As a researcher with a background in cryptocurrencies and blockchain technology, I find the recent findings by Flow regarding the performance of new tokens listed on Binance deeply concerning. The data shows that over 80% of these tokens have significantly decreased in value since their initial offering. This trend is not only limiting potential growth for these projects but also poses a significant risk to investors.

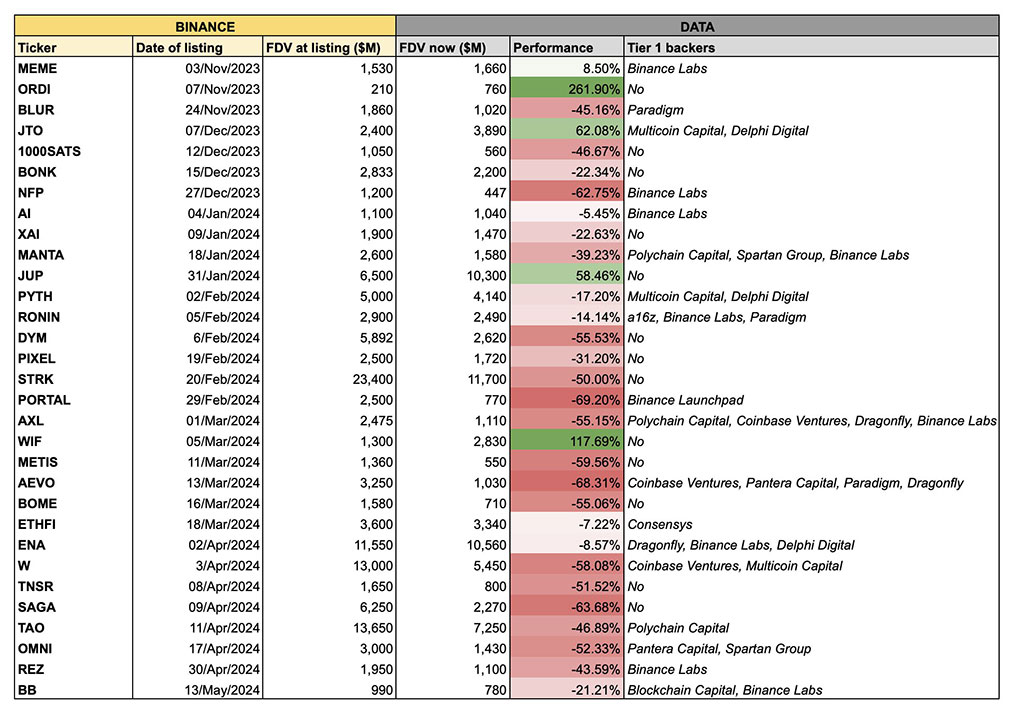

According to a recent report by crypto researcher Flow, over 80% of the tokens listed on Binance within the past six months have experienced substantial price drops since their initial offerings. In simpler terms, most new tokens added to Binance have seen a significant decrease in value post-listing.

Photo: Flow

Among the 31 tokens analyzed by Flow, just five held their value. These five tokens are Memecoin (MEME), Ordi (ORDI), The Jupiter token (JUP), Solana-based Jito (JTO), and the distinctively named Dogwifhat (WIF).

New Binance Tokens’ Valuation Overshoots

As a blockchain analyst and author, I observe the current market turmoil as a reflection of the complexities present in today’s crypto market landscape. Although certain altcoins persist in defying the trend, the broader crypto market seems to lack the intense growth momentum experienced during past bull runs. I highlight that Binance-listed projects could potentially face delayed progress compared to the instantaneous surges observed historically.

Despite the lack of a significant user base, these new tokens boast an average fully diluted valuation (FDV) exceeding $4.2 billion each. This excessively high valuation may hinder their future growth potential, as noted by Flow.

According to Flow, the majority of tokens launched on Binance no longer function as investment opportunities. Instead, they serve as a means for insiders to cash out, exploiting the limited access retail investors have to promising early-stage investments.

Meme Coins’ Retail-Led Surge

As a crypto investor, I’ve noticed that retail investor enthusiasm plays a crucial role in the success of meme coins. These digital assets thrive on the energy and excitement of individual investors, enabling them to function relatively autonomously from the broader altcoin market.

“Lian noted that while some investors have a long-term holding strategy, there has been significant interest from retail investors in meme coins recently. This is evident in the strong performance of coins like MEME and WIF. In fact, six out of the top trading coins currently are meme coins.”

It’s intriguing to note that Ordi, which didn’t receive funding from venture capitalists, has become the most lucrative investment, soaring by over 260% since its debut. Dogwifhat, the meme coin with a controversial reputation, came in second place, experiencing a substantial price rise of more than 117%.

Meme coins may provide momentary relief from market slumps, but the Binance token price crash acts as a warning for investors to practice prudence. New listings carrying inflated valuations and insufficient user bases can be hazardous investments.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-05-17 18:33