As a seasoned crypto investor with over a decade of experience in the industry, I have witnessed my fair share of ups and downs in the market. The recent developments regarding the distribution of funds from the defunct Mt. Gox exchange to Bitstamp and Kraken have left me both intrigued and cautious.

Following a ten-year delay, creditors of the collapsed Mt. Gox Bitcoin exchange are now receiving their due Bitcoin (BTC) and Bitcoin cash (BCH) through Kraken and Bitstamp as the intermediaries.

The confirmation of deposits from exchanges led to a significant decrease in Bitcoin’s value in the cryptocurrency market, resulting in approximately a 4% price drop.

Mt. Gox Distributes Millions To Bitstamp And Kraken

Early on a Tuesday morning, approximately $2.85 billion worth of Bitcoin was moved from wallet addresses associated with Mt. Gox.

Based on information from blockchain analysis company Arkham’s on-chain data, it appears that Mt. Gox transferred approximately $2.85 billion in Bitcoin to new wallets with the main intention of sending 5,110 BTC, which is equal to around $340.1 million, to four separate Bitstamp accounts.

Bitstamp is among the five collaborating platforms working with the Mt. Gox Trustee to process refunds for the exchange’s creditors, which include Kraken and the Japanese exchanges Bitbank and SBI VC Trade. Noteworthy, Mt. Gox continues to hold 85,234 BTC, valued at roughly $5.70 billion.

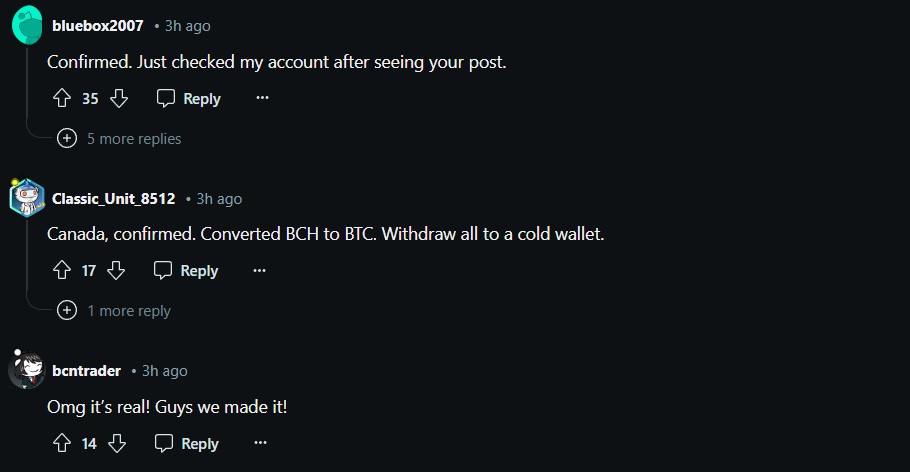

In the Reddit forum, certain members have reportedly received their Bitcoin refunds distributed by Kraken after Mt. Gox’s insolvency. Contrastingly, those using Bitstamp for their transactions have shared that they have not received their corresponding allocations as of yet.

The Kraken platform reportedly received approximately $3 billion, equivalent to 48,641 Bitcoin, from the Mt. Gox trustee earlier on. It’s predicted that this entire sum will be transferred into individual user accounts within a span of 7-14 days.

Critical Support Zones For Bitcoin

After Mt. Gox’s payouts, CryptoQuant, a market data analysis platform, has observed the recent price decrease in Bitcoin and reported its effect on Bitcoin investors with a holding period of 1 to 3 months.

According to CryptoQuant, keeping an eye on key support zones is crucial, with the $63,600 mark being particularly significant. This price point reflects the average buy price for Bitcoin investors who have held their coins for 3 to 6 months.

Crypto expert Caleb Franzen argues that Bitcoin’s recent return to a known support area is significant, as this zone has historically been effective. Although there was a brief dip, Franzen believes that Bitcoin’s short-term trend shows consistent increases in both highs and lows – an indication of its ability to bounce back amidst current market fluctuations.

According to analyst Ali Martinez’s latest analysis, there are indications of a possible double-bottom formation in Bitcoin’s price chart. This pattern is further reinforced by bullish RSI divergence on shorter time frames. If this trend continues and holds true, the cryptocurrency may bounce back to reach $67,600. However, this potential increase depends upon Bitcoin holding above the crucial support level at $66,000.

Exploring Bitcoin’s on-chain information, Martinez emphasizes a vital level of backing for the cryptocurrency around $63,440 and $65,470. In this region, roughly 1.89 million wallets hold about 1.23 million Bitcoins collectively, making it a noteworthy location to keep an eye on in the upcoming period due to its potential significance.

Read More

- DBD July 2025 roadmap – The Walking Dead rumors, PTB for new Survivors, big QoL updates, skins and more

- PUBG Mobile Sniper Tier List (2025): All Sniper Rifles, Ranked

- COD Mobile Sniper Tier List Season 4 (2025): The Meta Sniper And Marksman Rifles To Use This Season

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [Guild War V32] Cultivation: Mortal to Immortal Codes (June 2025)

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- Beyoncé Flying Car Malfunction Incident at Houston Concert Explained

- Delta Force Redeem Codes (January 2025)

- Best ACE32 Loadout In PUBG Mobile: Complete Attachment Setup

- Best Japanese BL Dramas to Watch

2024-07-24 00:40