As a researcher with a background in fintech and digital payments, I find the Visa and Allium Labs’ study on stablecoins’ role in the global payments landscape intriguing. Based on the data presented in the article, it seems that stablecoins are not yet gaining significant traction among regular consumers as a mainstream payment method.

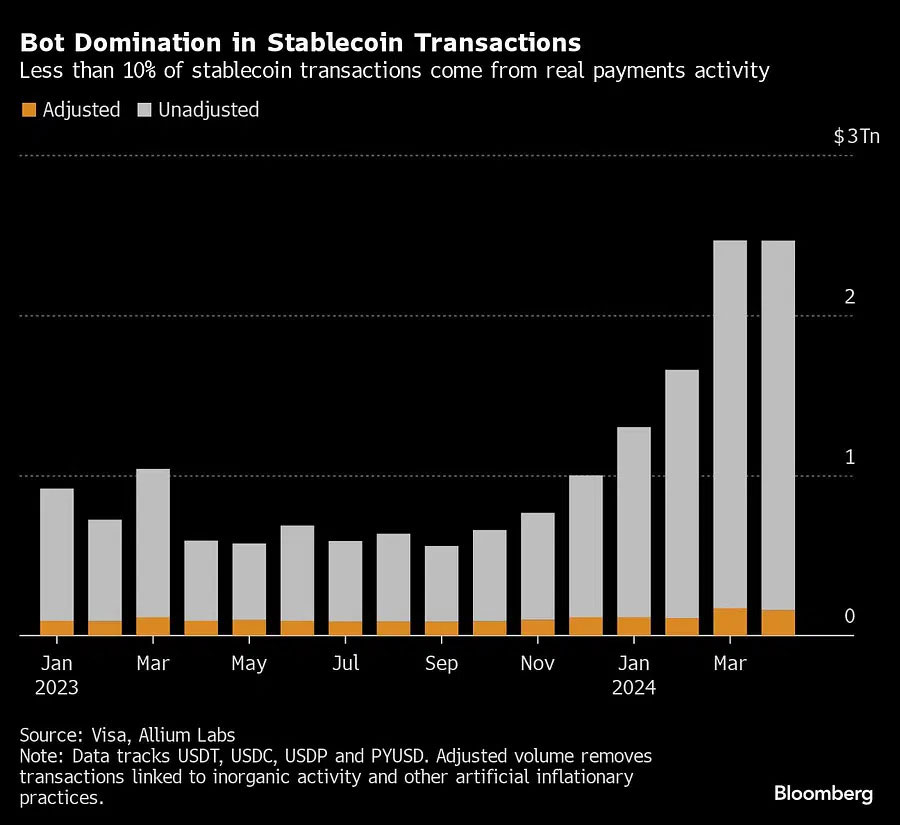

In an unexpected finding from Bloomberg’s latest report, Visa and Allium Labs’ study question the widespread belief that stablecoins will significantly reshape the global payments sector. The data indicates that a staggering 90% of stablecoin transactions in April 2024 were initiated outside of typical consumer circles, raising concerns about their viability as mainstream payment solutions.

Photo: Visa, Allium Labs

Visa’s measurement aims to distinguish “authentic payments behavior” by eliminating transactions originated from bots and heavy traders. This discovery indicated that just $149 billion, out of a grand total of $2.2 trillion in stablecoin transactions, were the result of genuine user interactions.

Stablecoins’ Slow Adoption as Payment Tool

Pranav Sood, the executive general manager for EMEA at Airwallex, expressed that stablecoins are currently in their early stages of development as a payment method. However, he emphasized that they hold significant long-term potential. In the meantime, it is crucial to improve the existing payment infrastructure before focusing too much on stablecoins.

It’s not surprising that real-world usage has yet to be extensively demonstrated. Valuing crypto transactions through blockchain data has long been a complex task. According to data firm Glassnode, it’s believed that the record $3 trillion market cap for digital tokens during the 2021 bull run was most likely nearer to $875 billion in reality.

The issue of double-counting transactions makes the situation more complex. Exchanging funds between different stablecoins on decentralized platforms such as Uniswap can artificially inflate the overall volume. For example, swapping $100 worth of USDC (from Circle) for PYUSD (offered by PayPal) on Uniswap results in a recorded total stablecoin activity of $200.

Stablecoins’ Disruptive Potential

Major payment companies such as Visa, processing over $12 trillion in transactions annually, have a vested interest in maintaining the existing system. However, Bernstein analysts predict that the total worth of stablecoins could skyrocket to an impressive $2.8 trillion by 2028, representing a significant 18-fold growth.

Proponents contend that the quick and almost cost-free nature of stablecoins makes them ideal for disrupting the payments industry. This persuasive viewpoint has motivated companies such as PayPal (with its USDP) and Stripe (which accepts stablecoins) to adopt this technology.

Despite Airwallex’s Sood acknowledging the intricacy as a significant challenge, many consumers find the technology overly complicated, he points out. Notably, checks continue to be prevalent for business transactions in the US, reflecting the slow shift towards technological innovation in the payments sector.

The future of using stablecoins as a widespread payment method is uncertain. Although their disruptive potential is clear, they must overcome challenges such as gaining user acceptance and ensuring transparent transaction data before they can significantly change the game.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-05-06 12:22