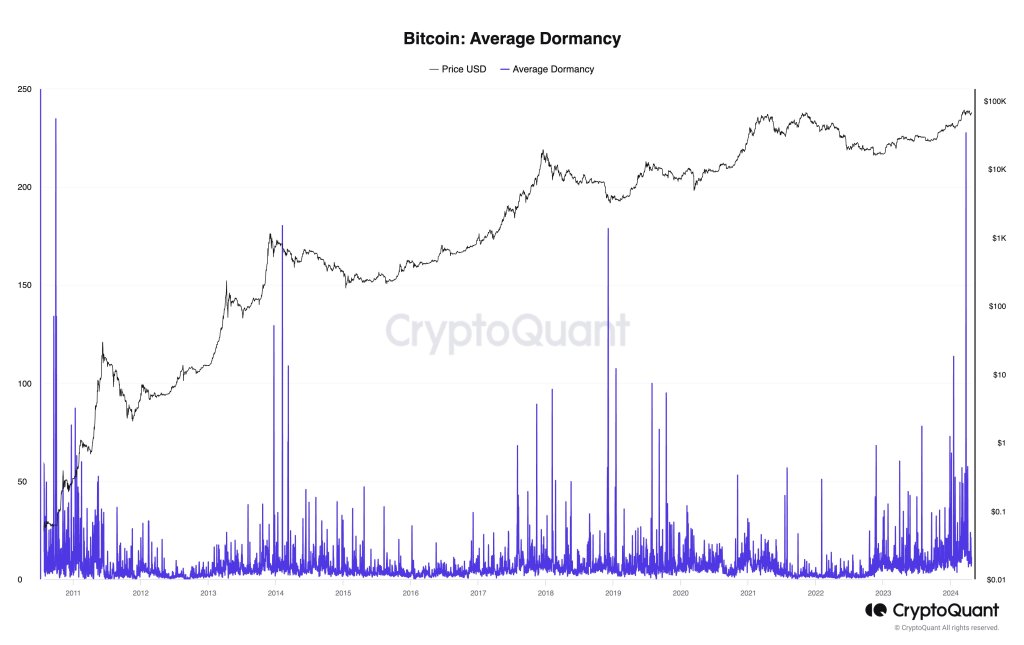

According to Ki Young Ju, the founder of CryptoQuant, there’s been an uptick in the transfer of older Bitcoins on the X network. This trend is reflected in Bitcoin’s Average Dormancy chart, which has reached a 13-year peak recently. In simpler terms, a large number of Bitcoins that have not been active for a long time are now being moved around.

More Old Whales Moving Coins

The Bitcoin Average Dwell Time reflects how long, on average, each Bitcoin coin has remained inactive. According to blockchain information, Bitcoins that have been owned for three to five years have been transferred to new users.

During periods of activity, it’s intriguing to note that no records indicate these assets were shifted to trading platforms. Instead, there’s a strong possibility they were dealt privately through over-the-counter (OTC) transactions.

Transactions moving coins to centralized platforms such as Binance or Coinbase often indicate an intent to sell. Large amounts transferred, particularly by “whales,” increase the likelihood of price drops. On the other hand, over-the-counter (OTC) trades do not significantly affect spot prices, which is beneficial for buyers.

Examining the Spent Output Profit Ratio (SOPR) of these transfers in greater detail reveals that the whales who carried out these transactions earned considerable gains. Typically, when whales sell off their holdings and realize profits, market prices often decrease.

Will Bitcoin Prices Retest All-Time Highs

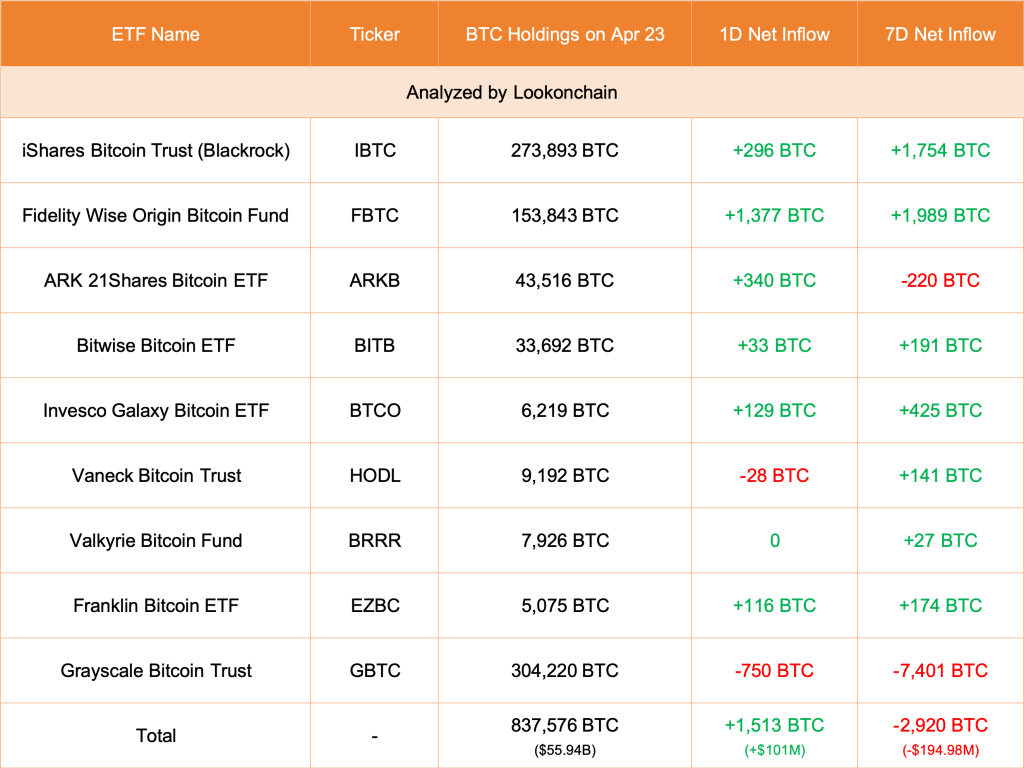

In a recent post on X, an analyst expressed the view that Bitcoin prices could rise due to the influence of newly launched spot Bitcoin ETFs. These financial instruments serve as a shield against price declines given the robust inflows seen in recent weeks.

Institutions can obtain controlled access to Bitcoin through Spot ETFs, contributing to a continued likelihood of increasing prices as withdrawals from GBTC have been shrinking.

Based on Lookonchain’s information, GBTC transferred 750 Bitcoin to someone on April 23. At the same time, Fidelity and other seven ETF providers acquired 1,513 Bitcoin for their clients. These Bitcoin ETFs allow investors to buy shares that represent actual Bitcoin holdings. These coins can be obtained from various sources such as secondary markets like Binance, over-the-counter (OTC) platforms, or directly from miners.

BTC prices remain muted and capped below $68,000, representing April 13 highs.

In simpler terms, an uptrend is established when there’s a significant increase in trading volume above the liquidation level, leading to price gains that counteract previous declines.

In the daily chart of BTCUSDT, the bullish trend can only be confirmed if they manage to surpass previous all-time highs. Preferably, this breakout should come with a significant increase in trading volume, signaling strong buyer interest.

Read More

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- Ford Recalls 2025: Which Models Are Affected by the Recall?

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Like RRR, Animal and more, is Prabhas’ The Raja Saab also getting 3-hour runtime?

- Best Items to Spend Sovereign Sigils on in Elden Ring Nightreign

2024-04-25 03:04