As an experienced analyst, I have closely monitored the cryptocurrency market, particularly Bitcoin, for several years. Based on my research and analysis of current trends, I believe that the direction Bitcoin takes next remains uncertain.

As a crypto investor, I’m closely watching Bitcoin‘s behavior, which currently holds the title as the most widely-used cryptocurrency. The anticipation is high that we’re on the brink of a significant price shift. However, pinpointing the exact direction – whether it’s an exciting bull run or a more prolonged period of consolidation – continues to elude even the most seasoned analysts.

Reaching New Highs: Euphoric Bulls On The Horizon?

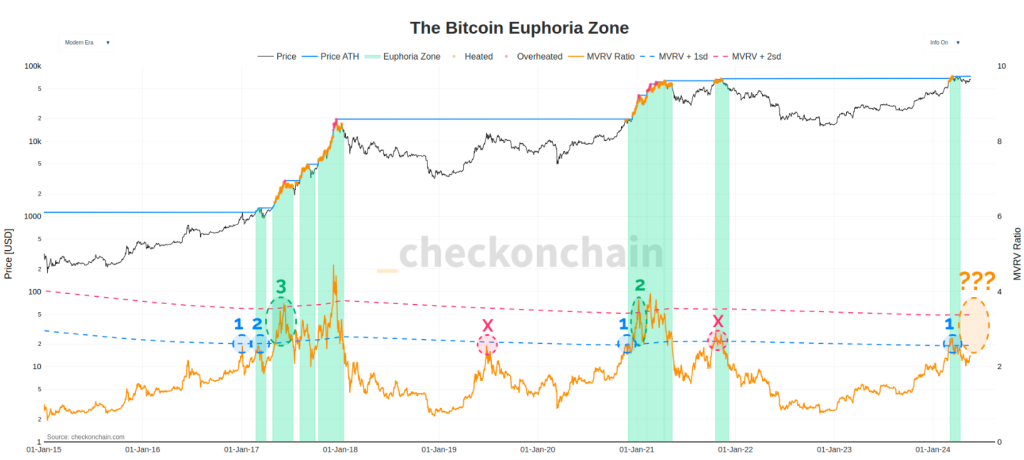

As a researcher studying the cryptocurrency market, I’ve come across an intriguing perspective put forth by well-known analyst Checkmate. His “Euphoric Bull” theory posits that reaching a new all-time high could be a pivotal moment in market sentiment. This bullish phase would signify a substantial increase in bullish momentum, which could result in a more pronounced price surge.

The theory behind Checkmate’s analysis relies on the Market Value to Realized Value (MVRV) ratio for Bitcoin. This metric calculates the current market value of all Bitcoins against the total amount paid to acquire them. Historically, when this ratio surpasses one standard deviation above its average, it has frequently indicated the start of a “Euphoric Bull” phase in the market.

As a researcher studying the behavior of the Bitcoin market, I have observed that reaching a new All-Time High (ATH) can signify a shift in sentiment from an Enthusiastic Bull phase to an Euphoric Bull phase.

As an analyst, I’ve noticed that when the MVRV ratio surpasses one standard deviation, there’s a tendency for the price to rise. However, this isn’t always the case as we don’t usually see a clear upward trend on the initial try.

Bull…Crab…Bull…

A…— _Checkmate (@_Checkmatey_) May 21, 2024

Bitcoin may not adhere to the expected pattern right away according to Checkmate’s observation. The cryptocurrency market could display hesitant movements initially, causing Bitcoin to make several attempts to surpass the significant MVRV threshold before achieving a clear breakthrough.

The past few weeks have seen Bitcoin’s price trend upwards, reaching a peak of $71,950 – a six-week high. Since then, there’s been a slight dip, but Bitcoin remains steadily above the $70,000 mark. Daily trading volumes remain robust, indicating potential for further price action. This pattern hints at a possible pause before Bitcoin makes its next major move, leaving both traders and investors on edge as they anticipate the market’s next big shift.

Breakout Or Consolidation? A Bullish Dilemma

As a dedicated crypto investor, I’ve been closely following the market discussions, and Rekt Capital’s insights have caught my attention. According to him, reaching a weekly close above $71,500 could serve as a pivotal moment in Bitcoin’s price action. If this level is surpassed, it might ignite a robust bullish wave, pushing the cryptocurrency towards an impressive uptrend.

I acknowledge the consideration put forth by Rekt Capital regarding an extended period of Bitcoin consolidation. Historically, I’ve observed that Bitcoin tends to consolidate within its re-accumulation range for several weeks before undergoing a significant breakout. This prolonged consolidation, according to my analysis, would bring Bitcoin closer in line with historical halving cycles. These cycles have been preceded by substantial bull runs in the past.

Bitcoin Price Prediction

At present, some cryptocurrency analysts anticipate a remarkable surge for Bitcoin by 2025, with estimates reaching an astounding $168,459. This forecast is driven by historical price patterns and the upcoming Bitcoin halving cycle. The bullish market sentiment, as indicated by technical analysis, is further fortified by extreme investor greed.

A dose of realism is essential given the significant gap between the projected maximum and minimum values ($69,971). Bitcoin’s volatile nature, as seen in its 4.47% price fluctuations within a month, adds complexity to the situation. The high level of investor enthusiasm indicates confidence but could also signal an impending market correction.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- The First Descendant fans can now sign up to play Season 3 before everyone else

2024-05-23 10:34