As a seasoned analyst with over two decades of experience in global financial markets, I’ve witnessed countless ups and downs, bubbles, and crashes. Yet, nothing quite compares to the intrigue and resilience of the cryptocurrency market, especially Bitcoin (BTC).

After over a decade of suspense, creditors of the defunct Mt. Gox Bitcoin (BTC) exchange have finally begun receiving long-awaited payouts this month. Data from research firm Glassnode shows that as of Tuesday, 59,000 of Mt. Gox’s 142,000 BTC had already been distributed to creditors via the Kraken and Bitstamp exchanges, with another 79,600 BTC to follow soon.

Muted Selling Pressure Expected?

As per a recent analysis by Glassnode, approximately 141,686 Bitcoin have been recovered so far, with roughly 59,000 Bitcoin already distributed to creditors. The rest of the recovered Bitcoin (around 82,686) is yet to be distributed.

Kraken and Bitstamp have been assigned as part of a group of five exchanges tasked with overseeing and distributing these funds. Specifically, Kraken has been given 49,000 BTC, while Bitstamp has received an initial allocation of 10,000 BTC.

It’s worth mentioning that these distributions exceed many notable transactions in the cryptocurrency sector, such as inflows into crypto ETFs, mining distribution, and the intense selling pressure faced by the German government from June to July.

In a surprising turn of events during the bankruptcy proceedings, creditors chose to accept Bitcoin instead of traditional fiat currency. This alternative method of payment is a recent addition to Japanese bankruptcy law, implying that these creditors are actively involved in the Bitcoin market, demonstrating their continued interest even amidst the complex legal procedures.

Engaging actively suggests that only some of the circulating bitcoins might be offered for sale, as suggested by Glassnode’s assessment. This could signal a long-term holding approach among investors, which may reinforce BTC‘s value rather than causing additional price drops for the leading cryptocurrency in the market.

Furthermore, examining the cumulative volume delta (CVD) trend on Kraken and Bitstamp reveals a modest increase in selling activity, indicating that creditors might prefer to keep their Bitcoin for a longer period.

Long-Term Bitcoin Holders Pile In

In addition, Bitcoin’s price surge over the past month can be attributed to increased demand from long-term investors. As per market analyst Ali Martinez, these investors have been actively purchasing Bitcoin, accumulating approximately 110,000 coins since hitting a 6-month low of $53,500 on July 5, which represents a nearly 25% rebound.

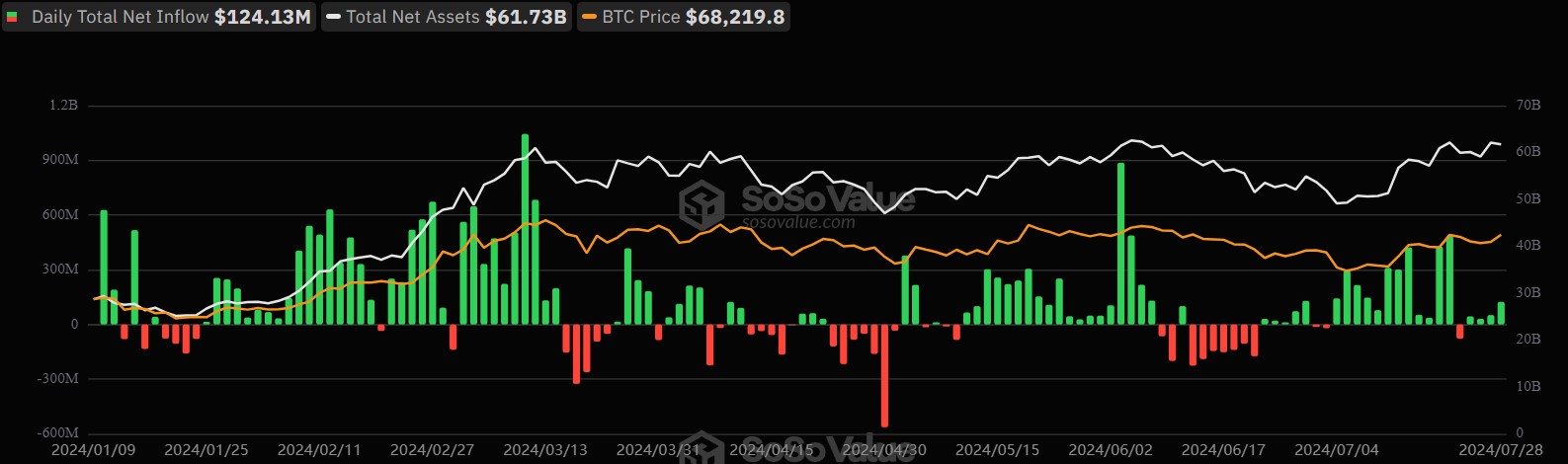

As an analyst, I’ve noticed that the Bitcoin ETF sector has been benefiting from the price uptick of Bitcoin over the past month. The most recent data indicates a continued influx of investments into the U.S. regulated Bitcoin ETF market.

Based on SoSo Value data analysis, U.S.-listed Bitcoin ETFs experienced a collective inflow of approximately $124 million on Monday. However, it’s worth noting that Grayscale’s GBTC ETF recorded outflows amounting to around $54 million. Among these ETFs, BlackRock’s IBIT ETF led the way with inflows totaling a substantial $206 million on that day.

Over the last few days, various factors have led to Bitcoin’s price stabilizing within the range of $65,000 and $68,000, and there is anticipation for a possible attempt to re-achieve its record high of $73,500, a level last seen in March this year.

At present, the most significant digital currency available for trade is valued at approximately $66,000. Over the last day, its value has decreased by 2.5%, and during the previous week, it has declined by 1.5%.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Delta Force Redeem Codes (January 2025)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-07-31 01:35