Recent data from the Bitcoin blockchain reveals that newly emerged large investors, or “newcomer whales,” now control nearly double the amount of bitcoin held by long-term investors, or “veteran whales.” Let’s explore some possible reasons for this change in market dynamics.

Bitcoin Newbie Whale Holdings Have Been Rapidly Growing Recently

Ki Young Ju, the founder and CEO of CryptoQuant, recently shared insights on X’s latest blog post regarding the comparison between the current whale holdings and those from the past in the present market scenario.

An on-chain metric we’ll focus on is called “Realized Capital.” In simpler terms, this measure records the overall investment made by Bitcoin holders when they bought their coins.

This capitalization method diverges from the standard market cap calculation, which determines the overall worth solely based on current market prices held by all shareholders.

When discussing the present subject, it’s not important to consider the total market’s Realized Cap. Instead, focus on the Realized Caps of two distinct groups: the short-term holding whales and the long-term holding whales.

In simpler terms, whales refer to individuals or entities possessing over 1,000 Bitcoins (approximately $66.6 million) in their cryptocurrency wallets. Given their substantial investment, whales significantly impact the Bitcoin market due to their capacity to influence price trends.

Whales in the cryptocurrency market can be classified into two groups based on how long they have held their coins. The first group, referred to as short-term holders (STH), are those who bought their coins within the last 155 days. On the other hand, long-term holders (LTH) are the whales who have owned their coins for more than 155 days.

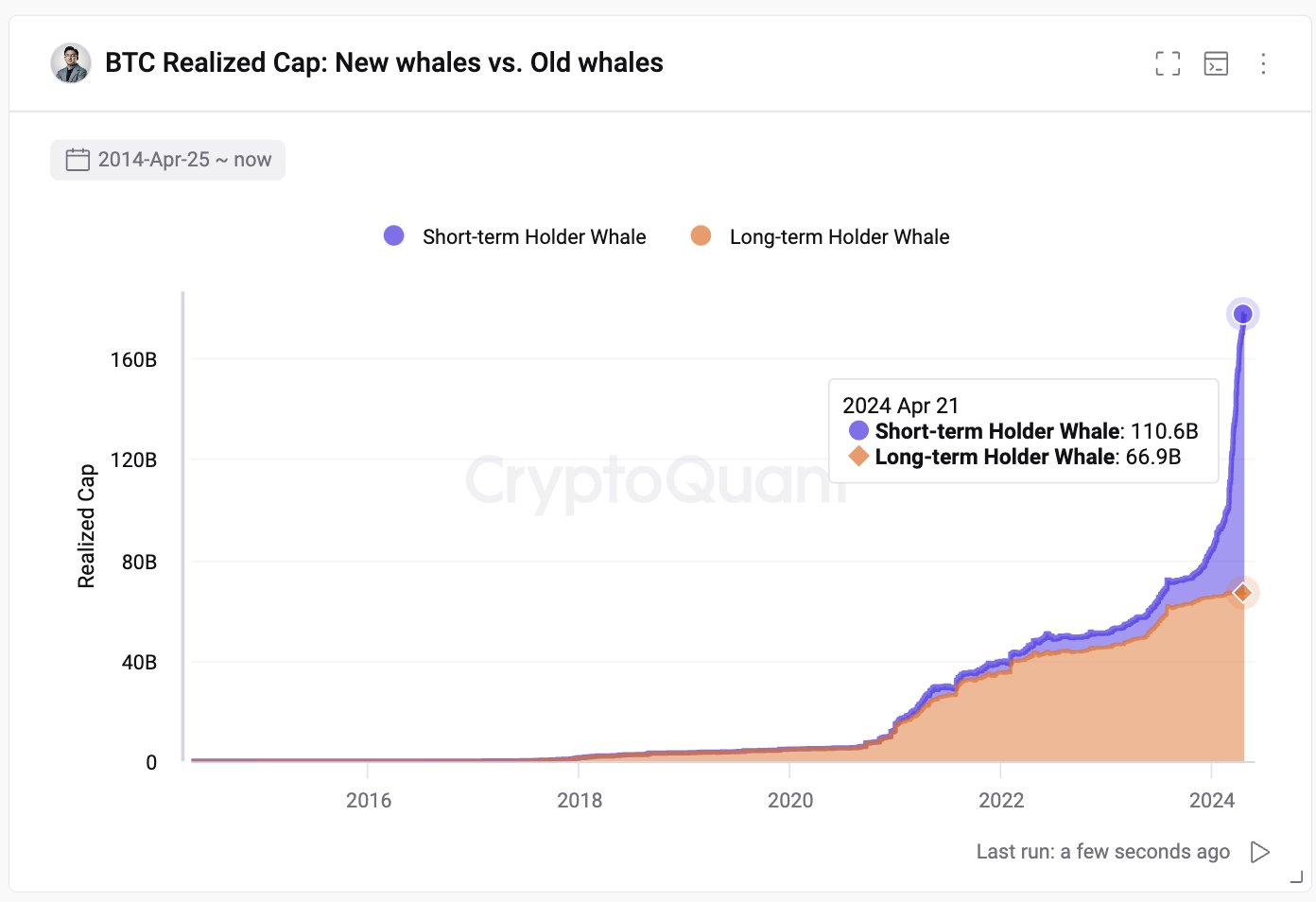

Ju has provided us with a chart showing the difference in Realized Cap for these two groups of Bitcoin whales.

Based on the graph above, it’s clear that historically, the Realized Cap of STH (Small-to-Medium) and LTH (Large-to-Hold) whales haven’t varied much. However, this trend seems to have shifted more recently.

For the new whale population this year, the metric has shown significant advancement and impressive growth, surpassing the $110.6 billion milestone. As a result, the collective purchase price for STH whales’ coins amounts to an astonishing $110.6 billion.

The total wealth of the LTH (Large Holder) whales hovers around $66.9 billion as usual, whereas the Realized Cap of the other group has significantly increased, creating a large disparity between the two.

Why has this new trend suddenly appeared, you ask? Previously discussed, the STH threshold is set at 155 days. This implies that the Realized Cap of the STH whales represents the overall value of their purchases during the past five months.

Over the last five months, a notable occurrence has arisen, absent in previous phases: the sanctioning of spot exchange-traded funds (ETFs).

An exchange-traded fund (ETF) focused on specific spots offers a alternative investment avenue for traditional investors towards assets, including Bitcoin (BTC). The surge of interest in these funds has significantly increased demand for BTC. If the holding period of these ETFs is less than 155 days, they will be classified as large Bitcoin holders, often referred to as “whales” in the market.

In simpler terms, the cost of buying Bitcoins this year has gone up due to its price rise, leading to an increase in the Realized Capitalization, which reflects actual investment into Bitcoin, making it grow even more.

BTC Price

Bitcoin is now trading at $66,400 after witnessing a surge of more than 6% over the past week.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-04-24 20:11