As a seasoned crypto analyst with years of experience in the industry, I find it intriguing that only eight altcoins have hit new all-time highs against Bitcoin since November 2022. This observation highlights the unique dynamics of this bull cycle compared to previous ones.

In the current cryptocurrency market boom, Bitcoin has been leading the charge with its bullish trend. Investors, in turn, are eagerly anticipating a significant event that could propel Altcoins to even greater heights.

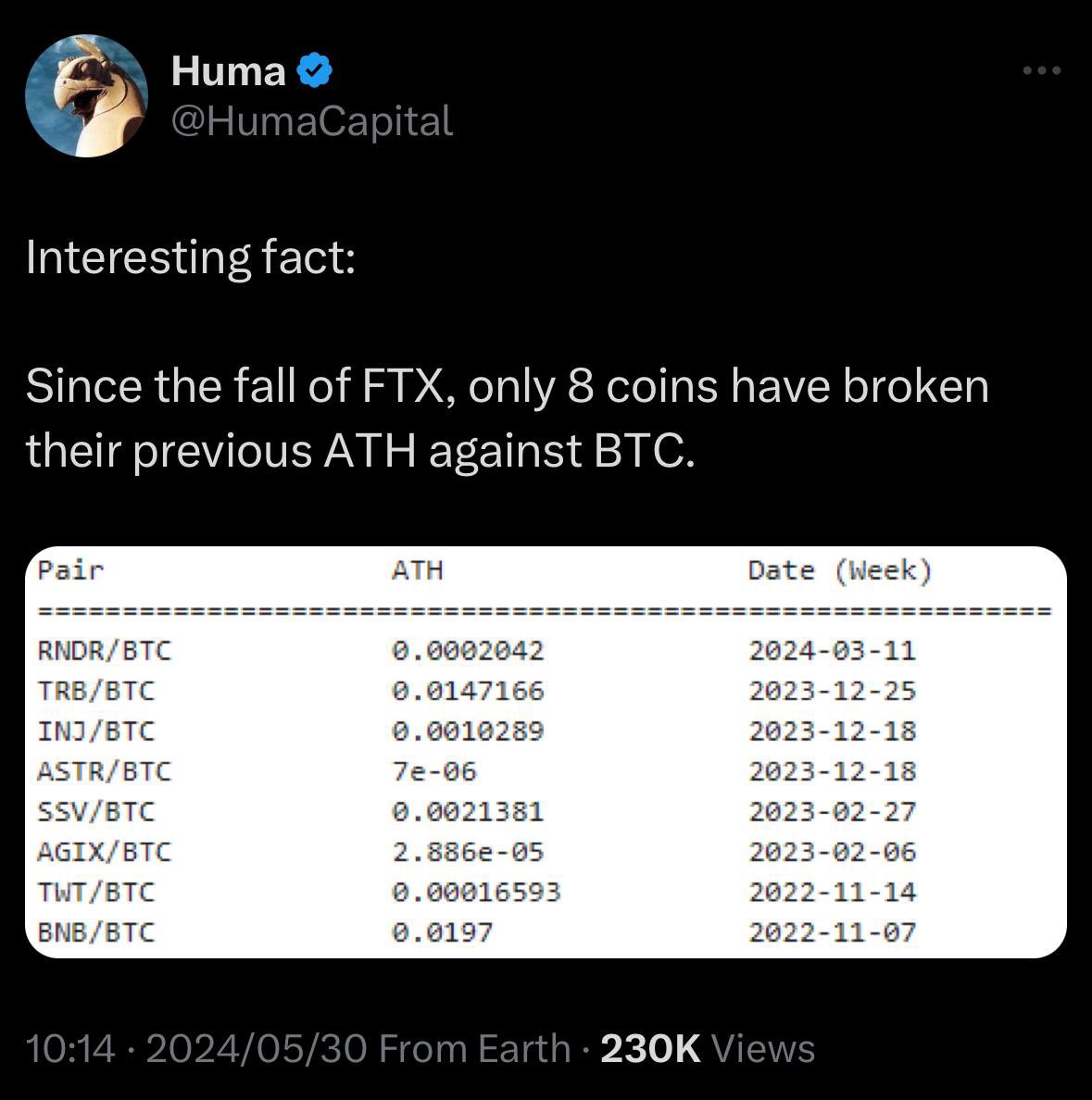

In the crypto sphere, it has come to light that just eight alternate coins have reached a fresh peak price in relation to Bitcoin following FTX’s downturn. A seasoned crypto analyst weighed in on this development.

Altcoins Underperforming Against Bitcoin This Cycle

Last Friday, crypto analyst Miles Deutscher brought up an intriguing piece of information regarding the crypto market. Specifically, he noted that only eight alternative coins (altcoins) have managed to surpass their all-time highs (ATHs) in terms of value against Bitcoin since November 2022.

To accomplish this task, the following cryptocurrencies are involved: Render (RNDR), Tellor (TRB), Injective (INJ), Astar (ASTR), SSV Network (SSV), SingularityNET (AGIX), True Wallet Token (TWT), and Binance Coin (BNB).

Notable is the fact that RNDR was the most recent addition to this list, achieving it on March 11. The list, however, includes only altcoins that were launched prior to FTX’s downfall.

Upon initially receiving the news, I was taken aback. However, upon further reflection, the information proved relevant and provided valuable insights based on its unique aspects.

As a crypto investor, I’ve noticed a shift in asset selection dynamics compared to past cycles. Previously, being heavily invested in sectors like L2 and gaming might have paid off. However, this time around, I’ve seen investors face consequences for overexposure to these sectors. On the other hand, memecoins and AI have been surprising standouts, offering rewards for those who jumped on board.

As a crypto investor looking back at the previous market cycle, I used to be able to place bets on virtually any altcoin and still come out on top against Bitcoin ($BTC). However, this time around, the analyst’s perspective is that sector-specific outperformance will persist, even with the retail liquidity injection into the market.

I recently came across this intriguing perspective that “crypto operates under the principles of an attention economy.” In simpler terms, it means that value and financial resources are allocated based on where people’s focus and interest lie. Even projects with superior technology may not succeed if there isn’t a compelling reason for individuals to invest in them.

Deutscher’s second key observation underscores the present-day record high dilution in the cryptocurrency market. He notes that an enormous number of new products, around thousands per day, are being introduced. Furthermore, he mentions that venture capital coins with low circulation and high fully diluted valuation (FDV) are entering the market in billions. The rate of these launches seems to exceed the availability of fresh liquidity, making it challenging for altcoins to deliver satisfactory performance.

More Room To Catch Up

The third argument of the analyst is that Bitcoin and Bitcoin-based ETFs have been driving the current bull market. As a result, it’s not surprising to see that most other cryptocurrencies or altcoins haven’t seen significant price increases yet.

Several crypto pundits and authorities hold this perspective. According to Alex Krüger, the Bitcoin market cycle has predominantly been fueled by the impact of Bitcoin ETFs.

As a crypto investor, I view the underperformance of Altcoins relative to Bitcoin as an encouraging sign. In past market cycles, Bitcoin’s dominance has played a significant role in setting the stage for Altcoin rallies. By not keeping pace with Bitcoin’s price action, these coins are providing me with an opportunity to invest and potentially reap substantial rewards. This underperformance creates “extra space” for Altcoins to surge ahead and reach new heights.

As an analyst, I recognize the current market situation and believe that while some altcoins have experienced growth during the first quarter, a significant catalyst is still needed to ignite a true altseason. Surprisingly, many investors have reported impressive returns even in the relatively mildly bullish climate for most alternative cryptocurrencies.

As a crypto investor, I believe that despite the current market conditions, there’s still potential for substantial gains during this cycle. We may not experience the mind-blowing altcoin seasons we’re longing for, but there are opportunities to make significant profits.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2024-06-01 04:16