As a seasoned crypto investor with battle-tested nerves and a portfolio that has weathered more market storms than a shipwreck survivor, I find myself analyzing the recent trend of Ethereum (ETH) with cautious optimism. The fact that only 66% of ETH holders are currently in profit despite a 21% rally over the past week is an intriguing statistic. It suggests that many investors have yet to recoup their initial investment, which can be both concerning and exciting.

Information from on-chain sources indicates that only about two-thirds (66%) of Ethereum‘s current holders are currently making a profit, even though it has experienced a significant surge (21%) in value during the last seven days.

Ethereum Holders In Profit Still At Relatively Low Level

Based on information from the market intelligence tool, IntoTheBlock, it appears that the recent drop in Ethereum’s value has noticeably impacted the profitability of those holding Ethereum within the network.

Over the past week or so, the price of ETH plummeted from its peak of around $3,400 at the end of July down to roughly $2,100. However, in recent days, there’s been a significant surge in its value, pushing it above the $2,700 threshold.

It appears that the market’s rebound has allowed some investors who suffered losses during the crash to regain their profits. However, as per IntoTheBlock’s analysis, only about 66% of the current holders are realizing gains at the moment, suggesting that the proportion of profitable investments is not significantly improving yet.

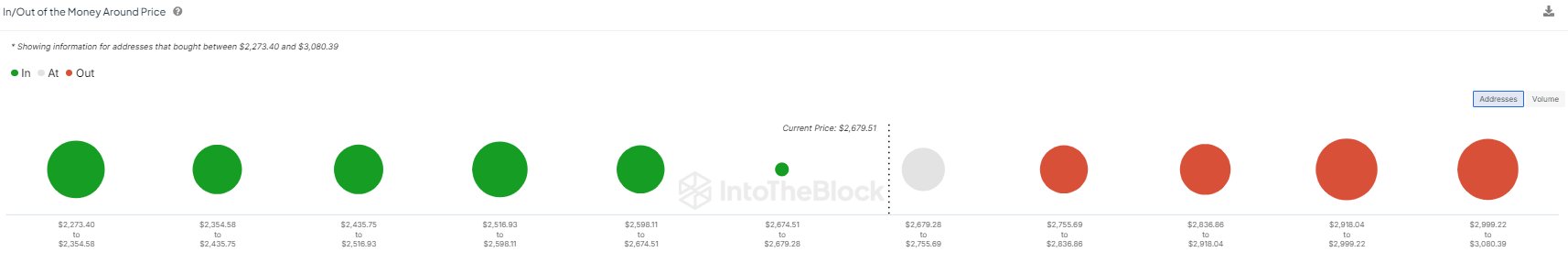

The analytics company provided a graph illustrating that the price levels close to the current one correspond with the number of investors who recently purchased these prices.

As a crypto investor, I noticed that the size of each dot in this graph corresponds to the number of individuals who purchased at roughly the indicated price range. It seems quite a few of us made our purchases within the $2,920 – $3,000 and $3,000 – $3,080 price ranges.

It’s obvious that these investors would currently experience losses because the asset’s current value falls below their specified price ranges. Those holding onto the asset despite being at a loss often anticipate its price increase to reach their initial investment amount, enabling them to sell and recoup their funds. Such selling actions can create resistance for the coin’s further growth.

In most cases, sales volume doesn’t pose a threat to Ethereum. However, when multiple investors have similar purchase prices, the likelihood of a large-scale selloff increases. This could potentially hinder Ethereum’s recovery if its price falls within those ranges.

One potential rephrasing for your sentence could be: “A significant risk to any rally is profit-taking, but since only 66% of investors are currently in profits, the likelihood of a selloff due to this reason might not be high. This is particularly true given that the coin may have already gotten rid of many weak hands during the crash.”

In related news, according to analyst Ali Martinez’s explanation in a recent post, Ethereum has triggered a Tom Demark (TD) Sequential sell signal on its hourly chart.

Based on the current signal, there might be a potential decrease in Ethereum’s value, but the magnitude of this drop is likely to be relatively small due to the brief time period represented in the chart.

ETH Price

Currently, Ethereum is being exchanged for approximately $2,700, representing a rise of over 2% in its value during the last 24 hours.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-08-13 09:40