As a seasoned analyst with over two decades of experience in the financial markets, I have seen countless cycles and trends unfold before my eyes. The current situation with Ondo Finance (ONDO) reminds me of a rollercoaster ride – exhilarating highs followed by nerve-wracking lows.

In the past few weeks, Ondo Finance has encountered considerable difficulties, witnessing a 30% decrease in price from its peak of $2.14. Despite this recent slump, several analysts are hopeful about Ondo’s ability to bounce back, pointing to its robust performance during earlier market cycles as proof of its durability. As one of the leading alternative coins, Ondo has consistently garnered investor interest, fueling discussions about its potential future actions.

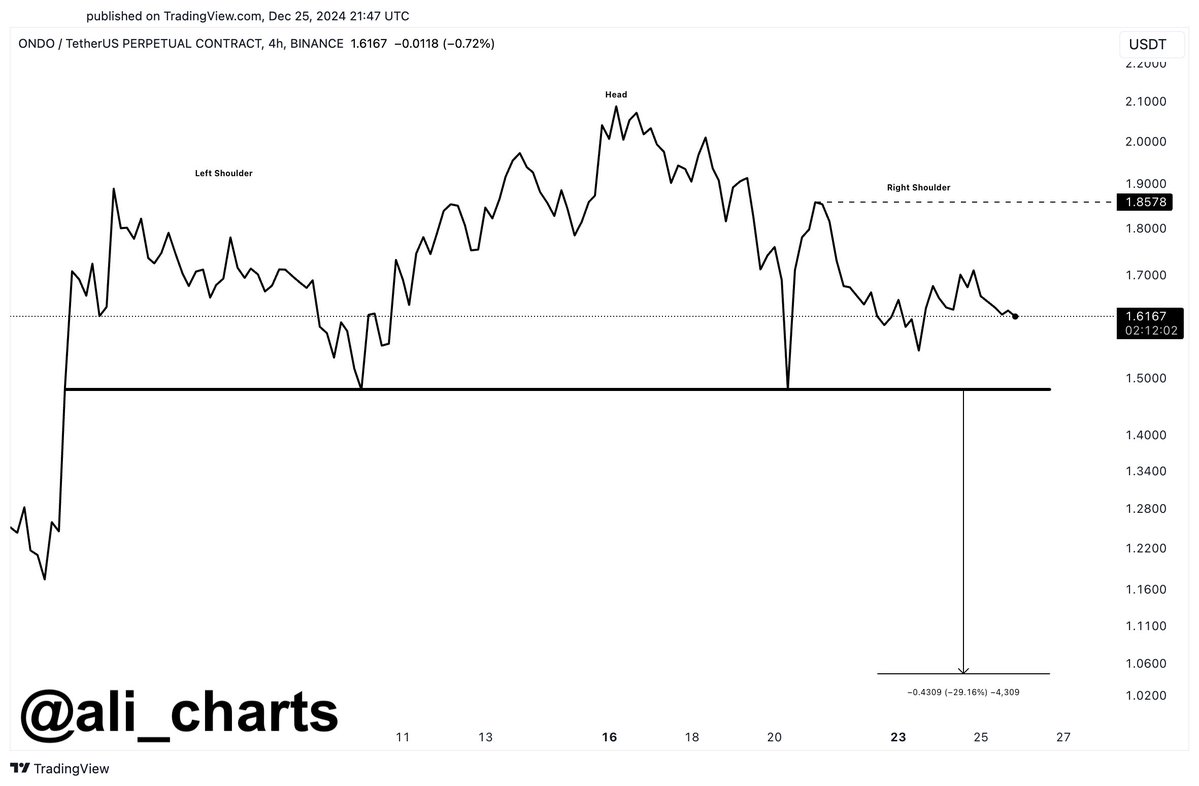

As a crypto investor, I’ve been closely watching ONDO, but I must admit a sense of caution has crept in lately. Analyst Ali Martinez recently pointed out a potential concern: the possibility of a head-and-shoulders pattern emerging on its price chart. This technical analysis signal is usually bearish and can indicate trend reversals. If this pattern materializes, it could potentially spark increased selling activity and lead to a more significant pullback in ONDO’s value. So, I’m keeping a close eye on this development.

Over the next few days, Ondo Finance faces a crucial juncture. Interestingly, investors will keenly observe if the token can buck bearish trends and rekindle bullish trends, or if it follows the predicted pattern, resulting in further drops. At present, the fate of ONDO remains uncertain, as market sentiment and technical signals provide mixed predictions about its immediate direction.

ONDO Testing Crucial Demand

After an impressive surge in the early stages of its cycle, Ondo Finance is currently experiencing a notable pullback and approaching important demand zones at key price points. The token’s value temporarily stopped near its previous record high, approximately $1.50, which has now transformed into a critical support level. If it manages to remain above this threshold, there’s a chance that bullish sentiment could resurface, possibly leading to another upward trend.

Nevertheless, top analyst Ali Martinez expresses worries due to a technical assessment which indicates ONDO might be developing a bearish head-and-shoulders configuration. If verified, this pattern usually predicts a shift in the trend direction, potentially causing higher levels of selling activity.

Martinez cautions that if the price falls decisively below the $1.48 mark, it could lead to a sharp 30% drop, potentially pushing ONDO’s value down to around $1.05. This potential shift would signify a substantial setback for the token and its stakeholders.

To counter this bearish prediction, it’s essential for ONDO to retake the $1.86 mark as a support level. This action would demonstrate strength and renew optimism about the asset’s bullish prospects. At present, the market is at a pivotal point, with traders keeping a close eye on price fluctuations to decipher ONDO’s likely direction. The upcoming days will be crucial in determining whether ONDO recovers or faces potential for additional downward pressure.

Technical Analysis: What To Expect

At the moment, Ondo Finance (ONDO) is being exchanged at $1.49. This follows a successful test of the crucial support level at $1.46, which was emphasized by top analyst Ali Martinez. This particular level has shown to be a robust barrier for ONDO, indicating strong buyer demand at this price. For now, ONDO appears steady, but investors are keeping a wary eye due to the possibility that broader market conditions could influence ONDO’s future course.

From my analysis perspective, the steady holding at $1.46 is quite promising, hinting that ONDO might be constructing a base for a potential upswing. Nevertheless, a broader market correction could intensify the stress on ONDO, potentially pushing its value downwards and challenging crucial demand zones. Therefore, I’m closely monitoring significant technical thresholds to verify any signs of a bullish resurgence among investors.

To help ONDO bounce back, it’s important for it to revisit and surpass the $1.70 mark soon. Overpowering this threshold would indicate a resurgence of power, setting the stage for a bullish comeback that could even lead to challenging past peaks. For now, ONDO is in a fragile state, as traders keep an eye on overall market trends and the asset’s capacity to uphold its current support. The upcoming actions will be key in deciding whether ONDO can restart its upward trend or continue experiencing consolidation.

Read More

- Is Average Joe Canceled or Renewed for Season 2?

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Analyst Says Dogecoin Has Entered Another Bull Cycle, Puts Price Above $20

- Where was Severide in the Chicago Fire season 13 fall finale? (Is Severide leaving?)

- General Hospital: Lucky Actor Discloses Reasons for his Exit

- Inside Prabhas’ luxurious Hyderabad farmhouse worth Rs 60 crores which is way more expensive than SRK’s Jannat in Alibaug

- Superman’s James Gunn Confirms Batman’s Debut DCU Project

- What Happened to Kyle Pitts? NFL Injury Update

- All Elemental Progenitors in Warframe

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

2024-12-26 20:46