As a seasoned researcher with a decade of experience in the volatile world of cryptocurrencies, I find myself intrigued by the current state of affairs in the market. The bearish conditions have certainly taken their toll on Bitcoin and Ethereum, but it’s the resilience of MakerDAO that catches my eye.

MakerDAO, a decentralized finance platform built on the Ethereum blockchain, is holding strong at the $1,500 psychological mark, despite a 18.94% drop over the past month. This tenacity is not only impressive but also a testament to its robustness and the demand for its services.

However, the increasing volatility in MKR price trends warns of a bearish continuation. The falling wedge pattern on the daily chart and the breakdown under key EMA lines suggest a potential downtrend. But then again, as Mark Twain said, “Reports of my death have been greatly exaggerated.”

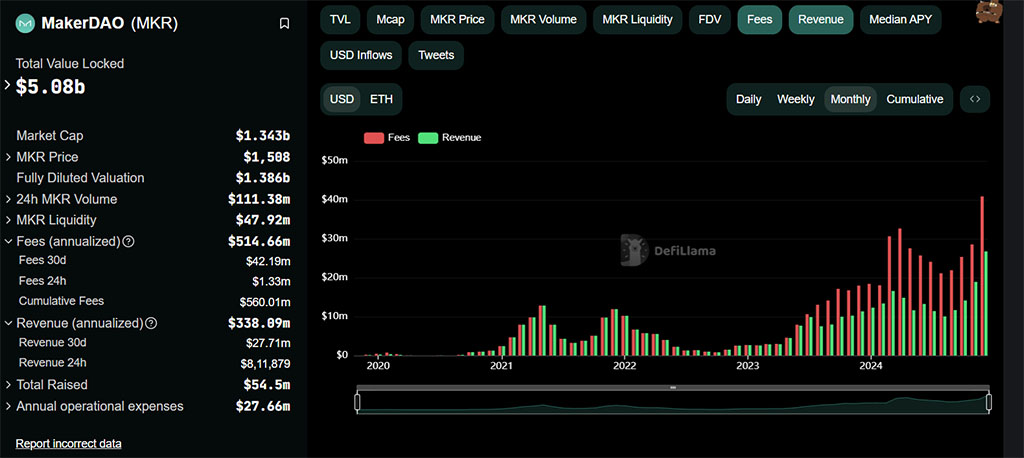

Despite these short-term bearish indicators, MakerDAO has hit new records in December. The network’s monthly fees have crossed the $40 million threshold, and the monthly revenues have surpassed the $27 million milestone, a feat worth noting in such challenging market conditions.

The on-chain analysis reveals a demand and supply disparity, with a significant difference between the immediate supply zone and support. This could potentially lead to a bearish continuation, but as they say, the market can stay irrational longer than you can stay solvent.

In the end, it’s all about riding the waves in this roller coaster ride we call cryptocurrency trading, and I’m just here to enjoy the view and make a few coins along the way!

Bitcoin (BTC) dipped below the $94,000 threshold, while Ethereum (ETH) remains below the $3,400 level in a generally bearish market. Notably, MakerDAO maintains its position at around the $1,500 psychological price point despite these conditions.

As someone who has closely followed and invested in the cryptocurrency market for several years now, I have learned to always be cautious when it comes to market trends. The recent 18.94% drop in MKR price over the past 30 days, coupled with the growing bearish influence in the crypto market, is a clear warning sign of a potential bearish continuation. With my personal experience of navigating through previous bear markets and volatility, I strongly advise keeping a close eye on the MKR price, especially given its current 24-hour volatility of 3.6% and a market cap of $1.32 billion. It’s important to remember that investing in cryptocurrencies always carries risk, but by staying informed and being vigilant, we can mitigate potential losses and capitalize on opportunities when the market turns around.

Regardless of the market’s bearish influence, the MakerDAO network continues to set new records in December.

MakerDAO Hits New Records This December

As a researcher immersed in the dynamic world of decentralized finance, I’ve noticed an interesting trend. Despite the temporary surge in price fluctuations, the MakerDAO network has reached a new peak in December. According to DeFi Llama’s data, the monthly fees on this network have surpassed the $40 million mark and are currently sitting at approximately $42.19 million.

Additionally, our monthly earnings surpassed the $27 million threshold, amounting to $27.71 million. This sets a new high for the network’s performance.

In the last day, revenues reached an impressive $811,879, bringing the total fees to approximately $560 million. As speculation mounts for a positive market trend in 2025, the expansion of the MakerDAO network hints at an upcoming bull market.

MKR Token Price Analysis

On a daily basis, the MakerDAO MKR token’s price trend exhibits a falling wedge configuration. Starting from December, the value of MKR has decreased significantly, going from $2425 to $1521.

Currently, the gradual decline in the market might jeopardize the significant $1500 level. This downturn has managed to dip below the moving average lines for 200 days, 50 days, and 100 days.

Moving forward, this situation enhances the probability of a bearish cross occurring between my 50-day Exponential Moving Average (EMA) and the 100-day EMA. As prices retreated, the Relative Strength Index (RSI) dipped below the midpoint, leveling off at approximately 40%.

Hence, the technical indicators are giving a bearish outlook of the short-term MKR price trend.

According to the Fibonacci sequence, the price has dropped below the 38.20% level, which is around $1,680. If the bearish trend persists, it seems probable that the drop will continue, potentially falling under the 23.60% Fibonacci level as well.

As a seasoned trader with years of experience under my belt, I have seen many market trends come and go. Based on my observations, if we are looking at a falling wedge breakdown rally for MKR, the immediate crucial support at $1,054 could potentially signal the beginning of a downtrend. However, if there is a bullish reversal, breaking through the overhead resistance trendline could be a strong indication that the MKR price might rebound and reach the significant mark of $2,000 once again. My advice would be to keep a close eye on these levels and adjust trading strategies accordingly as the market unfolds.

On-Chain Reveals Demand and Supply Volume Disparity

During this ongoing retracement, a significant resistance level is signaled by the global in-and-out-of-the-money indicator. Meanwhile, as MakerDAO grapples with initiating an upward climb, the immediate supply area stretches from approximately $1,602 to $1,772.

Out of a total of 138,090 MKR tokens, they are concentrated within approximately 3,610 different accounts or addresses. Yet, when it comes to immediate price support, there are only around 1,160 addresses that hold about 2,750 MKR tokens, suggesting a weaker base of support in the short term.

As a crypto investor, I’m observing that the supportive range for my digital assets stretches from around $1,413 to $1,434. The noticeable gap between demand (buyers) and supply (sellers) in this range suggests a possible downtrend could be on the horizon.

At present, the value range for the MKR token spans from approximately $1,435 to $1,602, encompassing around 120,180 MKR tokens distributed among roughly 6,700 different addresses. These addresses hold significant influence over the potential future price movements, but at this moment, the immediate indicators suggest a possible downtrend may continue.

In such a case, the MKR token is likely to test the $1,400 psychological mark.

Read More

- Brody Jenner Denies Getting Money From Kardashian Family

- I Know What You Did Last Summer Trailer: Jennifer Love Hewitt Faces the Fisherman

- New God Of War Spin-Off Game Still A Long Way Off, According To Insiders

- Bitcoin Price Climbs Back to $100K: Is This Just the Beginning?

- Justin Bieber ‘Anger Issues’ Confession Explained

- All Elemental Progenitors in Warframe

- Anupama Parameswaran breaks silence on 4-year hiatus from Malayalam cinema: ‘People have trolled me saying that I can’t act’

- How Taylor Swift’s Bodyguard Reacted to Travis Kelce’s Sweet Gesture

- The Wonderfully Weird World of Gumball Release Date Set for Hulu Revival

- The Entire Cast Of Pretty Little Liars Hopes For A Reunion Movie

2024-12-30 17:58