As a seasoned researcher with over a decade of experience in the financial markets, I have seen my fair share of bull and bear runs. However, the recent analysis by Jelle on Bitcoin’s potential price surge to $90,000 has caught my attention. Given his track record of accurate predictions, I find myself leaning towards a bullish outlook for the flagship crypto in the coming months.

Crypto analyst Jelle has highlighted a bullish pattern on the Bitcoin chart, which he predicts could send its price as high as $90,000. He also provided a timeline for when this parabolic rally could begin. This comes amid a bullish outlook for the flagship crypto following the Fed rate cuts.

Descending Broadening Wedge Could Send Bitcoin To $90,000

In a recent post on X, Jelle pointed out a downward-sloping broadening wedge pattern that appeared on Bitcoin’s price chart. He asserted that this pattern predicts a potential price target of $90,000 and forecasted that the breakout towards this target might commence in October. The analyst also hinted that the final quarter of this year could be an exciting time for Bitcoin.

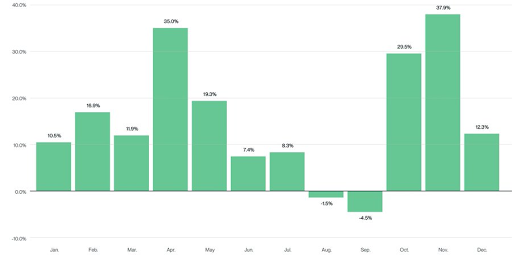

It’s quite likely that due to historical trends, Bitcoin might generate substantial gains during October, November, and December of this year. In the past two times Bitcoin underwent a halving event, it has consistently posted positive monthly returns in the fourth quarter. Furthermore, the fourth quarter is typically when Bitcoin achieves its highest annual returns.

In another post, Jelle emphasized significant price thresholds Bitcoin must surpass for a chance at reaching a fresh all-time high (ATH), which he predicts could be around $90,000. He suggested that first reaching $62,000 would be a strong step forward for Bitcoin, and once it exceeds $65,000, there might not be any obstacles left on the path to a new ATH.

Currently, Bitcoin’s all-time high (ATH) is at approximately $73,000, a price point last seen in March of this year. Nevertheless, analysts such as Jelle maintain that this value is significantly lower than Bitcoin’s peak during the current market surge. Moreover, there’s a chance that Bitcoin could surpass $100,000 during this bull run.

According to Standard Chartered’s forecast, Bitcoin might achieve a certain price point by the end of this year. Moreover, if Donald Trump wins the election, Bitcoin could potentially surge to a staggering $150,000, according to the bank’s predictions.

BTC’s Bull Case Just Got Stronger

Jelle also mentioned that Bitcoin’s bull case grew stronger following the Fed rate cuts. The US Federal Reserve announced a 50 basis point (bps) interest rate cut on September 18, a move widely regarded as bullish for the flagship crypto. The crypto analyst mentioned that expansionary policy is on the horizon with looser monetary back in place.

As more investors pour funds into riskier assets such as Bitcoin, there’s an anticipation that its price will significantly increase, breaking its recent period of price stability due to low investor interest. The return of bullish sentiment, possibly prompted by the interest rate cuts, might indicate a potential upward trend for Bitcoin.

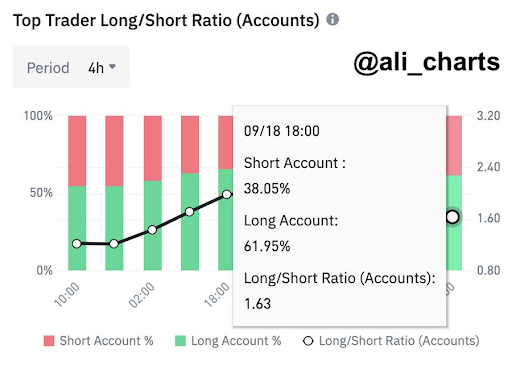

crypto analyst Ali Martinez has disclosed that around two-thirds (61.95%) of prominent traders on Binance are currently betting on the rise of the primary cryptocurrency. Previously, these traders had a negative outlook on Bitcoin, as reported by NewsBTC, with 51.41% of them choosing to bet against Bitcoin’s price increase.

Currently, as I’m typing this, Bitcoin is being exchanged for approximately $61,900, marking an increase of more than 2% in the past 24 hours, based on information from CoinMarketCap.

Read More

- Odin Valhalla Rising Codes (April 2025)

- Gold Rate Forecast

- King God Castle Unit Tier List (November 2024)

- POPCAT PREDICTION. POPCAT cryptocurrency

- Jurassic World Rebirth Trailer’s Titanosaur Dinosaur Explained

- Who Is Carrie Preston’s Husband? Michael Emerson’s Job & Relationship History

- Weak Hero Class 2 Ending: Baek-Jin’s Fate and Shocking Death Explained

- Severance Season 2: What Do Salt’s Neck & The Goats Mean?

- Dead By Daylight May 2025 Roadmap Revealed: New Survivor, FNAF PTB, Anniversary Livestream & More!

- First Monster Hunter Wilds updates fix a progress-blocking bug, but not the dodgy PC performance

2024-09-19 13:16