As a seasoned analyst with over two decades of experience in traditional and digital markets, I’ve seen my fair share of market cycles. The current Bitcoin rally reminds me of the Dot-com bubble days, where the excitement was palpable, and every coin seemed like the next big thing.

Bitcoin bounced back robustly following a 6% drop from its peak of approximately $69,500 on Monday, landing around the $65,000 mark. Even with this recent setback, Bitcoin continues to exhibit a positive trend that has been ongoing since early September. This rebound underscores its strength, contributing to the maintenance of a bullish market structure.

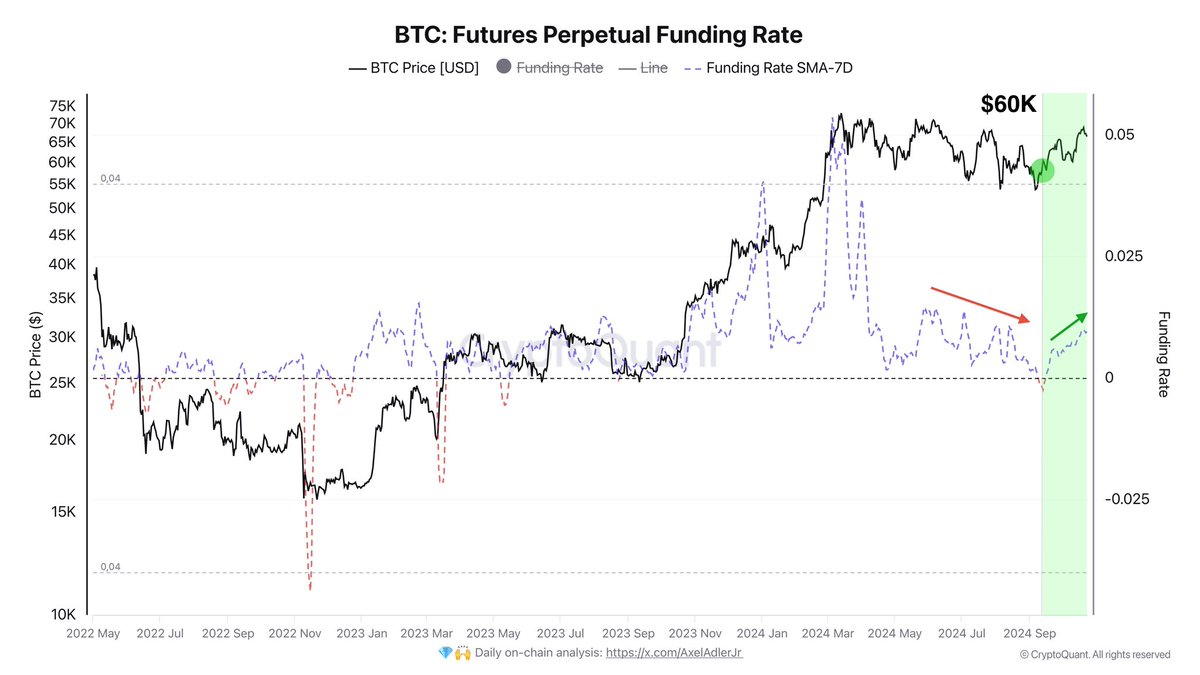

Information from CryptoQuant suggests a progressive rise in the typical funding rate since September, implying that optimistic feelings are growing stronger among traders, as they are increasingly active within the market.

Over the next fortnight, I find myself on the edge of my seat, as Bitcoin inches closer to its previous all-time high in March. Every price fluctuation is like a heartbeat, pulsing with anticipation. Analysts and fellow investors are tracking these movements closely, as we collectively watch Bitcoin build momentum to break through those crucial resistance levels.

Should the bullish momentum persist, it’s possible that Bitcoin may experience another substantial surge, potentially reaching new peak values in the near future. Yet, if it fails to maintain its current positions, there might be a resurgence of market instability.

Bitcoin Showing Strength

Although it has experienced a temporary drop, Bitcoin continues to hold its ground above significant support zones, indicating a generally positive trend. Experts and investors are paying close attention to the market fluctuations, hoping for evidence that this period is just a consolidation phase, preceding an additional surge upward.

According to CryptoQuant analyst Axel Adler’s recent findings, the BTC futures perpetual funding rate has been increasing consistently since Bitcoin surpassed $60,000, suggesting a significant increase in bullish investors entering the market. As the price continues to climb, optimism among these investors appears to be on the rise.

Adler proposes that the positive trend in Bitcoin (BTC) might persist as long as the funding rate keeps rising, signifying that BTC is currently in a stable period of consolidation. Yet, this doesn’t ensure an instant breakout. It’s possible that Bitcoin could remain in a holding pattern over the coming days. This sideways price movement may be crucial for enhancing liquidity, giving the market time to accumulate power for a more substantial move later on.

As the general market outlook continues to be hopeful, particularly due to the growing bullish trends, it’s essential for investors to brace themselves for possible market swings. The upcoming price movements might trend up or down, but the consistent support above crucial levels offers a promising sign for those anticipating more Bitcoin price growth.

BTC Holding Above Key Demand

Bitcoin is maintaining its position above $66,000 following a supportive base around $65,000. At present, it’s trading at approximately $67,100, suggesting a period of stability or consolidation. A significant move beyond the important $70,000 level might not happen immediately.

To keep the upward trend going, the price needs to stay above $65,000 or find a strong support at approximately $64,300. This level is significant because it’s where the 4-hour Exponential Moving Average (EMA) and Moving Average (MA) lines intersect.

If Bitcoin doesn’t sustain its current support levels, it might lead to a more significant downturn, possibly pushing the price back to areas of lower interest near $60,000. Conversely, if Bitcoin surpasses and holds above $70,000 in the upcoming period, this could ignite a robust surge aimed at breaking previous highs.

Keeping a close eye on critical support and resistance points, the coming days hold significant importance as they could reveal Bitcoin’s potential trend.

Read More

- POPCAT/USD

- Who Is Finn Balor’s Wife? Vero Rodriguez’s Job & Relationship History

- The White Lotus’ Aimee Lou Wood’s ‘Teeth’ Comments Explained

- DYM/USD

- Coachella 2025 Lineup: Which Artists Are Performing?

- Who Is Kid Omni-Man in Invincible Season 3? Oliver Grayson’s Powers Explained

- Beauty in Black Part 2 Trailer Previews Return of Tyler Perry Netflix Show

- Kingdom Come Deliverance 2: How To Clean Your Horse

- Thalapathy Vijay’s Jana Nayagan: Is the movie an attack on any political leader or party? H Vinoth clarifies

- Clare Crawley Subtly Reacts to Matt James & Rachael Kirkconnell Split

2024-10-24 17:46