As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I find myself consistently intrigued by the developments within the Polkadot (DOT) ecosystem. The Q3 performance report for DOT, released by Messari, sheds light on both its promising progress and challenging market conditions.

In a recent update, market analysis company Messari has shared their Q3 findings on Polkadot (DOT), offering valuable insights about the progress of its blockchain infrastructure and financial data over this specific time frame.

Polkadot Sees Strong Developer Engagement

One significant insight from the study is that there’s been a lot of developer work happening on the Polkadot network. As per Electric Capital, about 2,400 developers were actively working on it each month in July 2024, with around 760 of them being full-time contributors. This places Polkadot fourth in the rankings among prominent blockchain networks, just behind Ethereum, Base, and Polygon.

Additionally, during Q3, Artemis consistently monitored approximately 630 weekly active core developers and 760 ecosystem developers, highlighting the thriving nature of its developer community.

In the third quarter of 2024, Polkadot experienced notable advancements with several key projects designed to strengthen its ecosystem. The Decentralized Futures program, which boasts a sizable $20 million fund and 5 million DOT tokens, has played a crucial role in fostering innovation within the platform.

As an analyst, I can share that this particular initiative offered funding for diverse projects encompassing areas like marketing, business expansion, administrative structures, and technology advancements. Among the significant projects we’ve backed are AirLyft, DotPlay, and BlockDeep Labs.

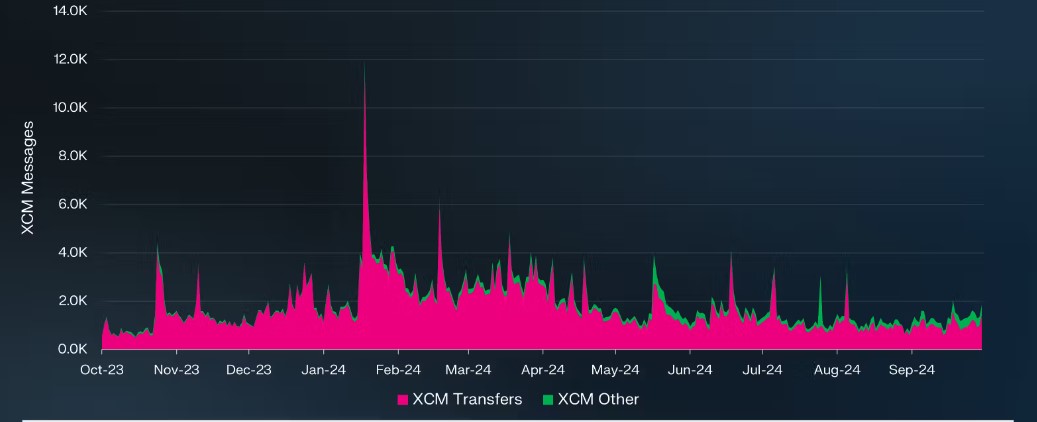

A significant advancement is the Cross-Consensus Message Format (XCM), a unified messaging system which simplifies communication between various consensus-based networks, such as rollups.

On a daily basis, the average XCM transfers were approximately 1,000, showing a decrease of 34% compared to the previous quarter. Contrastingly, the category known as “XCM Other,” which encompasses non-asset transfer use cases, saw an increase of 5%, with an average of 200 daily transfers.

In summary, the average number of XCM messages per day was approximately 1,300, marking a decrease of 29% compared to the previous quarter. However, it’s worth noting that a substantial part of activity on the Polkadot network persists through Polkadot rollups, despite these ups and downs.

DOT Market Cap Plummets 27% In Q3

Regarding its market fluctuations, DOT showed significant ups and downs throughout the year. Specifically, between Q3 2023 and Q1 2024, DOT’s market value skyrocketed by an impressive 150%, increasing from $5 billion to $13 billion.

In the following quarters, specifically Q2 and Q3 of 2024, DOT followed the general market trend, resulting in a market capitalization of $6.3 billion by the end of Q3 2024. This represented a 27% decrease quarter-over-quarter. This decline also caused DOT’s market cap position to slide from 14th to 15th, despite it still holding the seventh largest spot among base layer networks.

On the Polkadot network, transaction fees tend to be lower than other similar networks due to its unique architecture. In the third quarter of 2024, these fees matched their historical median, accumulating to $84,000 – a decrease of 44% from the previous quarter. Fees paid in DOT also dropped by 21%, reaching 17,000.

On a contrasting note, the Polkadot Treasury remained actively utilized. It disbursed approximately 9.5 million DOT for proposals, 7.4 million for rewards, and incinerated around 2.5 million.

A key event was the acceptance of Polkadot’s Referendum 457 in the second quarter of 2024, which expanded the treasury to include USDT and USDC. This change allowed future treasury proposals to be presented in stablecoins. By the close of Q3 2024, the treasury had amassed a balance of $122 million.

The number of daily active addresses declined by 26% compared to the previous quarter to approximately 6,200. Similarly, the number of returning addresses dropped by 23% QoQ to around 5,300. Moreover, the number of new addresses also saw a decrease of 38% QoQ, settling at about 900.

Over the last four days, the DOT price has hovered around $8 and subsequently strengthened to trade above this level, indicating consolidation. Notably, DOT has been among the top performers since Donald Trump’s election on November 5, with a remarkable increase of nearly 96% in the monthly chart.

Read More

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-11-27 08:46