As a seasoned analyst with over two decades of experience in traditional and digital markets, I have witnessed numerous market cycles and trends that have shaped my perspective. The recent projection by QCP Capital of Bitcoin hitting $100K-$120K is an intriguing development, given the impressive rally post-US election.

According to QCP Capital, a prominent digital asset trading company with an options desk, Bitcoin might reach between $100,000 and $120,000. This prediction is based on robust price movements following the U.S. election and the possible creation of a US Bitcoin Strategic Reserve, which they believe are significant factors driving this optimistic outlook.

According to QCP Capital’s recent market analysis, it seems that the price of Bitcoin could potentially reach between $100,000 and $120,000 based on its strong surge following the US election.

BTC Short-Term Risks

On the other hand, the trading company flagged the rise in call options sales (bullish wagers) and put options purchases (bearish wagers) by significant investors as a potential danger. This indicated that these substantial investors were liquidating their ‘Trump Trade’ bets and buying protective puts to shield against a possible price downturn.

As the market has been rising, implied volatility has decreased because major traders have been taking advantage of this trend by selling call options. In response to each new record high, our trading desk has noticed a pattern where traders are selling call options and buying put options to protect against potential losses.” – QCP Capital.

The analysis provided sheds light on why Bitcoin’s price has halted around $93K and subsequently dropped. As of now, Bitcoin is worth approximately $88K, representing a 6% decrease from its most recent record high (peak).

Source: BTCUSDT, TradingView

Research firm Presto Research, specializing in crypto, shared an opinion akin to QCP Capital. Their analysts pointed out a decreased interest from Traditional Finance (TradFi), using the drop in MicroStrategy’s MSTR and Coinbase’s COIN stock prices as signs of the unraveling of the ‘Trump trade.’

Currently, we’re experiencing record levels, and some investors are starting to reverse their ‘Bitcoin-Trump’ strategy, involving long Bitcoin positions… There’s also a hint of a decrease in ETF investments, but it’s unclear if this is just a temporary setback or a more permanent trend.

Based on Soso Value’s data, there was a daily withdrawal of approximately $400.67 million from U.S. Bitcoin exchange-traded funds (ETFs) on Thursday.

Insights from BTC Options Market

As a researcher examining the Bitcoin options market, I’ve noticed an interesting trend: Despite anticipation for significant price fluctuations in both directions, the overall sentiment seemed to lean heavily towards a bullish outlook. In other words, while everyone was expecting some wild rides, there was a strong preference for Bitcoin prices to rise rather than fall.

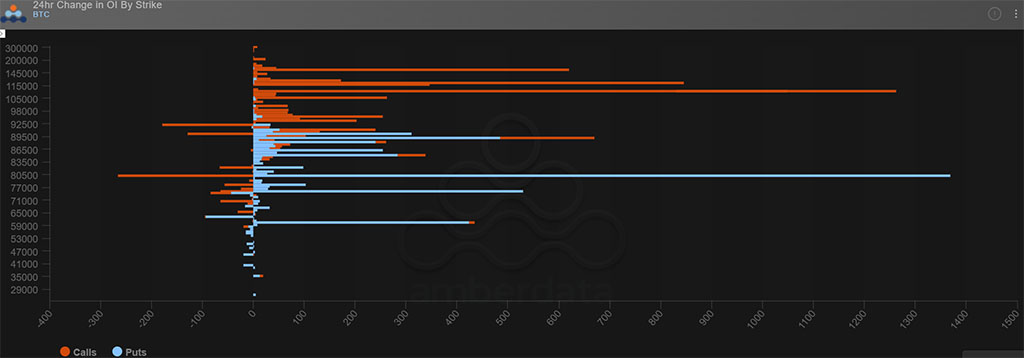

Source: Amberdata

Over the last day, significant shifts in Open Interest (OI) rates or call option inflows occurred primarily at the price points of $95,000, $105,000, $110,000, and $120,000. These levels are suggested as potential immediate upward targets due to the concentration of these changes.

Additionally, notable Option Instrument Investments (downside bets) were found at the price points of $80,000 and $75,000. Essentially, these prices might serve as potential support levels if there’s a prolonged market correction.

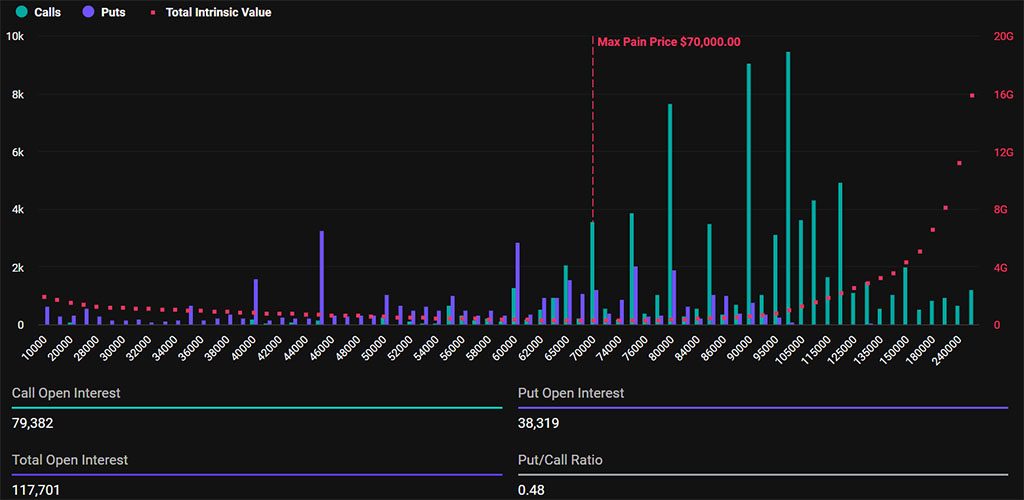

Source: Deribit

In simpler terms, it seems that the investment outlook for November’s end and December remained optimistic, as indicated by the Deribit options for December 27th. The Put/Call ratio was 0.48, which is less than 1, suggesting more bullish bets (calls) were made compared to bearish ones (puts), a sign pointing towards optimism.

Read More

- Connections Help, Hints & Clues for Today, March 1

- The games you need to play to prepare for Elden Ring: Nightreign

- Shiba Inu Sees Bullish Reversal In On-Chain Metrics, Can SHIB Price Recover?

- When To Expect Blue Lock Chapter 287 Spoilers & Manga Leaks

- What Is Dunkin Donuts Halloween Munchkins Bucket?

- Shruti Haasan is off from Instagram for THIS reason; drops a comeback message on Twitter

- Chiranjeevi joins Prime Minister Narendra Modi for Pongal celebrations in Delhi; see PICS

- BUZZ: Rajinikanth starrer Jailer 2 directed by Nelson Dilipkumar likely to go on floors from March 2025

- Pepe Battles Price Decline, But Analysts Signal A Potential Rally Ahead

- Bitcoin’s Record ATH Surge: Key Factors Behind the Rise and Future Predictions

2024-11-15 11:56