As a seasoned researcher with over two decades of experience in the financial markets, I have witnessed numerous bull and bear runs, but none quite like the one we are currently seeing with Bitcoin. The recent surge past $73,000 is reminiscent of the Dotcom bubble in 1999, where the market was driven by hype rather than fundamentals, but with a significant twist – this time it’s digital gold we’re talking about.

As a researcher studying cryptocurrency markets, I’m excited to report that Bitcoin has once again broken through significant resistance, reaching an all-time high of $73,544 on Tuesday evening. This latest surge represents a 6% increase in the world’s largest digital currency. Notably, this price point hasn’t been seen since March 14th.

In my exploration of the digital asset landscape, it’s evident that Ethereum and Binance Coin are performing admirably, recording increases of 4% and 2%, respectively. Recently, Bitcoin ETFs have experienced substantial inflows, and with the US elections approaching rapidly, there’s a growing anticipation for a significant price escalation in Bitcoin.

A Bullish Bitcoin Ahead

As a crypto investor, I witnessed an impressive surge in Bitcoin’s price to nearly hit its record high of $73,500 during US trading hours yesterday, just falling short of the all-time peak set on March 14th. Nevertheless, several positive developments and advantageous market conditions could potentially propel Bitcoin even higher in the coming days.

Initially, after a prolonged decline over seven months, Bitcoin has shown signs of recovery, breaking free from its previous trend. For quite some time, it had been holding steady slightly above the $68,000 mark, which encouraged traders and investors to drive up its price.

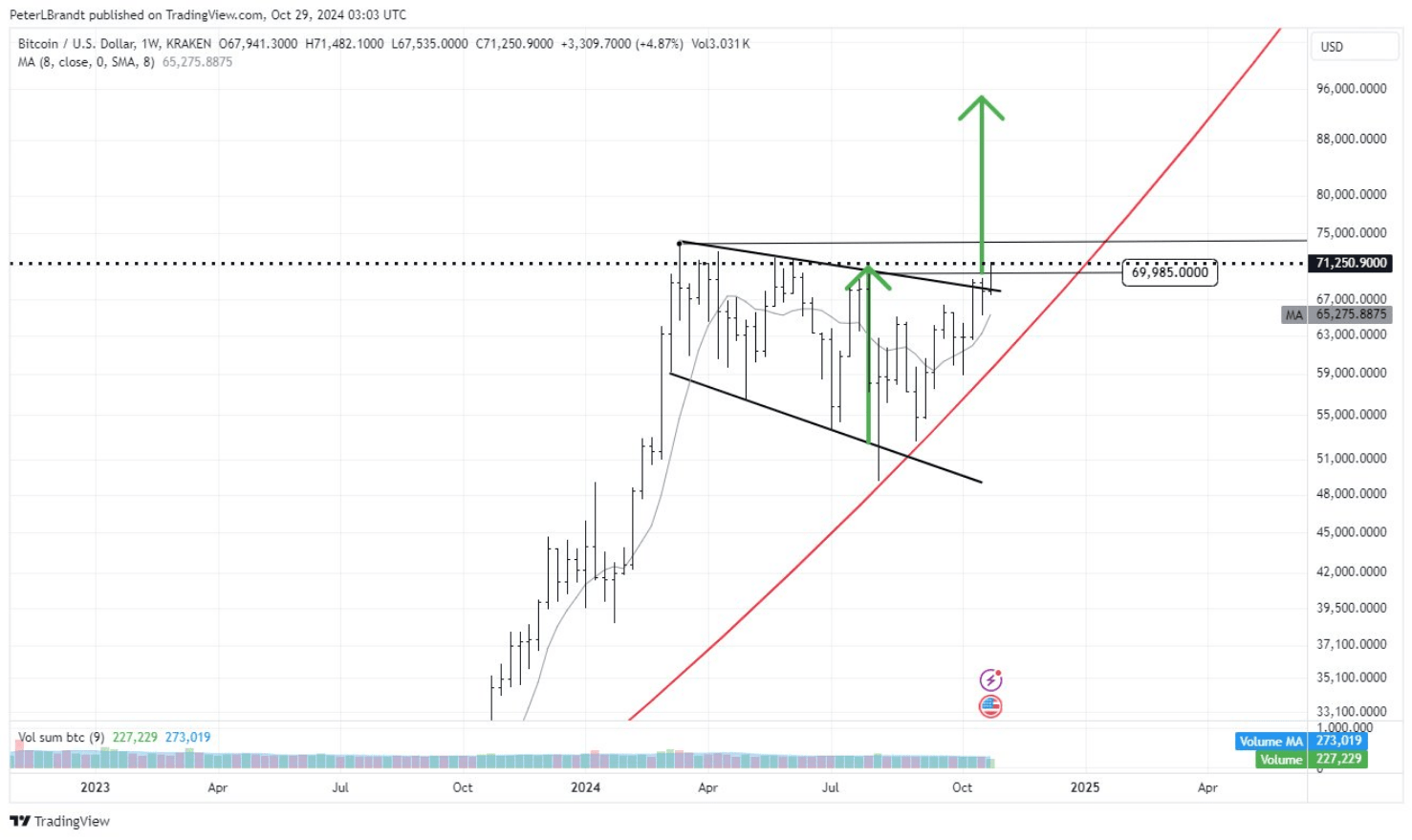

In terms of setting targets, one factor to consider is whether a semi-logarithmic or linear graph is employed. For the target of $94,000, it’s calculated as an extension of the triangle’s projected height from the breakout point on a semi-log scale. Put simply, it’s approximately 1/3 of the triangle’s height when measured in this type of graph.

— Peter Brandt (@PeterLBrandt) October 29, 2024

On Monday just gone, Bitcoin surpassed the significant $70,000 mark due to increased investments from ETFs and transactions by large investors (often referred to as “whales”). Some financial analysts, including seasoned trader Peter Brandt, predict an even more ambitious price range: Bitcoin could potentially reach between $94,000 and $160,000 in the near future.

Next, the price fluctuations have eliminated numerous short positions and successfully surmounted resistance levels between $65,000 and $71,000. This progress has fostered a positive atmosphere, making long-term short traders anxious.

Institutional Interest In Bitcoin Rising

The significant surge in Bitcoin’s value recently can be attributed, in part, to the continuous large investments into Bitcoin exchange-traded funds (ETFs) that received approval in January. As per Bernstein’s data, these leading BTC ETFs have attracted billions of dollars from corporations and institutional investors over the past few months. The combined assets managed by these top ETFs, as of October 28th, have already exceeded $68 billion and are expected to grow even more.

Furthermore, as more than $43 billion in interest accumulates, there’s growing excitement surrounding cryptocurrency futures. The escalating trade volumes suggest a favorable outlook among traders and underscores the heightened fascination of market participants.

All Eyes On The US Elections

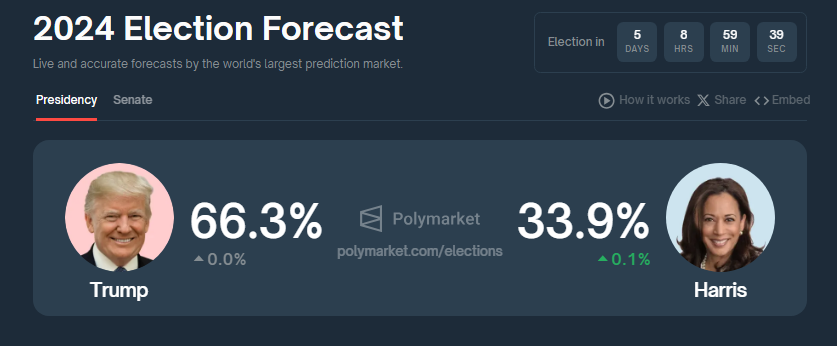

It seems that the upcoming US elections on next Tuesday could be a significant factor influencing the price of Bitcoin, as its value has been rising alongside an increase in Donald Trump’s chances of winning the presidency.

Originally expressing doubts about cryptocurrency, former Republican President Trump now advocates for digital currencies like Bitcoin and even suggests that our nation should consider accumulating Bitcoins strategically.

Each of these elements contributed significantly to Bitcoin’s recent spike in value, potentially propelling it towards another record peak.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Best Japanese BL Dramas to Watch

- Gold Rate Forecast

- Overwatch 2 Season 17 start date and time

- List of iOS 26 iPhones: Which iPhones Are Supported?

2024-10-30 18:04