As a researcher with a background in economics and experience in analyzing financial markets, I find James Coutts’ perspective on the relationship between the Global Money Supply (M2) and Bitcoin’s price cycles intriguing. His analysis sheds light on how economic indicators can influence the digital currency’s market dynamics.

In his latest assessment, James Coutts, the Chief Crypto Analyst at Realvision, indicates a possible bullish trend approaching for Bitcoin in the near term. He bases this prediction on alterations to global liquidity indicators, with a significant focus on the Global Money Supply (M2) index. This index is often regarded as the key driver of price movements in Bitcoin. Coutts elaborated on his perspective in a series of posts on platform X, where he explored the correlation between significant economic markers and Bitcoin’s pricing trends.

Global Money Supply And Its Correlation With Bitcoin

As a crypto investor, I find Coutts’ analysis intriguing as he starts by examining the M2 money aggregates, which include cash, checking deposits, and near money that can be easily converted. By tracking these aggregates across the 12 largest economies, all adjusted to USD, we gain insights into global liquidity flows within the traditional fiat, credit-based financial system. In my perspective, this measurement plays a pivotal role in comprehending monetary trends and fluctuations. Based on Coutts’ observations, I concur that the money stock generally moves consistently, with substantial declines like those witnessed in 2022 being uncommon and usually short-lived.

As an analyst, I’m observing a neutral current state of the Global M2, but according to Coutts, we’re on the brink of shifts. My macro and liquidity dashboard is awash in red hues, yet hints have surfaced suggesting imminent transformation. The Global M2 holds significant influence over the next phase of the cycle due to its strong correlation with Bitcoin bull markets.

The speed at which M2 money supply is increasing is more significant than its current value. Coutts pointed out that the graph corroborates their MSI (Money Supply Indicator) table’s findings: Bitcoin tends to follow trends in M2 momentum. However, despite a rising trend in the global money supply MSI, the momentum remains slow, keeping the MSI rating Neutral. To trigger a bullish MSI signal, an acceleration in momentum is essential, which entails a mix of currency depreciation, expanded credit, and heightened government debt issuance.

Coutts highlighted the importance of credit market conditions based on the comparison between corporate bond spreads (BBB/Baa) and the US 10-year Treasury yield. Historically, these spreads have mirrored important turning points in Bitcoin’s price cycle. Currently, the spreads are shrinking, suggesting that corporations are successfully issuing and renewing debt despite the elevated interest rates following the substantial rate increases in 2022 and 2023.

According to Coutts’ recommendation based on the chameleon trend indicator on the corporate spread index, investors should consider the following approach: “Go long on Bitcoin when the index exhibits a bearish signal (indicating red), while keeping a close eye for possible trend reversals signaled by the turning green.”

The Role Of the Dollar And Future Outlook

As an analyst, I’d interpret Coutts’ perspective this way: According to his assessment, the DXY (Dollar Index) plays a significant role in the current cycle. I personally believe the US dollar is confined within a range. If the DXY drops below 101, it could potentially serve as a powerful catalyst for Bitcoin’s price surge. The market mood regarding liquidity frequently mirrors the real-time fluctuations of the DXY.

As an analyst, I’d like to share my perspective on Coutts’ remarks regarding the US debt situation. He raised concerns that without a change in Congress toward fiscal responsibility, leading to reduced deficit spending, the favorable liquidity conditions for Bitcoin could persist.

Coutts issued a warning tinged with hope in his conclusion: “Although my model requires two-thirds of MSI indicators to switch from bearish to bullish for macro headwinds to become supportive, it’s likely that Bitcoin’s price movements will detect this shift before most indicators respond.”

According to his assessment, surpassing its previous peak by Bitcoin would indicate a risky proposition to short it, possibly leading to gains reaching around $150,000 during this market cycle. The DXY index plays a crucial role in the Bitcoin trend as it reflects real-time market expectations regarding liquidity. Once the DXY index breaches the 101/102 level, we can expect Bitcoin to reach approximately $150,000 during this phase.

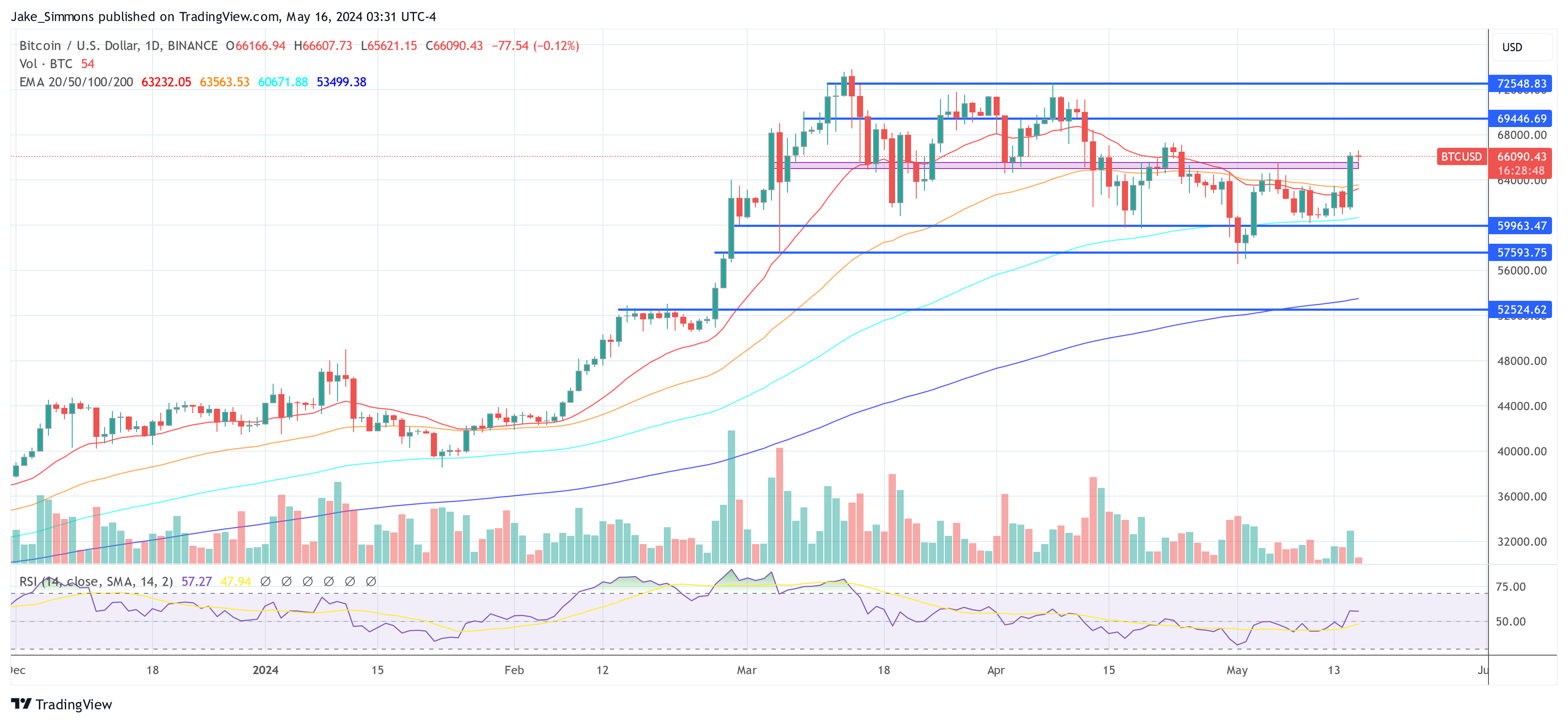

At press time, BTC traded at $66,090.

Read More

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Best Heavy Tanks in World of Tanks Blitz (2025)

- [FARM COSMETICS] Roblox Grow a Garden Codes (May 2025)

- CNY RUB PREDICTION

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Gold Rate Forecast

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Delta Force Redeem Codes (January 2025)

- Overwatch 2 Season 17 start date and time

2024-05-16 10:52