As a seasoned researcher and long-time observer of the cryptocurrency market, I find the predictions made by Erik Voorhees, the CEO of ShapeShift and an early Bitcoin investor, particularly intriguing. His assertion that Bitcoin could outshine gold, the US dollar, and other major assets in the near future is not only bold but also plausible, considering the unique nature of Bitcoin as a finite resource.

An OG Bitcoin advocate made a bold forecast that demand for Bitcoin will increase rapidly in the near future, bolstering the estimates of some crypto experts that BTC is on a trajectory to hit the six-figure level.

The term “OG,” which can stand for “original gangster” or “original gangsta,” is an informal way to refer to someone who is particularly impressive, one-of-a-kind, or old-fashioned in a good way.

The BTC supporter also suggested that the coin is moving in the direction that will allow the crypto to outshine gold, the US dollar, and other major assets soon.

Rising Over Gold, Greenback

Erik Voorhees, who was among Bitcoin’s earliest investors and is currently CEO of ShapeShift, predicts that Bitcoin will outperform major assets like gold, the U.S. dollar, and oil in the coming months. According to him, Bitcoin has a significant capacity to surpass these traditional assets.

As the need for gold increases, additional amounts of gold are mined.

When demand for Bitcoin rises…

— Erik Voorhees (@ErikVoorhees) October 29, 2024

In a recent post, Voorhees explained that an increase in gold’s popularity leads to a boost in gold production, and similarly, an increase in oil demand results in more oil extraction. He further noted that an escalation in the need for US dollars would not deplete the supply of these assets over the next few years because more dollars can be printed.

Contrarily, the innovator behind Venice.AI suggested that things might differ with Bitcoin when its demand surges. This is due to the fact that more Bitcoin cannot be generated as Satoshi Nakamoto, Bitcoin’s creator, designed the cryptocurrency to cap its total supply at 21 million coins.

Bitcoin-Gold Relationship

Previously, fellow Bitcoin enthusiast Max Keiser proposed a correlation between the cost of gold and Bitcoin’s value, suggesting that Bitcoin’s price might surge due to the influence of gold prices.

Keiser elaborated that an increment of $1 in the price of gold typically results in a surge of around $20 in the value of Bitcoin. Given that gold has recently reached a new peak, it’s plausible that the price of Bitcoin will also trend upward accordingly.

Expecting A Bitcoin Surge

Voorhees advises the cryptocurrency community to closely monitor Bitcoin as he anticipates all its components, including its price, will trend upward.

According to the ShapeShift executive, it’s this unique characteristic of Bitcoin that will likely drive a rapid increase in its popularity.

Over the last few days, numerous cryptocurrency analysts have predicted that Bitcoin’s value will surge past six figures.

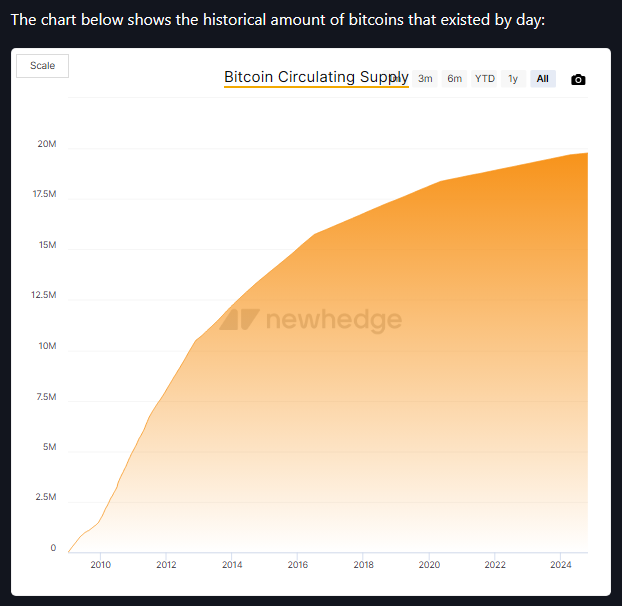

19 Million BTC Mined

The number of Bitcoins (BTC) currently circulating in the cryptocurrency market stands at a record high of over 19 million, according to recent reports.

Experts assert that a significant number of these cryptocurrency coins have been kept in “offline wallets” for extended periods. They further suggest that some of these Bitcoins might be held by Bitcoin Exchange-Traded Funds (ETFs).

Approximately 5% of all existing Bitcoins are held by Bitcoin ETFs, which collectively have a roughly estimated worth of $72.545 billion.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Overwatch 2 Season 17 start date and time

2024-11-01 05:10