So, here we are, folks! Market intelligence firm Messari has just dropped a bombshell of an analysis on the NEAR Protocol’s performance in Q4 2024. And let me tell you, it’s like watching a soap opera—full of drama, suspense, and a few too many plot twists. Despite the crypto market being as stable as a three-legged dog on roller skates, NEAR has managed to keep its head above water. Or at least, it’s trying really hard.

Drop In Market Cap Ranking But Resilience Through Increased Activity

Picture this: NEAR Protocol starts the quarter like a kid on Christmas morning, reaching a token price high of about $8.19 in December. But just like that one relative who shows up uninvited, it quickly retraced to around $4.91 by the end of the quarter. Talk about a party crasher!

And what’s this? A significant drop in market cap to approximately $5.73 billion? That’s a 2.09% decrease quarter-over-quarter (QoQ). NEAR has now dropped ten spots in the rankings, sitting comfortably at 21st overall. It’s like being the last kid picked for dodgeball—nobody wants you, but you’re still there, awkwardly waving.

But wait! Despite the market’s mood swings, NEAR’s revenue from network transaction fees saw a substantial increase. It grew to about $2.11 million, which is a 26.81% QoQ rise. Who knew that heightened transaction volumes and decentralized exchange (DEX) activity could be so lucrative? It’s like finding a $20 bill in your winter coat pocket!

The average transaction fee during the quarter was roughly $0.0031, a 15.91% increase from the previous quarter. I mean, who doesn’t love paying more for the same service? It’s like going to a restaurant and being charged extra for the breadsticks!

Now, let’s talk about the NEAR token. It’s like the Swiss Army knife of the ecosystem—essential for staking, transaction fees, and storage fees. The protocol has a flexible supply model with an annual inflation rate of 5%. Of the inflationary rewards, 90% go to validators, while the remaining 10% supports the protocol’s treasury. So, if you’re keeping score, that’s 90% for the cool kids and 10% for the rest of us.

As of the end of Q4, about 95.12% of NEAR’s total supply was in circulation, with around 49.08% actively staked. The annualized nominal yield from staking was reported at around 8.95%, with a real yield of 4.55%. It’s like a savings account, but with a little more pizzazz!

NEAR enjoyed a surge in address activity and transaction volume during Q4. The average daily active returning addresses rose by 15.82% QoQ, reaching 3.55 million. Meanwhile, the average daily new addresses surged by 29.05% to 361,046. It’s like a party where everyone suddenly decides to show up!

However, not all is rosy in the NEAR garden. Developer activity took a hit, with weekly active core developers decreasing by 13.95% to 159 and ecosystem developers falling by 30.34% to 129. It’s like watching a band lose its lead singer—things just aren’t the same anymore.

NEAR Balances Market Setbacks With Promising Innovations

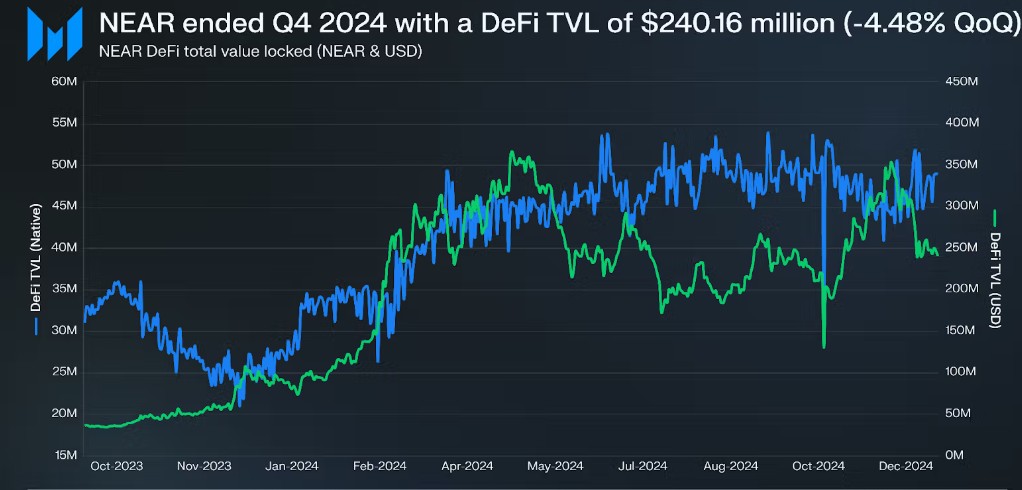

NEAR’s DeFi total value locked (TVL) concluded Q4 at approximately $240.16 million, reflecting a 4.48% decline from the previous quarter. The Liquid Staking TVL also experienced a decrease of around 10.32% QoQ, settling at about $250.81 million. It’s like watching your favorite TV show get canceled—just when it was getting good!

Notably, the LiNEAR Protocol’s TVL was approximately $132.41 million, down 8.77%, while Meta Pool’s TVL declined by 11.78% to around $111.70 million. It’s a tough crowd out there!

On

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Delta Force Redeem Codes (January 2025)

- Gold Rate Forecast

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Overwatch 2 Season 17 start date and time

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

2025-02-25 10:17