As a seasoned crypto investor with a decade of experience under my belt, I must say that the recent surge in Bitcoin’s price has filled me with a sense of optimism that I haven’t felt since the halvening of 2016. The market’s bullish sentiment and the growing demand for Bitcoin are reminiscent of the early days of Bitcoin, when it was just a dream in the minds of a few visionaries.

Yesterday, Bitcoin experienced a more than 5% increase, mirroring a favorable trend across the cryptocurrency market. This abrupt price jump has ignited optimism among investors and experts, who are now expecting even greater returns in the upcoming months. The market’s overall mood is brightening, aligning with this upward trend, and fostering expectations for a sustained uptick.

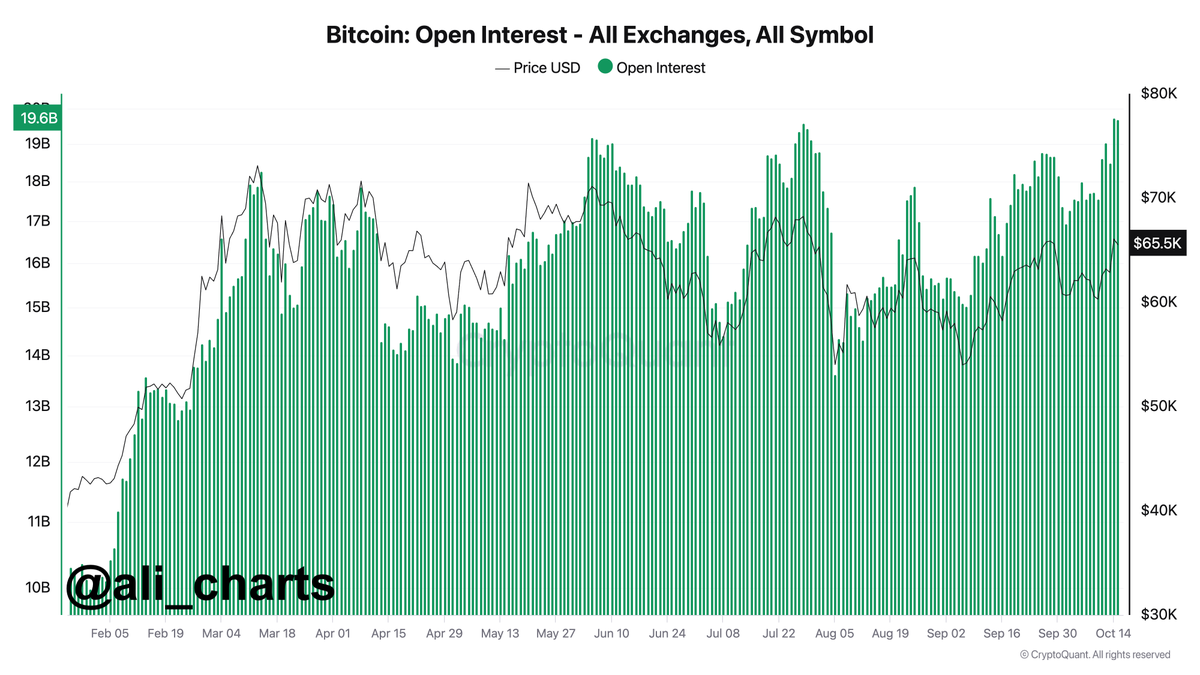

According to information from CryptoQuant, it appears that the desire for Bitcoin is increasing, lending credence to the notion that Bitcoin’s price might further increase. This escalating interest, combined with a more positive overall market outlook, sets up an advantageous scenario for a bullish trend.

Continuing the recent price surge could set the stage for Bitcoin to reach new highs, while any hesitation might lead to further consolidation. Either way, market participants are eagerly awaiting the next major move.

Bitcoin Open Interest Reaching New Highs

Following a spike to record-breaking levels in its local market, Bitcoin now finds itself at a pivotal juncture, potentially poised for an upturn that leaves financial experts and stakeholders hopeful.

In just a few days, the price has shot up more than 12%, indicating a strong optimism among investors about the market. This surge has fueled expectations for further growth, as some believe that Bitcoin could soon experience a major leap forward.

crypto expert and investor Ali Martinez recently posted an intriguing chart from CryptoQuant, showing that the total open interest in Bitcoin across all trading platforms has reached a record peak of $19.75 billion.

Increased open interest frequently signals upcoming major price changes, indicating increased market activity with higher amounts of money involved. A rise in open interest implies that traders are preparing for substantial price fluctuations, which might further intensify the ongoing trend surge.

According to CryptoQuant’s data, there’s a rising optimistic perspective about Bitcoin, since it indicates that more and more investors and traders are becoming convinced of Bitcoin’s short-term potential.

If this current trend persists, Bitcoin might reach fresh peaks, potentially triggering a larger bullish trend across the market. The coming days are significant as they could shape Bitcoin’s future direction.

BTC Pushing Local Highs

Currently, Bitcoin stands at approximately $65,600, having stabilized after yesterday’s spike to record levels. It’s now attempting to breach the significant resistance point of $66,500. If successful, this could propel Bitcoin towards new record-breaking peaks.

Overcoming this resistance is crucial for Bitcoin’s progress, as doing so would underscore its bullish trend and possibly result in additional upward movement.

Currently, Bitcoin is trading significantly higher than its 200-day moving average at approximately $63,336. This suggests a favorable perspective for Bitcoin over the next few weeks. Maintaining this level above the moving average indicates that the bulls are dominating the market, potentially leading to an upward trend. In other words, the market conditions appear ripe for a potential price increase.

But if Bitcoin is to persistently rise higher, it needs to surpass the $66,500 mark and establish a new peak.

If Bitcoin doesn’t manage to overcome this resistance, there might be a pullback towards support at approximately $62,000. This would represent a normal correction within the overall upward trend.

The current outlook is positive for BTC, yet the upcoming days hold significance; they could either let it continue its upward trend or trigger a temporary setback.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Delta Force Redeem Codes (January 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Overwatch 2 Season 17 start date and time

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2024-10-16 05:10