As a seasoned researcher with a decade of experience in the cryptocurrency market, I have witnessed Bitcoin’s volatile yet fascinating journey firsthand. The current price action between $65,000 and $69,500 presents an intriguing conundrum – a calm before the storm, perhaps?

At the moment, Bitcoin‘s price fluctuates between approximately $65,000 and $69,500 due to two weeks of positive market trends. This has rekindled hope among experts and investors, as they believe that Bitcoin might soon reach unprecedented highs in the upcoming weeks. There is growing conviction that the predictions made in March about the cycle top happening may have been too early.

Looking at the insights from CryptoQuant, I find myself in a rather optimistic position as a crypto investor heading towards November. Instead of typical cycle-top conditions, the data points towards a bullish trend for Bitcoin. With the U.S. election approaching on November 5 and global economic factors constantly evolving, I anticipate the market to stay erratic and volatile in the coming weeks.

Keeping a close eye on developments, market players anticipate that global political and financial occurrences might impact Bitcoin’s direction. Consequently, there is a widespread belief that the upcoming significant shift in Bitcoin could lead to a new upward surge, possibly surpassing earlier peaks.

Bitcoin Calm Before The Storm?

Bitcoin remains strong over $67,000, demonstrating strength as it approaches a possible surge beyond $70,000. Yet, the current trends hint that Bitcoin might stabilize below this critical threshold before climbing to record-breaking highs in its next phase. Investors are keenly observing Bitcoin’s behavior around these price points, as a persistent rise above $70,000 could pave the way for substantial growth.

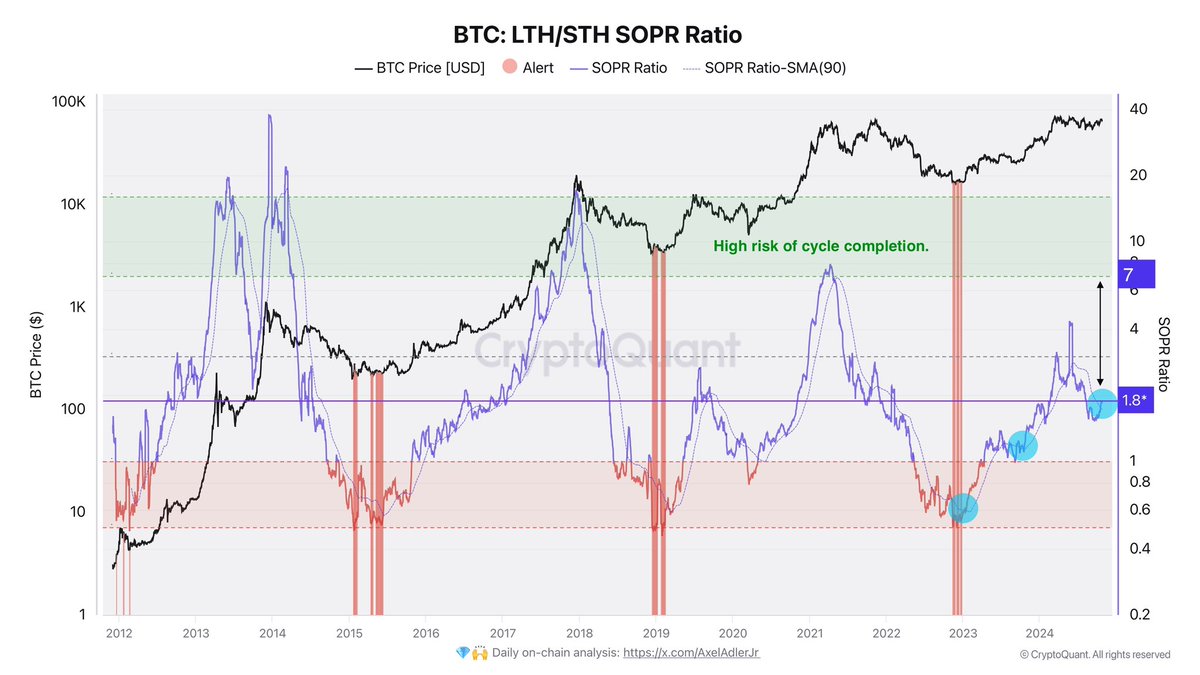

CryptoQuant analyst Axel Adler recently shared critical insights on X, highlighting the current Long-Term Holder (LTH) to Short-Term Holder (STH) SOPR Ratio, which sits at 1.8. This metric is often used to gauge selling pressure and market sentiment, with higher levels indicating increased profit-taking that could signal a market peak.

As suggested by Adler’s analysis, when the ratio reaches approximately 7, Bitcoin is getting close to a cycle peak. A bullish crossing of this ratio with its 90-day moving average suggests a favorable perspective, indicating that Bitcoin is still far from reaching its maximum cycle value.

In simpler terms, the way this measure is changing and the overall market situation seem to indicate positive trends for Bitcoin’s price movements over the next few weeks. The data indicates that there may be more growth potential for Bitcoin within this cycle, which boosts the confidence of long-term investors who are hoping for further gains.

BTC Technical Levels

Currently, Bitcoin is being traded at approximately $67,500. However, it’s encountering difficulties following its inability to sustain its optimistic pattern on the 4-hour chart. The price couldn’t surpass $69,500, which might indicate a change in momentum direction. A significant support point now lies at $65,000, representing a previous low that had earlier supported the bullish trend. Maintaining the price above this level is crucial to avoid a wider pullback and preserve optimism among investors who favor a bull market.

At present, Bitcoin’s price trend is uncertain, making it difficult to predict its direction in the near future. If we see a surge above $69,500, it could strengthen the bullish momentum, encouraging more investors and suggesting another attempt at an upward rally. On the flip side, falling below the $65,000 support level might indicate a correction, possibly leading Bitcoin to less active price regions as the bulls reassess their positions.

Right now, the ongoing consolidation period emphasizes the significance of these price points in shaping Bitcoin’s immediate direction. As both bulls and bears compete for dominance, it is essential that Bitcoin manages to stay above $65,000 to maintain a positive outlook.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

2024-10-25 22:16