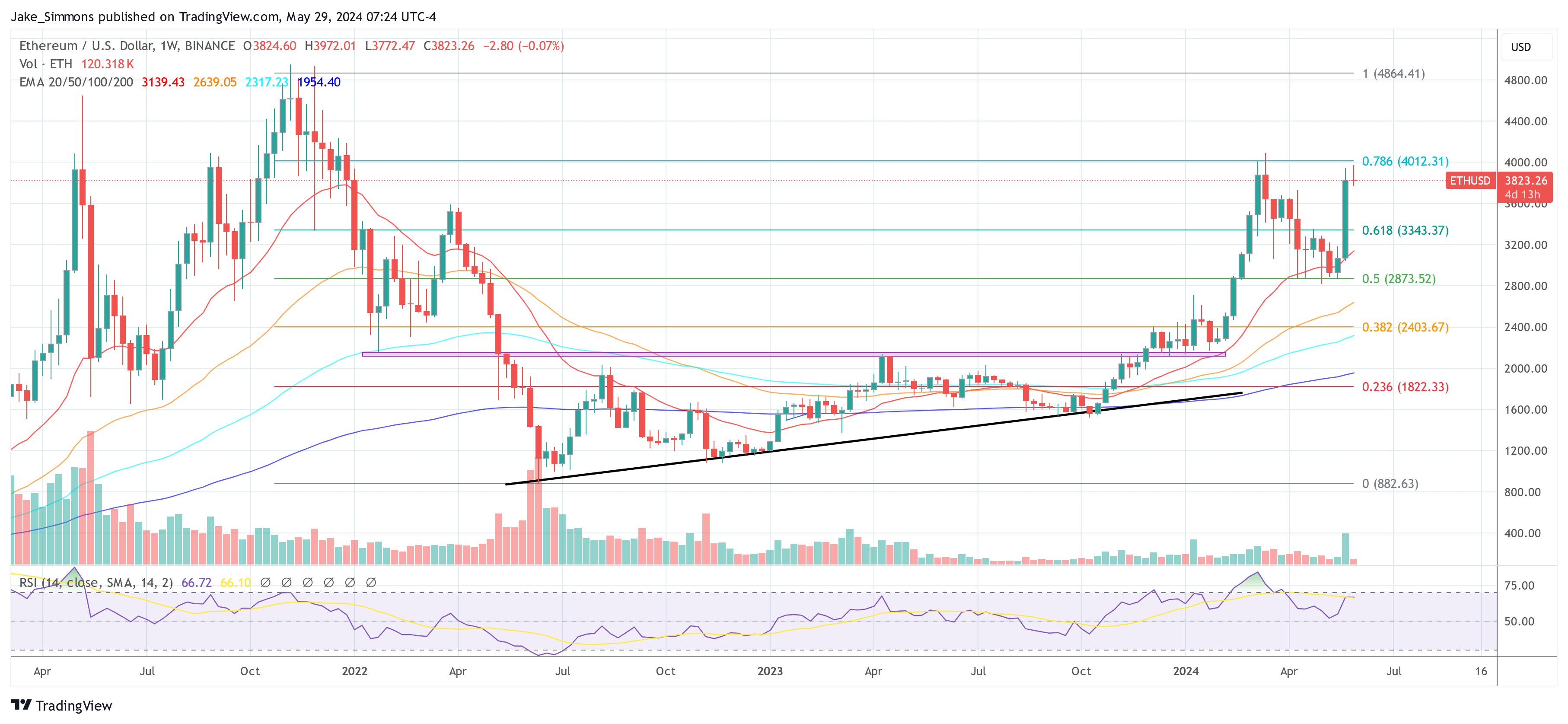

At press time, ETH was trading at $3,823, still around 29 % away from its 2021 all-time high.

Read More

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-05-29 15:41