As a researcher with experience in the blockchain and crypto space, I find Optimism’s Q1 2024 performance to be quite impressive, especially given the broader market rally during this period. The network saw significant growth in key metrics such as daily active addresses, transactions, revenue, and TVL, which is a testament to its increasing adoption and usage within the Ethereum ecosystem.

In Q1 2024, Optimism, a Layer 2 scaling solution, experienced impressive network statistics and saw a 9% increase in value for its native OP token due to buoyant market conditions.

Optimism Sees Higher Activity And Rising Transaction Fees

Based on the latest findings from Messari’s analysis, the market capitalization of Optimism grew by 11% compared to the previous quarter, reaching a total of $3.7 billion. Additionally, its fully diluted market cap expanded slightly by 1%, amounting to $15.7 billion.

Although Bitcoin (BTC) and Ethereum (ETH) experienced significant quarterly growth of 69% and 53%, respectively, in the larger crypto market, the market capitalization ranking of OP slipped from 26th to 39th among all blockchain networks. Nevertheless, within the Ethereum ecosystem, OP remains among the top four rollups based on market capitalization.

In the first quarter of 2024, there was a substantial rise in the number of daily active addresses and transactions on the Optimism network. The number of daily active addresses amounted to 89,000, which represented a 23% increase from the previous quarter. Similarly, daily transactions skyrocketed by 39%, reaching 470,000. Although these figures came close to their all-time highs recorded in Q3 of 2023, they fell slightly short.

The network’s income experienced a remarkable 78% jump quarter over quarter, reaching $16 million. This growth was fueled by heightened activity and a significant 48% surge in the average transaction fee to $0.42. Nevertheless, the average fee underwent a considerable decrease in the second half of March following the adoption of Ethereum Improvement Proposal (EIP) 4844. This update substantially cut L1 submission costs by 99%.

Total Value Locked Jumps 18% In Q1

In the quarter one of 2024, Optimism managed to boost its on-chain profits by 14%, amounting to a total of 2 million US dollars, despite a fee reduction. Simultaneously, its Total Value Locked (TVL) experienced a growth of 18%, reaching an impressive figure of 1.2 billion US dollars. However, the network’s TVL ranking among all other networks slipped down to the 11th position.

As an analyst, I’ve examined the distribution of Total Value Locked (TVL) within the Optimistic Finance (Optimism) ecosystem. Notably, the Decentralized Finance (DeFi) sector holds a significant dominance, accounting for approximately 86% of active addresses. In contrast, non-fungible token (NFT) applications and gaming sectors trail behind, contributing around 6.9% and 6.7%, respectively.

The top protocols on TVL featured Synthetix with a market size of $307 million, marking a 4% increase quarter-over-quarter. Aave came in second place with a total value locked of $270 million, representing a significant surge of 52% compared to the previous quarter. Velodrome followed closely behind with $171 million in TVL, showing an impressive growth of 10% quarterly.

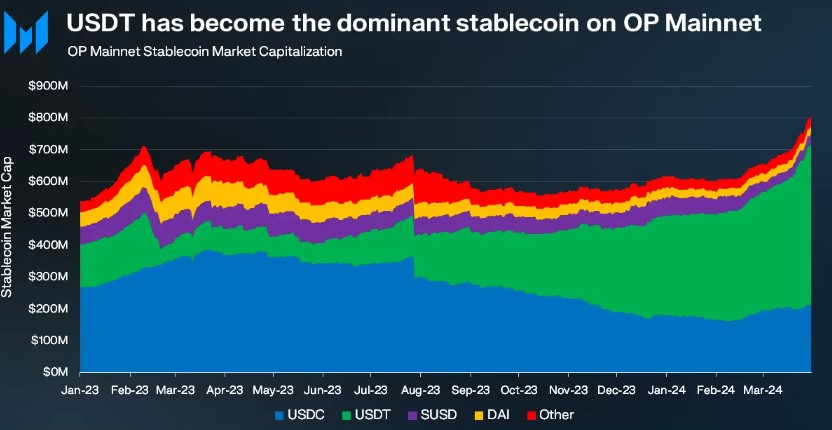

As a crypto investor, I’ve observed a remarkable growth in the stablecoin market capitalization on the Optimism network during the first quarter of 2024. The total market capitalization surged to $809 million, representing a 32% increase from the previous quarter. Among the major players, Circle’s USDC and Tether’s USDT dominated this growth. Notably, USDT experienced an impressive surge of 64% QoQ, reaching a market capitalization of $512 million, which accounted for 63% of Optimism’s total stablecoin market cap.

OP Rebounds Alongside Crypto Market Resurgence

In Q1 2024, Optimism outperformed expectations in crucial areas. However, its native token, OP, failed to reflect this success in terms of price hike. Contrarily, OP mirrored the general market trend and plunged to a yearly low of $1.80, only a month after reaching an astounding peak of $4.84 in March.

As a crypto investor, I’ve noticed an exciting development in the market recently. The overall cryptocurrency scene has experienced a surge of bullish energy over the last few days, and my token of interest is no exception. In fact, within the past 24 hours, there has been a substantial 9% price hike, and just in the previous week, there was a modest 3% uptick. At present, my token trades at an invigorating $2.56.

The trading volume for OP, as reported by CoinGecko, has risen by 19% within the last 48 hours, amounting to $290 million.

As a researcher analyzing the current market trends, I observe an uptick in optimistic investor sentiments. However, it’s important to remember that the stock under consideration (OP) remains 46% undervalued relative to its all-time high. In the near future, this asset may encounter substantial resistance levels before attempting another test of its historic peak.

In simple terms, the initial hurdle for the token’s price is at $2.65, followed by $2.90. Overcoming these levels is necessary for the token to advance towards $3.00. On the other hand, the support level at $2.34 has shown significant importance and requires close attention should there be any signs of a bearish trend reversal.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Gold Rate Forecast

2024-05-18 05:10