As a seasoned crypto investor with memories of the market rollercoaster stretching back to 2017, I find myself both concerned and intrigued by the current state of Bitcoin. The latest data revealing that over 80% of short-term holders are underwater is an eerie echo of past bearish trends. Yet, I’ve learned in this wild ride that the crypto market is as unpredictable as a game of three-card monte in a dimly lit alley – it’s all about the flip of a card at the right moment.

Currently, Bitcoin (BTC) is experiencing a dip in its price, causing a ripple effect across the entire crypto market. Despite persistent downward price trends, recent findings show that short-term Bitcoin investors are now facing losses, as they have paid more for their coins than what they can currently sell them for.

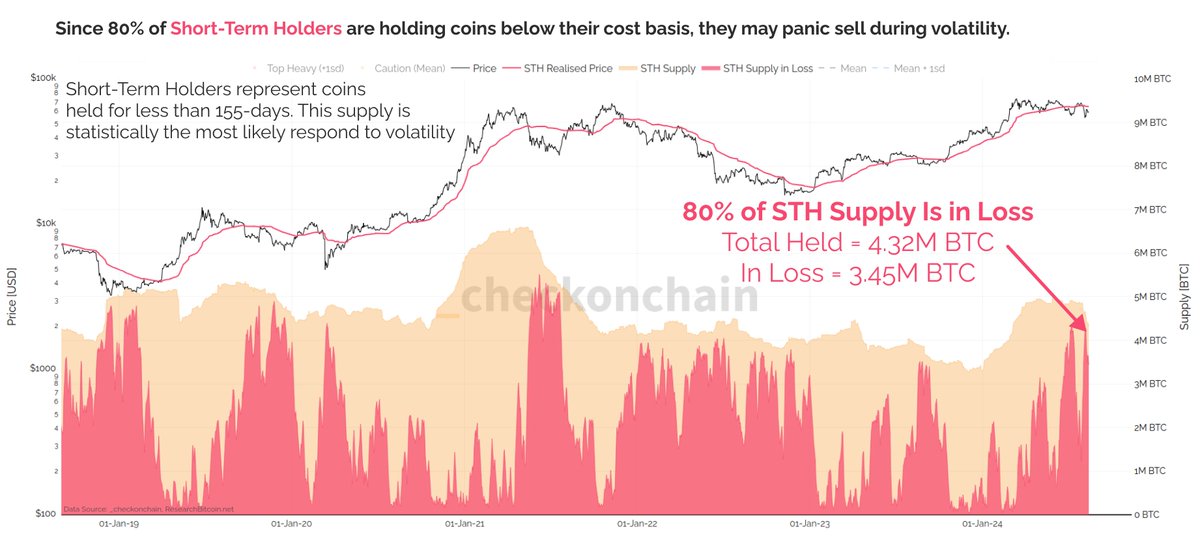

As a crypto investor, I recently came across an interesting finding: According to onchain data expert James Check’s latest post, approximately 80% of Bitcoin’s short-term holders – those who acquired their BTC within the last 155 days – have actually purchased their tokens at prices higher than the current market value.

Underwater Investors, Implication For Bitcoin

In essence, Check’s observation about most short-term traders being in the red (at a loss) now mirrors the periods of 2018, 2019, and mid-2021. During these times, many investors found themselves at risk of panicking, which could have potentially triggered a downtrend or bear market.

Currently, more than 80% of my short-term Bitcoin investments were made at a price higher than the present market value, which means I’m in the red for now.

2018, 2019, and the middle of 2021 were periods that hinted at investor anxiety, potentially leading to a downward market trend (a bear market).

— _Checkmate (@_Checkmatey_) August 19, 2024

As a crypto investor, I’ve noticed that a significant number of short-term holders find themselves ‘underwater,’ but this doesn’t necessarily mean a grim picture for the market. The situation is more complex than it seems at first glance.

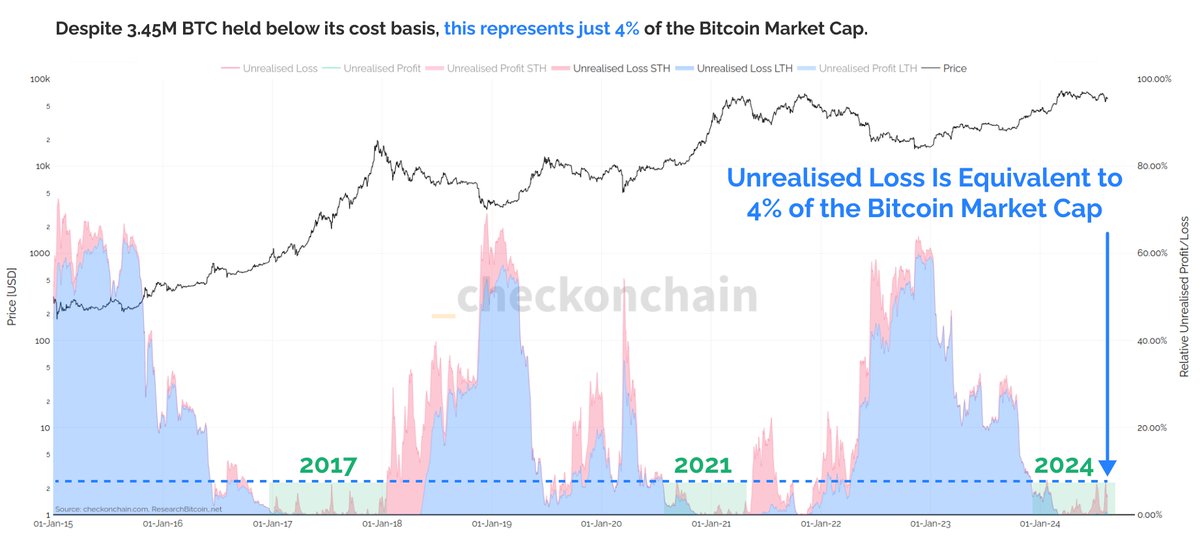

Check highlighted that the psychological impact on holders varies greatly depending on the extent of their losses. He elaborates that a minor unrealized loss, such as 1%, has a significantly different psychological effect on an investor than a more substantial loss of 20%.

Even though a large number of Bitcoin holders are experiencing losses, the combined potential loss throughout the market only amounts to about 4% of Bitcoin’s overall value. This suggests that although attitudes might appear negative, the actual financial repercussions could be less dramatic than anticipated.

BTC Market Performance And Outlook

Over the last week, I’ve noticed a steady descent in the value of my Bitcoin investment, breaking several support levels along the way. In the past seven days, it dipped by approximately 1.7%, and just yesterday, it fell an additional 2.7%.

Today’s bearish trend caused Bitcoin (BTC) to dip as low as $57,918 earlier today, but it has since slightly recovered to trade at $58,339 at this moment. Interestingly, while BTC experienced a decline, its daily trading volume showed an increase in activity instead.

Based on information from CoinGecko, the value of this metric grew from around $17 billion at daybreak to approximately $22.6 billion by now.

Despite some reservations, numerous analysts continue to be optimistic about Bitcoin, predicting a recovery in the near future. Notable crypto expert Elsa from X has disclosed that Bitcoin’s daily Moving Average Convergence Divergence (MACD) indicator has turned bullish. However, it seems that Bitcoin is currently short on the necessary liquidity to trigger an upward surge.

$BTC daily MACD has turned bullish

But still, liquidity is lacking which is needed for a big #Bitcoin pump!

— Elja (@Eljaboom) August 19, 2024

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-08-20 05:47