On January 17, 2025, Morpho’s own token, MORPHO, experienced a significant increase of more than 40%, hitting a record high of $4.11. This remarkable rise was prompted by a groundbreaking collaboration with Coinbase, which introduced Bitcoin-backed loans to US customers. As a result, the trading volume skyrocketed by an impressive 183% to reach $222 million, demonstrating a notable surge in investor enthusiasm for the DeFi platform.

Source: CoinMarketCap

The collaboration redefines the way people borrow money by doing away with the need for credit scores. Instead, borrowers secure loans using more Bitcoin than the value indicated, thereby receiving amounts lower than the actual value of their Bitcoin holdings. This process is made simpler through Coinbase’s wrapped Bitcoin (cbBTC) and Morpho’s lending services, enabling users to generate cbBTC for loan purposes.

Can Morpho Maintain Its Momentum?

On a 4-hour scale, the Morpho/USDT graph shows a robust upward trajectory, starting from $2.50 and reaching $4.04. The Relative Strength Index (RSI) has climbed into the overbought region at 75.59, suggesting that the surge in momentum could be nearing its limit. However, the Moving Average Convergence Divergence (MACD) line supports this bullish trend, as it shows an increase in green bars, signifying strengthening bullish momentum.

Source: TradingView

Further examination reveals a surge above the $3.50 mark, suggesting strong demand from buyers. The Relative Strength Index (RSI) stands at 75.59, implying that the market may be overbought, potentially requiring a correction. However, the support at $3.50 could prove crucial during any downturns. Moreover, the Moving Average Convergence Divergence (MACD) lines are ascending, indicating persistent optimism and a possibility of further growth.

The MACD (Moving Average Convergence Divergence) line currently stands at 0.19 and is above the signal line at 0.15, indicating a positive or ‘bullish’ crossover. If the resistance level of $4.10 gets breached, it might sustain the upward movement. On the flip side, a drop below $3.58 may reverse the current upward trend, possibly causing prices to fall towards $2.26. It’s important to note that investor decisions to cash out (profit-taking) can be hard to foresee and could potentially slow down the ongoing bullish trend.

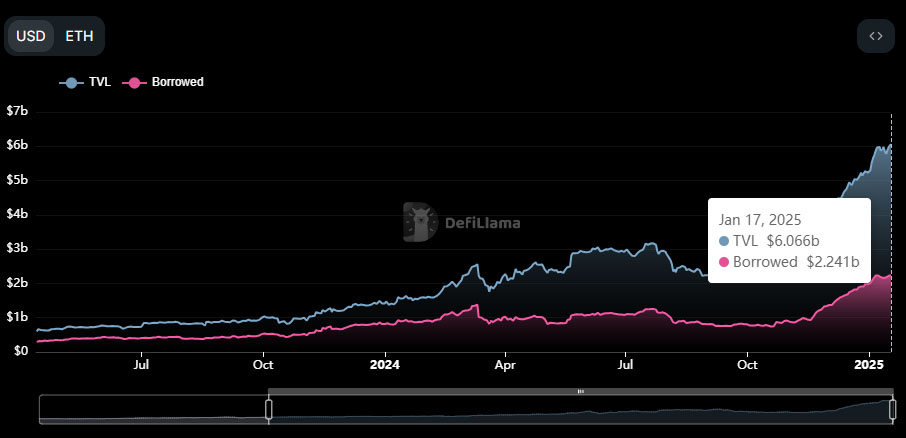

Morpho Protocol’s TVL Surges to $6 Billion

The value locked in the Morpho Protocol has seen a significant surge, currently standing at an impressive $6.06 billion, as reported by DefiLlama. This rapid increase suggests that the project is rapidly expanding within Ethereum layer-2 networks, leading to higher daily fees and increased user activity. The Morpho system accommodates various applications such as credit cards, savings accounts, and controlled markets. It also collaborates with platforms like Moonwell and Centrifuge.

Source: DefiLlama

The expansion of Decentralized Finance (DeFi) into broader areas has solidified its standing, significantly so as the sector recovers after a surge in last year’s financial market. However, this advancement is not without controversy, as new IRS broker reporting regulations have sparked discussions about regulatory hurdles that DeFi advocates are now grappling with.

The excitement about Morpho isn’t solely based on figures. This platform has just raised $50 million in investments, with Ribbit Capital taking the lead in this funding round. Major industry players such as a16z, Pantera Capital, and Coinbase Ventures have also shown their support for this venture, which indicates a robust institutional belief in its future prospects.

Read More

- Best Heavy Tanks in World of Tanks Blitz (2025)

- CNY RUB PREDICTION

- Here Are All of Taylor Swift’s Albums in Order of Release Date (2025 Update)

- List of iOS 26 iPhones: Which iPhones Are Supported?

- Death Stranding 2 smashes first game’s Metacritic score as one of 2025’s best games

- Delta Force Redeem Codes (January 2025)

- Hermanos Koumori Sets Its Athletic Sights on the adidas UltraBOOST 5

- Vitality Triumphs Over The MongolZ To Win The BLAST.tv Austin Major 2025

- Honkai Star Rail 3.4 codes and how to redeem in HSR June 2025

- ‘No accidents took place’: Kantara Chapter 1 makers dismiss boat capsizing accident on sets of Rishab Shetty’s film

2025-01-17 15:24