As an experienced analyst, I believe that the current consolidation phase of Bitcoin (BTC) is a crucial one for the cryptocurrency’s price action. The selling pressure has significantly reduced compared to earlier in the year, as evidenced by the lower unrealized profits and the ability of BTC to perform positively on days when it is not closely correlated with the US stock market.

As a crypto investor, I’ve noticed Bitcoin (BTC) has been holding steady over the past week, with prices fluctuating between $67,000 and $70,000 after a significant correction brought it down to $56,400 in early May. This 20% price drop was a stark reminder of the market’s volatility.

During this stabilization phase, the inflow of funds into the US Bitcoin spot ETF has surged once again. Meanwhile, selling intensity seems to have subsided not only in the ETF sector but also amongst Bitcoin holders as a whole.

Bitcoin Selling Pressure Fades

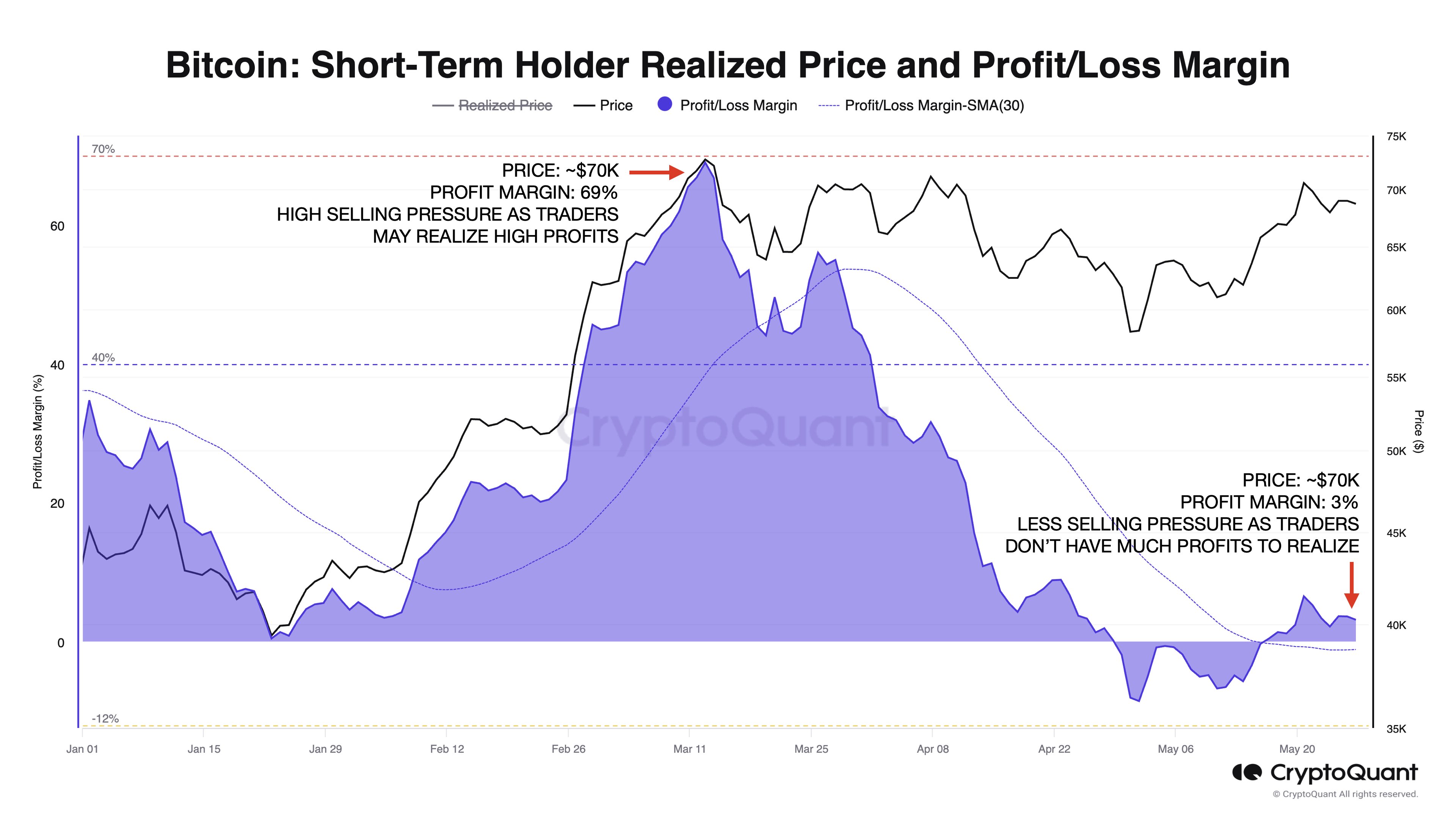

As a market analyst at CryptoQuant, I’ve noticed that the current Bitcoin price level of $70,000 is distinct from its previous reach at this price point in March.

Moreno observes that traders currently apply less force in selling due to modest unrealized gains of approximately 3%, contrasting with the significant 69% unrealized profits observed in early March. This observation implies that a substantial portion of intense selling activity has already occurred, as depicted in the accompanying chart.

According to Santiment’s data, Bitcoin has surpassed a market capitalization of $70,000 yet again, despite the pause in the US stock market during the Memorial Day break.

As a researcher studying the cryptocurrency market using the intelligence platform Santiment, I find it noteworthy that Bitcoin (BTC) has shown positive performances on days when its price action is less correlated with the primary stock market in 2022. This observation signifies BTC’s resilience and potential to generate gains independently from the stock market trends.

Final Pre-Breakout Consolidation Phase

Crypto analyst Rekt Capital points out an intriguing development: Despite the recent optimistic trend, Bitcoin’s weekly candle finished below the resistance level of its ongoing “re-accumulation” phase. This phase, which lies between approximately $60,000 and $70,000, indicates a consolidation period for the cryptocurrency.

Based on current market conditions, it’s plausible that the frontrunner cryptocurrency will experience more consolidation within its existing range. This view aligns with Rekt Capital’s perspective, which posits that the ongoing bull cycle still has two stages: a post-halving phase of re-accumulation and a subsequent parabolic rally phase.

Bitcoins historical pattern indicates that it typically gathers strength and consolidates around record-breaking prices prior to initiating significant price surges during bull markets. As per the analysis, Bitcoin has been holding steady at these peaks for an extended period, following a trend observed in past market upswings.

At these high price points, there’s still some potential for lateral trading, but the window of opportunity is shrinking. It’s widely anticipated that the highly anticipated post-Halving surge, fueled by heightened investor enthusiasm, will propel Bitcoin to new heights beyond its previous peak of $73,700 in mid-March.

In its ongoing bull run, Bitcoin seems poised for a significant shift based on past trends. The prolonged phase of consolidation and buying back that characterized the market may be nearing an end, potentially leading to another dramatic price spike.

Currently, Bitcoin has experienced a 2% increase over the last 24 hours, contributing to its impressive 10% growth during the past month. The cryptocurrency is now being traded at a price of $70,200.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- The First Descendant fans can now sign up to play Season 3 before everyone else

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-05-28 07:16