In the grand theater of the financial world, Bitcoin once again took the spotlight, as if it were the lead actor in a tragicomedy. The infamous Mt. Gox, a name that echoes like a ghost from the past, decided to stir the pot by moving a staggering 12,000 BTC—worth over a billion dollars—into the abyss of an unknown wallet. This spectacle unfolded while Bitcoin was strutting around at a price of about $92,000, a figure that has sent ripples of uncertainty through the market like a stone tossed into a still pond.

Big Bitcoin Moves: A Comedy of Errors?

Ah, Mt. Gox! The once-mighty exchange that crumbled in 2014 under the weight of its own misfortunes, now finds itself in the limelight again. For years, it has been playing the long game of repaying its creditors, like a tortoise in a race against time. The recent transfer of 12,000 BTC is like a plot twist in a novel that no one asked to read. Some folks are whispering that this could be a sign of long-awaited repayments, while others are wringing their hands, fearing a market meltdown if a sell-off occurs. It’s like waiting for a pot to boil—will it bubble over or simmer down?

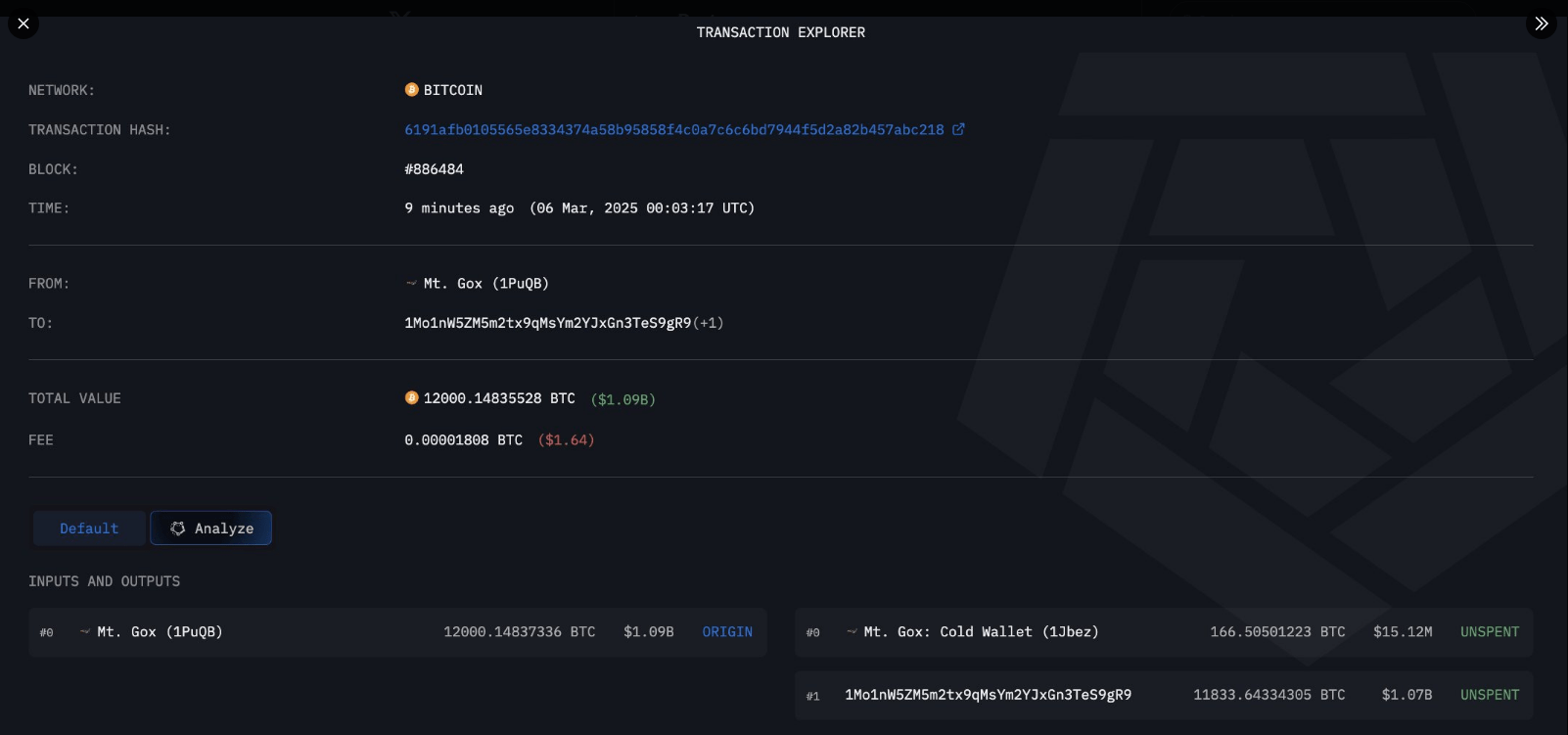

On March 6, the ever-watchful Arkham Intelligence reported that a wallet linked to Mt. Gox, whimsically named “1PuQB,” decided to play Santa Claus, moving 12,000 BTC. Of that, a whopping 11,834 BTC (over $1 billion) was sent to the mysterious “1Mo1n,” while a mere 166.5 BTC ($15 million) was tucked away in Mt. Gox’s cold wallet, “1Jbez.”

ARKHAM ALERT: MT GOX MOVING $1B $BTC

— Arkham (@arkham) March 6, 2025

This marks the first major transaction since January, when smaller amounts were shuffled around like a deck of cards. According to Arkham, Mt. Gox still clutches approximately 36,080 BTC, valued at a cool $3.26 billion. Talk about a hoarder!

Such a hefty movement of Bitcoin has historically sent the market into a tizzy. Investors are watching like hawks, waiting to see if this is a prelude to a massive sell-off or a benevolent redistribution to creditors. While Bitcoin’s recent surge suggests a strong appetite for the digital gold, this latest maneuver—if it turns out to be a sell—could send prices tumbling faster than a cat off a hot tin roof.

Bitcoin Holds Steady: A Rock in a Stormy Sea

//s3.tradingview.com/snapshots/w/WQeDDPTa.png”/>

Meanwhile, the creditors of Mt. Gox are left in a state of limbo, waiting for their long-overdue payback. The process has been slower than molasses in January, and while this latest transaction hints at some movement, the timeline for when they’ll see their Bitcoin remains as murky as a foggy morning.

Many are crossing their fingers for a smooth restitution process, hoping it won’t send the market into a tailspin. But until the powers that be make an official announcement, speculation will run rampant. The crypto community is on high alert, like a cat watching a mouse hole, waiting for any sign of what’s next.

As the dust settles, any news regarding Mt. Gox’s next steps could send shockwaves through the market. Investors and analysts are poised, ready to pounce on any signs of heavy selling activity. It’s a waiting game, and in the world of Bitcoin, patience is a virtue—unless, of course, you’re a creditor.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- Delta Force Redeem Codes (January 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- CNY RUB PREDICTION

- Best Japanese BL Dramas to Watch

- Overwatch 2 Season 17 start date and time

- Gold Rate Forecast

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

2025-03-06 23:45