As an analyst with over two decades of experience in the financial markets, I have seen my fair share of market fluctuations and trends. However, the recent performance of RUNE, the native token of THORChain, has piqued my interest. Despite the broader crypto market’s recovery, RUNE remains flat, down nearly 60% from its May highs.

In simpler terms, the cryptocurrency known as RUNE, which is used on the multi-chain decentralized exchange called THORChain, is experiencing a drop in value. Compared to its peak in May, it has fallen approximately 60%. Despite the overall crypto market rebounding, RUNE’s price remains unchanged.

Despite RUNE appearing lifeless right now, there’s optimism that its price could surge in the near future, largely due to strong underlying factors and the dedicated work being done by the development team.

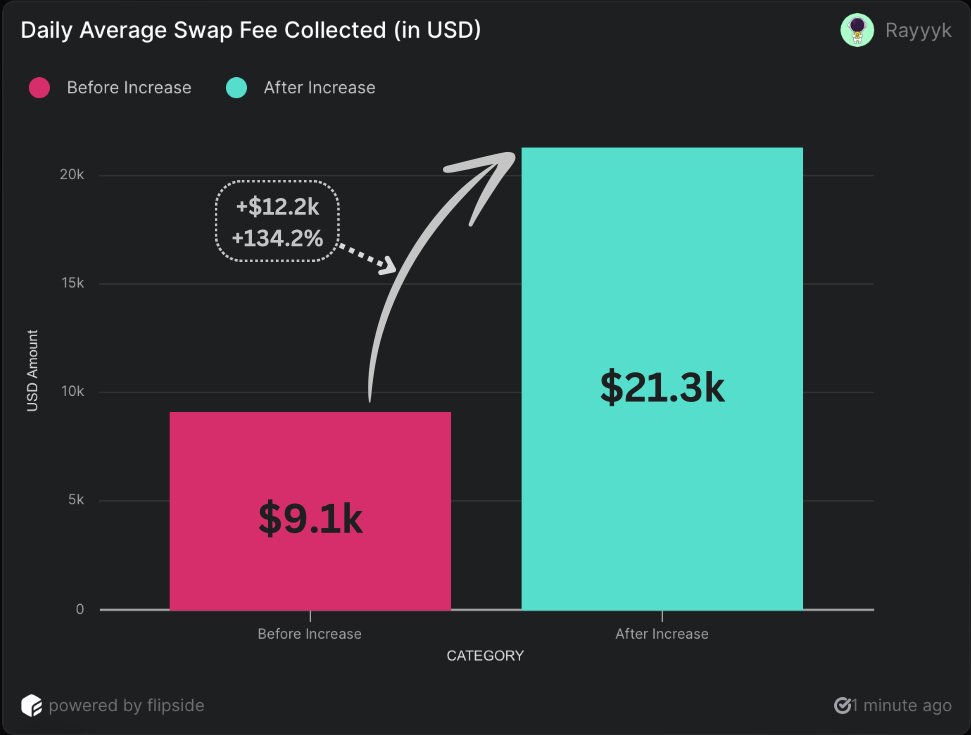

THORChain Revenue Rising After Swap Fee Increment

On X’s latest post, an analyst pointed out that due to the community’s recent decision to raise the minimum swap fee on their DEX, THORChain has experienced a nearly 100% surge in its earnings over the past two days.

Lately, THORChain’s node operators have agreed and executed a plan to boost the fee for swaps in layer-1 native trades to 0.05%. This seemingly small adjustment, as experts point out, has significantly enhanced THORChain’s protocol, nearly doubling its daily income.

It’s intriguing to point out that unlike most protocols where increased fees typically worsen user experience, this was not the case with THORChain. As the swap fee grew, users didn’t seem to be discouraged. Instead, the swap volume remained consistent while the average fee per transaction shot up.

With transaction fees climbing higher, the weekly liquidity fees on THORChain now surpass the block reward, marking a significant achievement for this decentralized exchange (DEX). It’s worth noting that this substantial change in revenue generation could significantly increase the rate at which RUNE tokens are burned once the community proposal ADR 17, planned for implementation in the coming days, is enacted.

As RUNE tokens are removed from circulation, their scarcity increases, causing prices to climb higher. When ADR 17 is introduced, the protocol will buy and destroy $1 worth of RUNE for every $10,000 in revenue generated. Therefore, an increase in revenue resulting from the swap fee hike implies that more RUNE tokens will be eliminated.

Impact Of RUNEPool On Liquidity: Will RUNE Break $5?

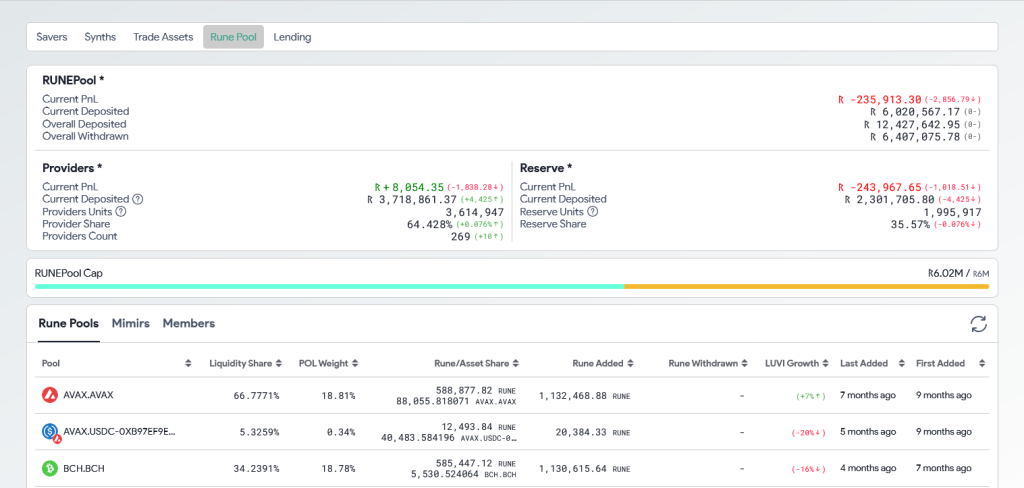

Around the end of July, THORChain unveiled RUNEPool as an additional tool for motivating liquidity contributions. This allows users to conveniently deposit their RUNE tokens via either the THORSwap or THORWallet platforms into a collection of various tokens pooled together through this feature.

By doing so, they aid in minimizing potential temporary losses and enhancing liquidity. As of August 9, a total of 3.7 million RUNE has been contributed by 265 liquidity suppliers to the RUNEPool.

Regardless of recent shifts, RUNE continues to face significant downward demand, but it’s holding steady at the moment. After the bearish breakout in early August that dropped prices below July’s lows, the token has had a tough time. Yet, if the market recovers and pushes spot rates above July highs of approximately $5, RUNE could potentially soar past $7.5.

Read More

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- List of iOS 26 iPhones: Which iPhones Are Supported?

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Delta Force Redeem Codes (January 2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

2024-08-10 03:40