As a seasoned crypto investor with over a decade of experience navigating the volatile digital asset market, I have learned to appreciate the nuances that drive price action and market sentiment. Polkadot (DOT) has always intrigued me due to its impressive technology and strong fundamentals.

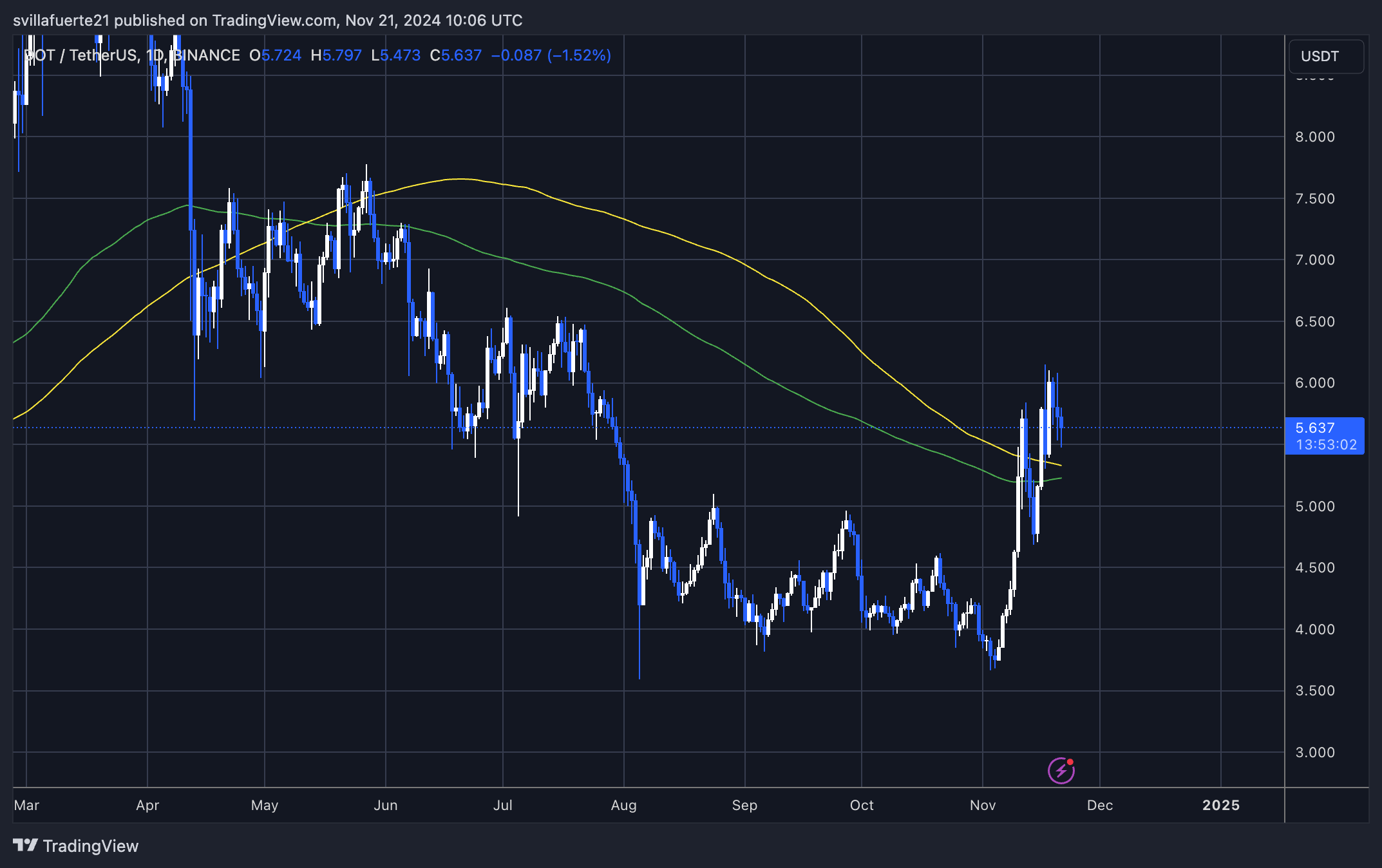

Polkadot (DOT) is currently in a holding pattern, trading under $6 following a robust 30% surge since last Friday. This phase of sideways movement has introduced some volatility, but market indications hint that DOT could be preparing for its next significant move. The asset is being closely monitored by investors as it continues to exhibit a bullish pattern, albeit encountering temporary hurdles near the $6 price point.

Crypto expert Ali Martinez recently provided an analysis emphasizing Polkadot’s strength. According to him, DOT is maintaining itself above a crucial support area, suggesting that it could be on the verge of a substantial surge. His observations hint at increasing enthusiasm and anticipation for Polkadot, driven by its potential for another bullish phase.

In the rapidly growing blockchain sector, Polkadot stands out with its strong interoperability features, garnering more attention as investors favor high-quality projects. The upcoming days will reveal if DOT can leverage its current momentum to surpass crucial resistance points. Everybody is watching Polkadot’s price movements as they gauge both investor faith and market strength. Should the expected rise occur, DOT could quickly regain ground, reinforcing its status in the crypto world.

Polkadot Preparing For A Breakout

It seems that Polkadot is about to burst forward, holding onto its bullish energy even after briefly pulling back from the $6 mark. Following a nearly 10% dip, DOT has regained its footing above the vital $5.7 support area, suggesting buyers are still strongly in charge. This durability has ignited hope among investors and experts, who see the current market movements as a precursor to a major surge.

Crypto analyst Ali Martinez recently expressed his views on X, citing Polkadot’s weekly price chart as proof of its possible growth potential. As per Martinez, DOT has demonstrated impressive resilience by maintaining itself above the $3.6 support level, which has played a crucial role in its recent rebound. He proposes that if the current trend persists, we might see DOT reaching $11 within the upcoming weeks, marking a significant increase from its present position.

Martinez further highlighted that surpassing and stabilizing at around $11 might pave the way for an even more significant upsurge. He foresees this development potentially pushing the price to $22, in line with optimistic trends forecasted for the altcoin sector.

As Polkadot’s foundational strengths and technical indicators seem to be in harmony, there is growing anticipation about its potential to surpass crucial resistance points. Should this forecast prove accurate, DOT may regain its prominent position within the cryptocurrency sector.

DOT Price Action: Technical Details

Currently, Polkadot’s trading at about $5.6, keeping its stance over the significant 200-day Moving Average (MA) of $5.3. Crossing above this important marker indicates a powerful bullish sign, implying that DOT demonstrates long-term resilience as buyers take charge. Additionally, the price is steadily holding above the $5.6 demand point, a level that acted as vital support in June and July, but was lost until its recent rebound.

Reaching the demand level of $5.6 again has sparked optimism among investors once more, as maintaining this area could lay the groundwork for continued bullish movements. If DOT can hold its ground above this price in the near future, a push toward new supply zones might occur, with an estimated target at around $6.5.

As a researcher, I find the confluence of falling below the 200-day Moving Average and rebounding at an essential support level suggests that DOT may hold its ongoing bullish trend. Yet, to surmount resistance and advance toward higher goals, persistent buying power is crucial. At this moment, we’re keeping a close watch on DOT’s performance in consolidating above the $5.6 mark. This critical threshold will serve as an essential signal of whether it can continue its upward momentum in the forthcoming weeks.

Read More

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Move Over Sydney Sweeney: Ozzy Osbourne’s DNA Is in Limited-Edition Iced Tea Cans

- Anna Camp Defends Her & GF Jade Whipkey’s 18-Year-Old Age Difference

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

- Brody Jenner Denies Getting Money From Kardashian Family

- Aaron Taylor-Johnson Debuts New Look at 28 Years Later London Photocall

- Capcom Spotlight livestream announced for next week

- What Is Going On With Justin Bieber?

2024-11-22 07:34