As a seasoned analyst with years of experience navigating the volatile cryptocurrency markets, I find myself intrigued by the current state of Ethereum. While the coin remains flat at press time, it’s interesting to note the significant support found at $2,300, with over 52 million ETH acquired in this price range. This level could potentially anchor an uptrend if buyers regain control, but a resurgence of selling pressure could see Ethereum dropping below its Q3 2024 lows.

Currently, Ethereum is holding steady, confined within a tight price band of approximately $400, with the lower boundary at around $2,300 and the upper limit at $2,800. While investors remain optimistic, anticipating a potential price surge in the near future, there remains a lingering sense of doubt hanging over the market.

Ethereum Finds Support At $2,300: Over 52 Million ETH Bought

Currently, the second-most precious crypto coin in the world is showing bearish trends, plummeting more than 50% from its July highs and failing to surpass the local resistance at $3,500. As traders keep a keen eye on how the price unfolds, one analyst has pointed out an intriguing observation from market data.

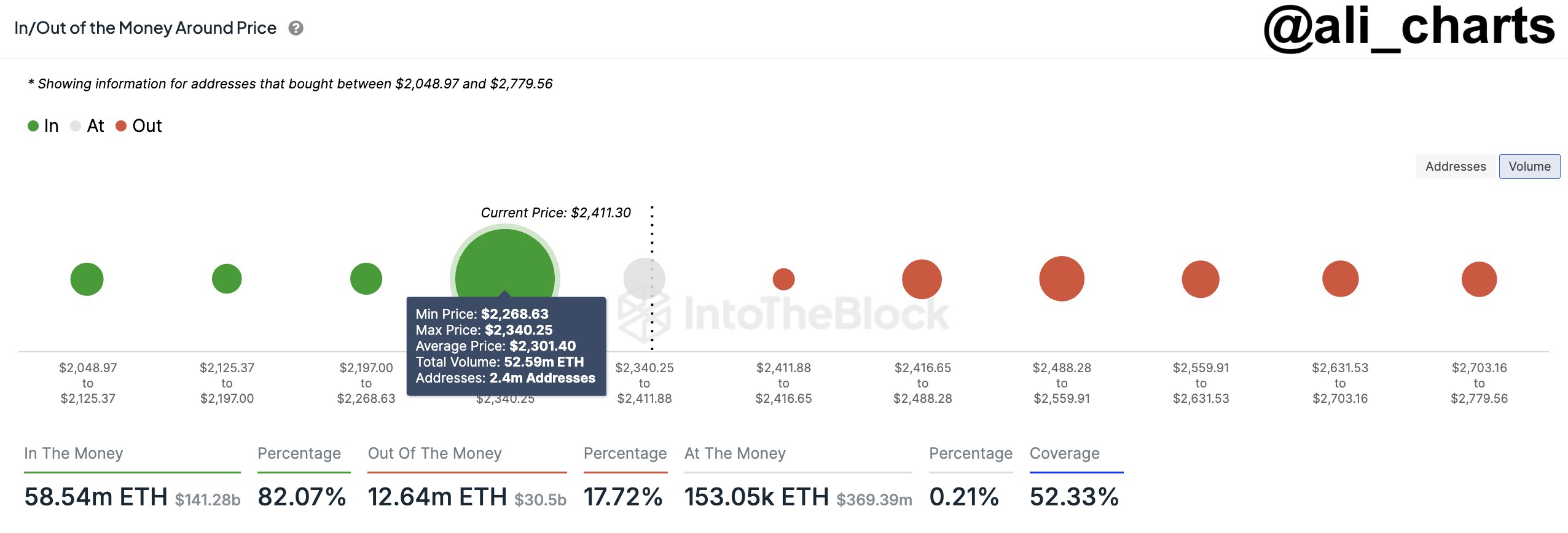

According to information from IntoTheBlock on October 11th, an analyst notes that approximately 52 million ETH were bought by traders near the $2,300 price point. Given the quantity of coins held by traders at this price level, it suggests that this range could serve as immediate support.

In simpler terms, if buyers are dominant and push prices up from here, this level could serve as a foundation for the upward trend. However, if sellers intensify their actions, similar to what we’ve seen in recent trading months, there’s a higher chance that ETH might fall below its Q3 2024 lowest point.

Currently, there’s a pessimistic outlook reflected in the CoinMarketCap poll, with over 65% of Ethereum holders and traders predicting short-term price difficulties.

In other words, whether prices increase significantly at the current support level will significantly influence the development of the market over the short to medium term. If Ethereum breaks through and stays above $2,800, it could stimulate demand and offer a strong push for bullish investors.

USDT, USDC, And Stablecoin Market Cap Falling: Is Buying Power Dwindling?

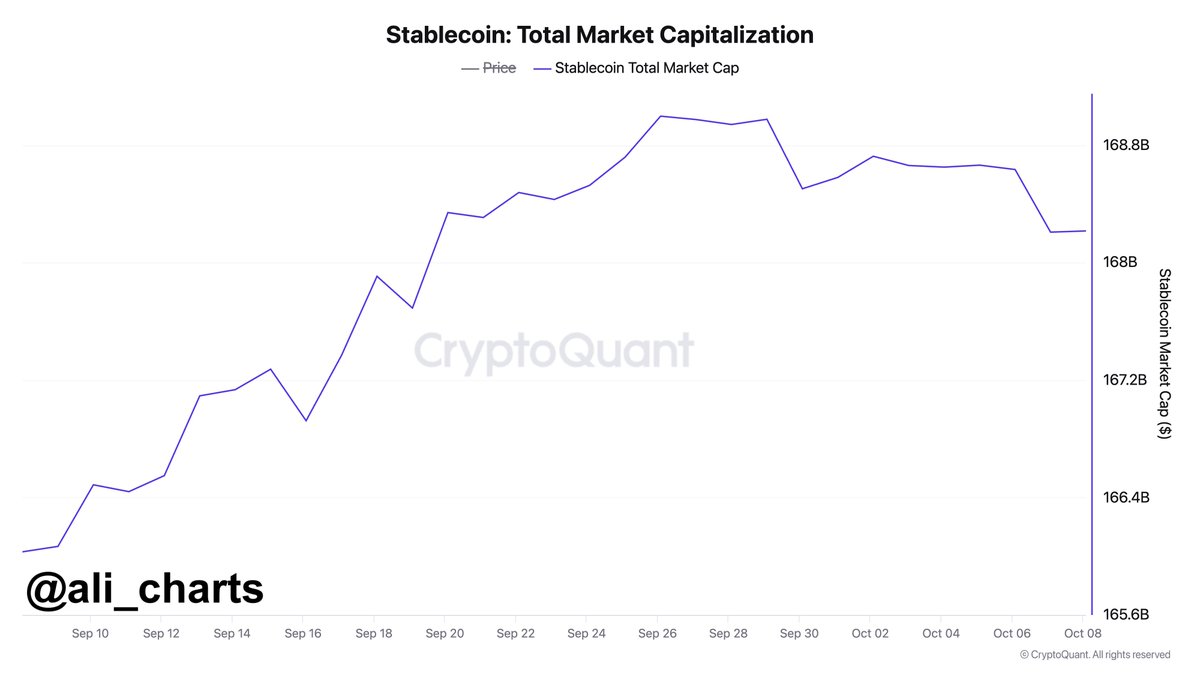

From my perspective as an analyst, while there’s a sense of optimism prevailing, some related market indicators seem to suggest weakness. Specifically, over the last few trading weeks, the market capitalization of stablecoins like USDT and USDC has been on a downtrend. As I observed on October 10, this capitalization had dropped by approximately $780 million from its recent peak highs, which could potentially signal a decrease in buying power.

Typically, when stablecoins like USDC, USDT, and DAI transfer to centralized exchanges, there’s often a surge in interest among users to purchase other cryptocurrencies such as Ethereum (ETH) and Bitcoin (BTC). Conversely, if there is an outflow or its market value decreases, it could indicate that users are becoming more cautious and carefully observing developments before making any further investments.

Generally, as people become worried about the market’s future, they often transfer more cryptocurrencies, such as stablecoins, to centralized platforms. This movement of funds usually signals an upcoming market-wide adjustment or correction.

Currently, there hasn’t been much Ethereum flowing into centralized exchanges. Instead, more people are choosing to stake their Ethereum. By the middle of this week, market data showed that approximately 34 million ETH were locked in staking, earning holders an annual percentage yield of about 3.3%.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-12 03:05