As a seasoned researcher with a knack for deciphering market trends, I find myself intrigued by the current state of Ethereum. The 10% drop over the last week is a stark reminder of the volatile nature of the crypto market. Yet, the accumulation of ETH around the $2,350 support level gives me a glimmer of hope.

Currently, Ethereum is experiencing a dip, reflecting a broader trend across the cryptocurrency market. This dip, approximately 2%, is primarily because of the contraction in Bitcoin, Ethereum, and leading altcoins. At present, the total market capitalization has dropped to $2.17 trillion. If the bearish pressure continues, there might be further losses, potentially undoing the gains made in September.

Ethereum Under Pressure, Will $2,350 Offer Support?

Over the past seven days, data from CoinMarketCap indicates that Ethereum has dropped by 10%, falling below $2,400 – a level that was previously a support but now serves as resistance. Despite this week’s steep decline potentially discouraging some investors, a number of traders are actually buying at current market rates.

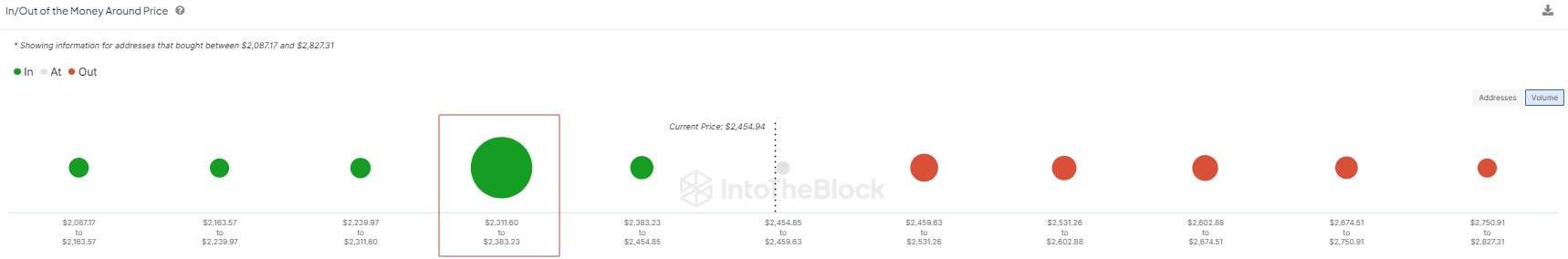

89 million Ethereum wallets purchased approximately 52 million ETH between the price ranges of about $2,311 and $2,383, according to IntoTheBlock data from October 3. This suggests that $2,350 is a significant support level for traders, as a considerable number of buyers tend to purchase Ethereum at this average price point, making it an important level to monitor closely.

Looking at the current amount of ETH held by sellers, it seems they would need to work harder to push the price below this point, potentially driving the coin back towards $2,100 and its August lows. Examining the activity of traders and the September range reveals that the $2,350 level aligns with approximately 61.8% and 78.6% Fibonacci retracement levels.

What’s Next For ETH?

In simpler terms, the cost of cryptocurrencies like Ethereum often stabilizes in areas defined by a Fibonacci retracement level. The behavior of prices within the range between $2,100 and $2,350 could significantly influence the direction of the market over the mid-term to long-term period.

A refreshing bounce around this emerging support and Fibonacci retracement zone would be a massive boost. In this case, ETH could rally, even above $2,800, as bulls target $3,500.

In a reverse scenario, a steep drop below the low points of August and September could lead to widespread panic selling. As a result, Ethereum (ETH) might plummet beyond $2,100 and $2,000, potentially reaching as low as $1,800, which would solidify losses that started in early August.

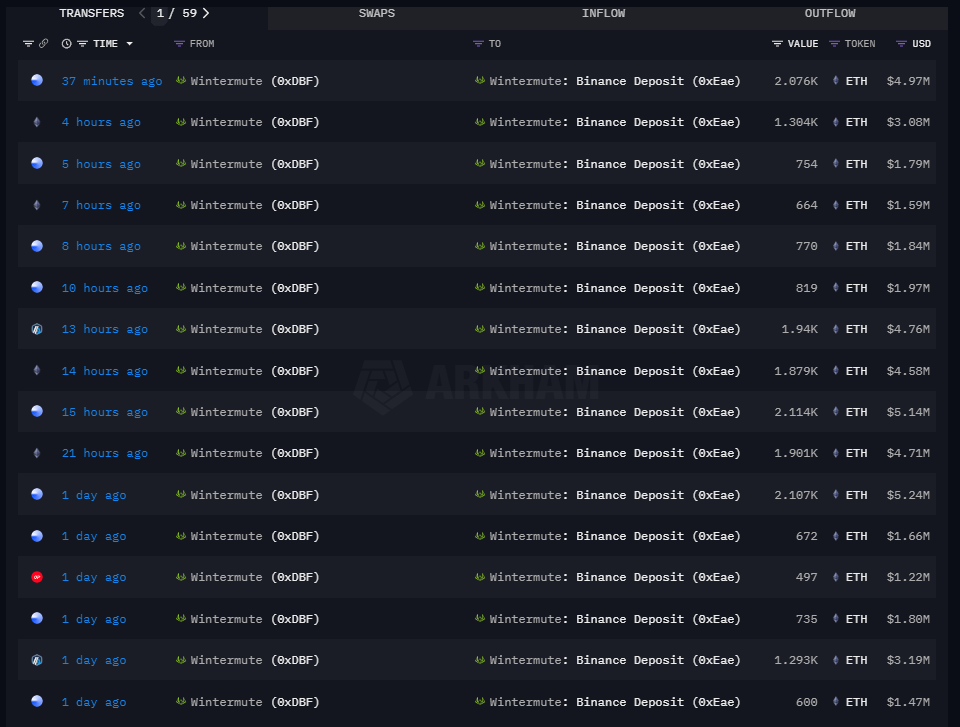

Given the current market trends, it seems that sellers are holding more power. Notably, there has been a significant withdrawal of cryptocurrencies from major exchange platforms over the recent trades.

Today, it was disclosed by The Data Nerd that Wintermute, a significant player in the crypto market, transferred 14,221 Ether to Binance, potentially signaling an intention to sell. In August, Wintermute, along with other prominent market makers like Jump Capital, offloaded more than 130,000 Ether, thereby driving prices down.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- How Many Episodes Are in The Bear Season 4 & When Do They Come Out?

2024-10-04 06:40